Osmond Resources (ASX:OSM): The stars are lining up for this company with its Orion EU Critical Minerals Project

![]() Nick Sundich, October 16, 2024

Nick Sundich, October 16, 2024

On 6 September 2024 the stock of the mineral explorer Osmond Resources (ASX: OSM) started coming back to life. Before then it was bumping along at around 7 cents per share. Suddenly investor interest in took off, after the company announced it was buying into the Orion EU Critical Minerals Project in Spain. Osmond stock recently got to 32 cents and looks like going higher. Why all the excitement?

Another venture from Anthony Hall

Part of it has to do with the vendor of the Orion Project. The Sydney-based investor Anthony Hall was founding Managing Director and CEO of Highfield Resources (ASX: HFR) in late 2011 and then American Pacific Borates (ASX: ABR) in 2017, and both of them got to large market capitalisations in the hundreds of millions before he moved on. Highfield went from a seed round in November 2011 at 5 cents to $2.08 in 2015 and American Pacific Borates went from a seed round at 12 cents in 2017 to $3.86 in 2022.

So, it’s reasonable to expect that with Hall’s latest venture there’ll be some excitement. Hall is now the Managing Director and CEO of Osmond Resources, after his decision to move on from 5E Advanced Materials (ASX: 5EA), the successor company to American Pacific Borates, early last year.

