Parker Hannifin (NYSE:PH): One of the world’s top motion control manufacturers

![]() Nick Sundich, October 30, 2023

Nick Sundich, October 30, 2023

Parker Hannifin (NYSE:PH) is this week’s international stock deep dive. It is one of the world’s top industrial companies and is a specialist in so-called ‘motion control technologies’ – every technology under the sun related to the movement of objects.

Introduction to Parker Hannifin

This US$47bn company is more than a century old and is headquartered in Cleveland, Ohio (a state that is home to other high-quality companies too such as Sherwin Williams).

Motion control technologies is an enormous industry, worth US$135bn globally. It encompasses several other industries aerospace, water, climate control, process control and even renewable energy. Examples of this technology include hydraulics, pneumatics, electro-mechanical mechanisms, filtration, fluid & gas handling, process control and engineered materials.

Global presence

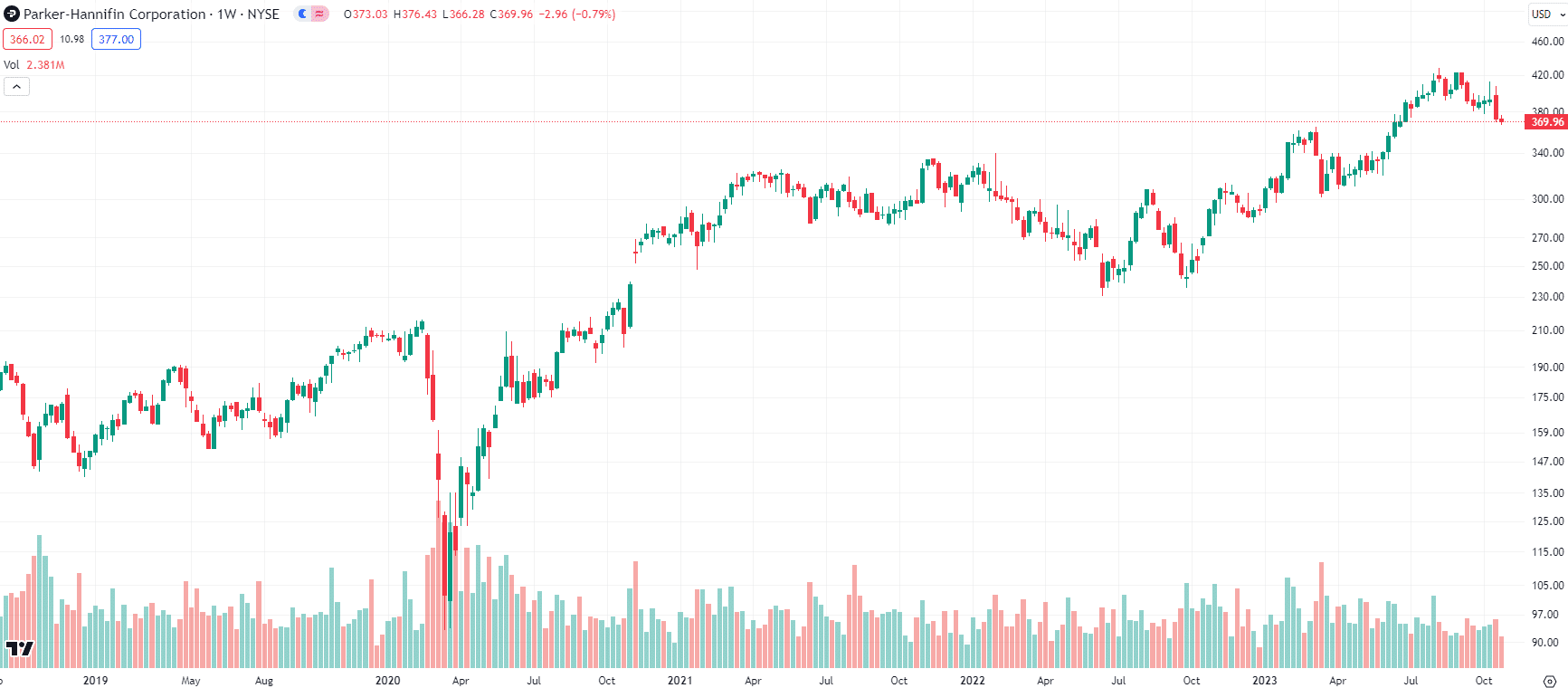

Parker Hannifin is one of the world’s top players with operations in 45 countries across 6 continents. In the last 7 years it has tripled its EPS and grown revenues by over 50%. Two-thirds of the company’s revenue comes from customers who buy 4 or more technologies. Parker Hannifin shares are up 30% in the last 12 months and 130% in the last 5 years.

Source: Parker Hannifin (NYSE:PH) share price chart, log scale (Source: TradingView)

There’s a good ESG element to this company, with a significant proportion of its portfolio enabling clean technologies. It is targeting a 50% reduction in emissions by 2030 and achieving carbon neutrality by 2040.

