Orphan Drug Designation: What is it and why is it a big deal for biotech stocks?

![]() Nick Sundich, May 30, 2024

Nick Sundich, May 30, 2024

While most small cap health stocks dream of commercialisation, healthcare companies at an early stage get excited about achieving Orphan Drug Designation.

Achieving this won’t be as meaningful to the bottom line as a stock receiving regulatory approval, but it is a big step nonetheless. If and when commercialisation is achieved, this will have been a necessary step and may have even provided a leg-up.

What is Orphan Drug Designation?

Orphan drug designation is a type of approval granted by regulatory bodies, such as the US Food and Drug Administration (FDA), to drugs and biologics intended to treat, diagnose or prevent rare diseases or conditions.

There are varying classifications of what is a rare disease or condition, although American regulators define it as one that affects fewer than 200,000 people. In Australia, our regulator (the TGA), defines a rare disease as one affecting fewer than 5 in 10,000 individuals. There will likely be a number of criteria to be satisfied that will vary from jurisdiction to jurisdiction.

Strict criteria

Take the TGA for example. The disease needs to meet the aforementioned threshold as well as a handful of other conditions, including that it is for a life-threatening or seriously debilitating conditions that no therapeutic goods intended to treat, prevent or diagnose the condition are TGA-approved and that a refusal for approval was given by the US, European, British or Canadian regulator, or by the TGA before. The application has to be for one specific condition.

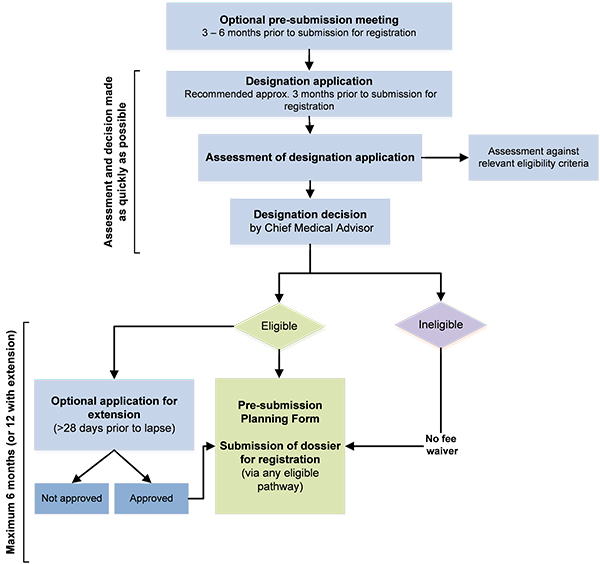

The FDA, likewise, has its own criteria that are outlined in the Orphan Drug Act of 1983. The most important is that there are no existing products in the market. And of course, the whole process to obtain Orphan Drug Designation is a minefield in and of itself. Just check out the TGA process in the image below.

Is it all good news?

Orphan drug designation is a big step, but shareholders need to remember that this is the start of the journey, not the end. And the end of the journey, commercialisation, will likely be many years ahead. When this is borne in mind, it can be a very positive development, as orphan drug designation comes with various incentives that can benefit the developing company.

Pharmaceutical companies receive incentives for bringing new orphan drugs to market such as tax credits for clinical research expenses, waiver of certain user fees, and exclusive marketing rights for seven years after approval.

In addition to providing financial incentives, regulators create an expedited review pathways designed to quickly move promising treatments from preclinical testing through clinical trials and ultimately into the hands of patients in need. This includes fast track designation, breakthrough therapy designation and accelerated approval pathways.

Companies that obtained Orphan Drug Designation

The most recent company to achieve an approval is Radiopharm Theranostics (ASX:RAD). Earlier this week, it obtained orphan drug designation for its radiopharmaceutical technology, Ga68-Trivehexin (RAD 301) to treat pancreatic ductal adenocarcinoma (PDAC).

Prescient Therapeutics (ASX:PTX) is the another recent company to obtain this status. The company received it for peripheral T-cell lymphomas (TCL) in 2022 and a broader one for all TCLs and their substypes in March 2023.

Another company that is a recent recipient is none other than industry behemoth CSL (ASX:CSL). Yes, even companies with established products on the market are always undertaking R&D work with an aim to finding new products. In September last year, CSL won Orphan Drug Designation for etranacogene dezaparvovec, a gene therapy candidate developed for haemophilia B.

A big step or not

If your health stock has received orphan drug designation then it could provide significant financial and logistical benefits to the company if and when commercialisation is achieved. But the extent to which it is a big step depends on the stage the company is at. And of course, it will all be for nothing if the company fails in its endeavours to achieve commercialisation.

What are the Best ASX Life Sciences Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Alvo Minerals finds itself a new Brazilian target

Every now and then in the mining game you meet people with a knack of finding more than one good…

Goodman Group (ASX:GMG): It looks expensive at A$65bn, but can its expansion into Data Centers make it worth its high price?

Goodman Group (ASX:GMG), the ASX’s biggest industrial property player, is making a shift into the world of data centres. On…

Here are 5 ASX resources stocks with a DFS unveiled in the last 12 months!

ASX resources stocks with a DFS (Definitive Feasibility Study) have the best possible chance for investors to profit. Companies in…