The rock chips were rocking

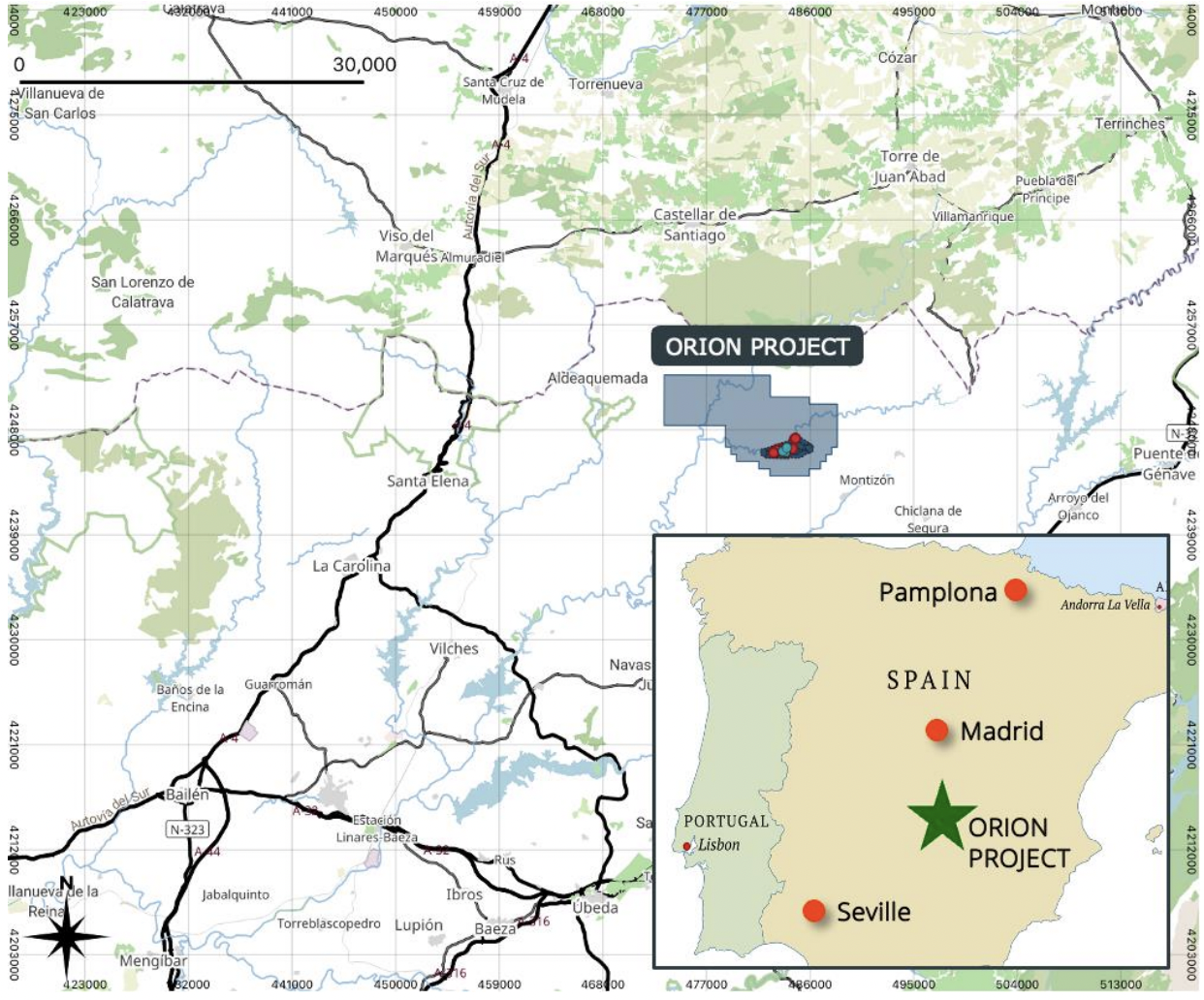

Osmond’s new flagship project, Orion, covers around 86 sq km near Jaén in northeastern Andalusia, just under three hours’ drive south of Madrid.

Source: Company

Way back in time there were substantial lead mines in Jaén Province’s Linares-La Carolina mining district, mines that were first worked by the Romans. However, the initial explorers back in 1950s weren’t looking for new galena deposits but rather thorium and uranium. Unfortunately, these exploration activities failed when only low levels were detected.

In 2020, two geologists went over the area, now called the Orion Project, with a scintillometer and then took rock chip samples across 16 sections of outcrops that got them excited. Those rock chips were assaying for significant amounts of titanium, zircon, rare earths, and a mineral called hafnium, which encouraged Hall and his Spanish collaborators to look further.

By 2024 the Hall team had a 150 kilogram bulk sample from Orion with very encouraging results. Ordinarily one would need more than rock chips and bulk samples to get excited about a project, but this bulk sample was unusually rich. How would you like rutile at 13-15% and ilmenite at 4-6% ilmenite to start with? And then over 9% zircon and very high hafnium results of over 1,200 ppm? And just for some more by-product credits, how about Nd and Pr numbers for the rare earths grading well over 2,500 ppm? Yeah, we thought you’d like all that.

Just add gravity

What was really interesting was the metallurgical test work on that 150 kg bulk sample. The Hall team’s consultants found that after grinding down to only about 100 micron most heavy metals could be liberated by gravity alone, which suggests a very low capex for any future processing operation. And if you’re worried about any radioactive material, you can rest easy – there were only low levels of both uranium and thorium.

Importantly, there seemed to be a lot more where that came from.