The company’s 3 longer-term goals

However, there are 3 goals Parker Hannifin is targeting to achieve. First, increasing its market share. It has only a 13% share globally and plans on reaching 20%. Second, continuing the move away from shorter cycle revenue trends towards longer cycle trends and sales from the industrial aftermarket. EVs are an important part of this because they mean twice as much content as combustion engine vehicles. Among other things, Parker Hannifin makes flame-resistant coatings, environmental and hermetic sealing, high temperature materials and vibration dampening. Third, continuing to increase its bottom line. It is anticipating a further 50% increase to its EPS and a 250 basis points increase of its operating margin.

M&A is on the menu

Parker Hannifin has plenty of organic growth but isn’t one to shy away from M&A activity that will bring substantial synergies – unless such a business is above its yardstick of 11x EV/EBITDA. It plans $30bn in capital deployment up to FY27. For FY23, it is planning a dividend payout of 30-35% of its net income and capex of 2% of net sales.

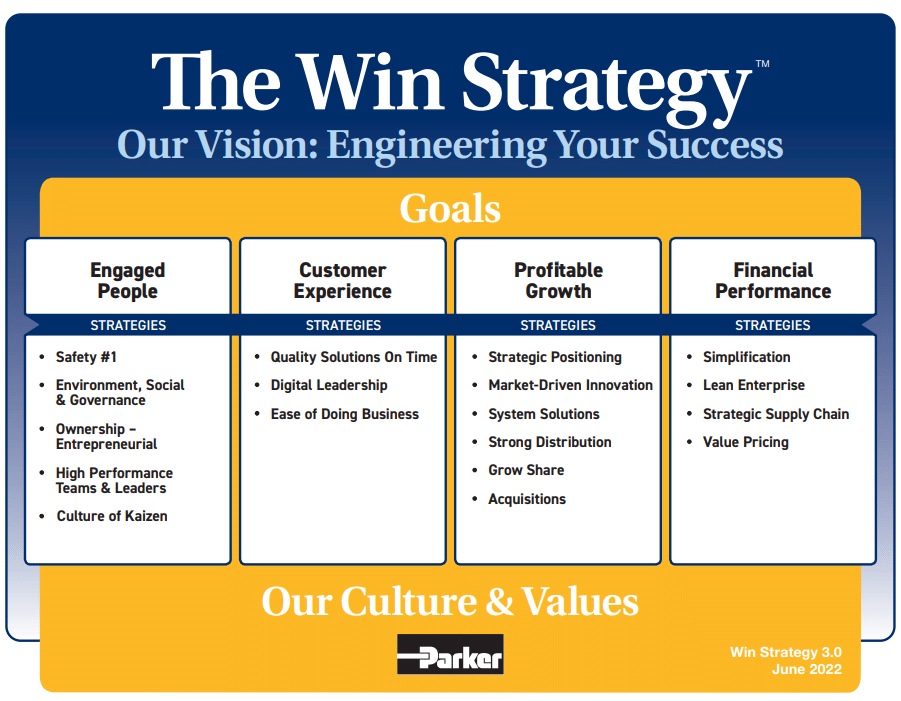

Whenever you hear the company’s investor relations talk, you’ll hear about the company’s so-called ‘Win Strategy 3.0‘. It comprises four goals — including engaged people, customer experience, profitable growth and financial performance.

Source: Company

How analysts think Parker Hannifin can perform?

Parker Hannifin is covered by 19 analysts in the US and they expect $19.9bn in sales and $18.79 EPS in the coming year, representing growth of 4% and 17%. For FY25, revenue of $20.8bn and EPS of $20.90, representing growth of 5% and 11% respectively.

The mean target price is $445.16 per share, a 20% premium to the current share price. Right now, the company is trading at just 14.8x P/E for FY24 and a PEG of ~1. We think it is worth US$471.67, which is a 26% premium to the current share price. This is using a DCF approach with consensus estimates and a 7.5% WACC.

The key risks with Parker Hannifin are:

- The risk of major industrial accidents,

- The company being hit by higher interest rates – it closed FY22 with a debt burden of US$9bn, and

- Adverse equity market conditions.

But, as with all companies we take deep dives into, even though there is some short-term risk, we think investors that hang around for the long-term will be just as disappointed as those who’ve stuck around for the last 5 years with Parker Hannifin.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Trump vs. Jerome Powell: What Happens to the Market If Powell Is Fired?

The relationship between President Donald Trump and Federal Reserve Chair Jerome Powell has often been tumultuous, particularly around decisions regarding…

Telix Pharmaceuticals (ASX:TLX): It’s made ~A$1.7bn in revenue from Illucix, but here’s why the best is yet to come!

What would you have thought if you were told 5 years ago you would see Telix Pharmaceuticals as a successful…

Anti Woke ETFs: Do they practice what they preach and have they outperformed since Trump’s return to power?

Have you ever heard of so-called ‘Anti Woke ETFs’? If you’re sick of companies that are big on ESG, this…