What are the opening hours of the ASX? What are the 2024 market holidays and are they set in stone?

![]() Nick Sundich, April 10, 2024

Nick Sundich, April 10, 2024

The opening hours of the ASX are 6 every day that the market opens. Simply put, they are 10am to 4pm. However, it is more complicated than that.

The Opening Hours of the ASX

Firstly, it ought to noted that these hours are only relevant on trading days, and not on market holidays – which are virtually all weekdays that are not public holidays.

The ASX opens at 10am, but stocks start trading in phases dependant on the letter in the alphabet the company name begins with. So companies with A and B open right on 10am, and by 10.10am all stocks are trading.

- Group 1 10:00:00 am +/- 15 secs 0-9 and A-B,

- Group 2 10:02:15 am +/- 15 secs C-F,

- Group 3 10:04:30 am +/- 15 secs G-M,

- Group 4 10:06:45 am +/- 15 secs N-R,

- Group 5 10:09:00 am +/- 15 secs S-Z,

At 4pm, the market pauses in preparation for closure 10 minutes later. This phase enables brokers to enter, change and cancel orders for the market close.

Between 4.10pm and 5pm, there is the ‘Adjust‘ phase. There is no trading allowed, but brokers are allowed to amend orders or cancel unwanted orders. This is nonetheless a distinct phase from the ‘Close’ phase that kicks in formally at 7pm when even this is not allowed to take place.

Is there after hours trading?

Although some investors call the 4pm-4.10pm period after hours trading, this is not strictly speaking ‘after hours trading‘ in the sense that it is known in jurisdictions that allow it, with North America being one.

Of course, even though the market is closed for trading, the announcements platform is open to submit announcements between 7.30am Sydney time and 7.30pm AEST (which is 8.30pm AEDT). Companies like to sneak bad news after the market close, thinking investors either won’t notice, or will punish them less severely the following morning.

What about pre-market trading?

Again, there’s no pre-market trading on the ASX as is in other markets, although brokers are allowed to submit orders as early as 7am.

Market holidays

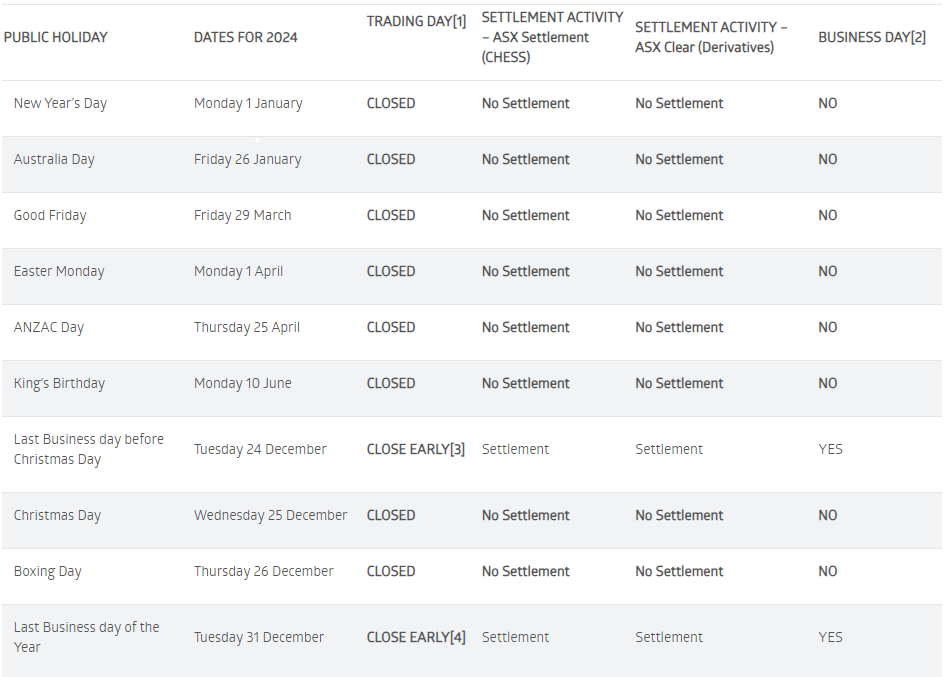

As noted above, the ASX is closed on market holidays. We’ve attached below the list of market holidays in 2024. These include Australia Day, the Easter Weekend, ANZAC Day, The King’s Birthday (In Victoria and NSW), Christmas Day and Boxing Day. Inevitably, New Year’s Day in 2025 will be a holiday too.

Are market holidays secure?

Seemingly market holidays are secure, in the sense that existing holidays will not be changed. But could there be new holidays. Potentially.

The ASX retains discretion to add market holidays at its discretion and may well when unexpected public holidays are announced. For instance, when Queen Elizabeth died and a public holiday was announced with less than a month’s notice, the ASX closed on that date. ‘ASX Limited reserves the right to declare additional Non-Business Days or alter those currently specified herein without notice to holders of this calendar’, the bourse declares on its calendar.

Trading halts

Of course, just because the bourse is open, it does not mean your company will trade. Stocks may have trading halts for a day or two for a variety of reasons such as capital raisings or if the company is responding to an ASX query.

For investors in that stock, it will be as though the market was closed even if they could trade other stocks just the same. If a stock is suspended, it can be a longer-term thing – sometimes up to 2 years before the company is automatically delisted, barring ASX clemency for a short-term extension beyond that.

Be aware of market holidays

Obviously this goes without saying. It won’t do investors too much harm to forget – they will just open their brokerage and find they cannot trade, although this will happen quickly. If you’re an investor it will help to have these dates pin-pointed so you are aware.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…