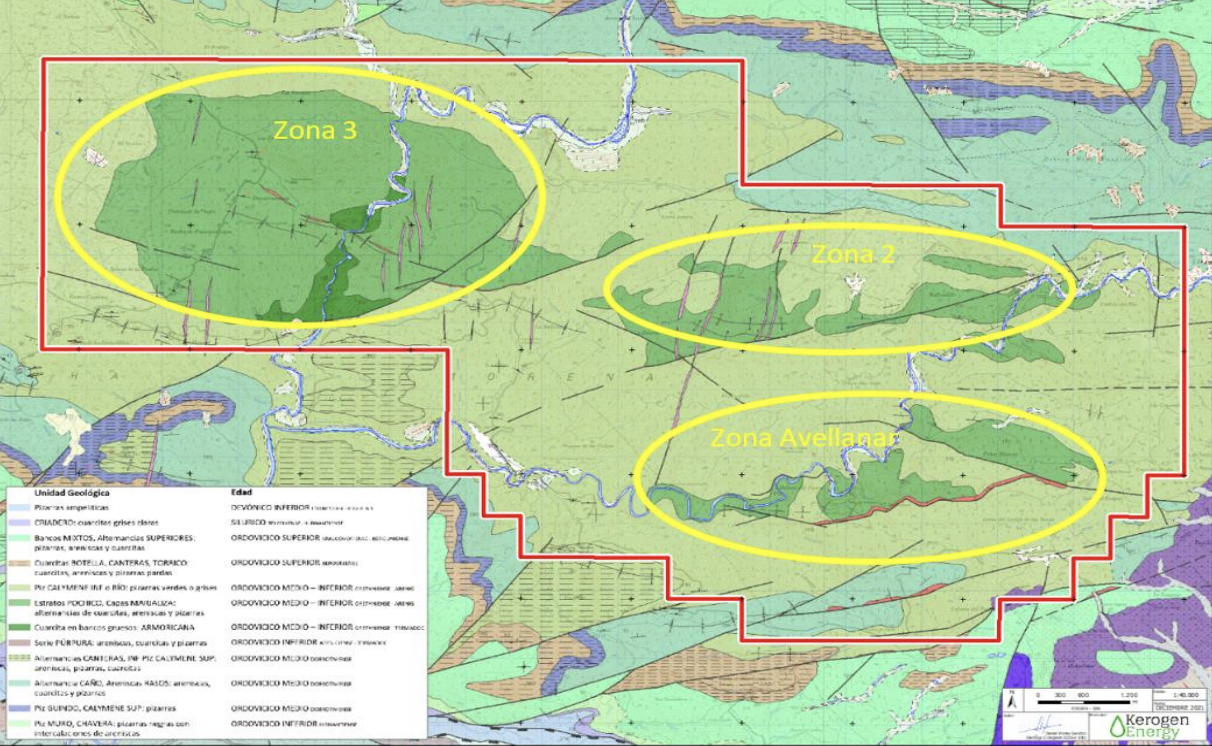

Osmond believes that the mineralised outcrops at Orion stretching more than 2 km. The bulk sample came from a zone called Avellanar, and Osmond believes that two other target zones of interest will have similar structures in terms of the sandstone layers, and that the three zones in question are all linked up.

Map showing the initial 3 target zones (Source: Company)

Europe wants more projects like Orion

Obviously, Osmond Resources has plenty of work to do at Orion to prove up the potential of this project, and the first drilling campaign probably won’t happen until early 2025. However, with grades as big as they showed up in the rock chips and the bulk sample we expect some decent intersections in the drill holes.

What makes this project potentially valuable is not just because there’s more than one commodity at play, but also because each represent a critical mineral that the European Union wants to get more of. Titanium demand is growing because its use in aerospace, medicine, chemical processing and nuclear power. Rare earth magnets are important in wind turbines and Electric Vehicles. Hafnium, atomic number 72, is less well known but also important for its use in nuclear power and in aerospace. And zircon is useful as a refractory material and also in semiconductors and ceramics.

In each case the EU has just about no domestic production, meaning that it often has to get its titanium from Russia, its rare earths from China and its hafnium from South Africa. To counter this, the EU isn’t just engaging in wishful thinking: the recently passed Critical Raw Materials Act of 2024 has set targets of how much of such materials will get sourced from the EU by 2030. Observers of the battery minerals and critical minerals scene will have noted that the EU is happy to help fund projects like Orion to give Europe a better edge on local sourcing. That puts the companies with projects like Osmond has with Orion, in a potential future box seat.

Put Osmond Resources on your watchlist

Osmond has 51% of Orion under the September 2024 acquisition agreement and can go to 90% after a JORC-compliant Scoping Study. Osmond shareholders will vote on the project acquisition at the company’s Annual General Meeting on 29 October, and that will give the company a chance to showcase what it thinks it has got. Put this one on your watch list.

What are the Best ASX Resources Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…