Percheron Therapeutics (ASX:PER): Releasing Phase II data by the end of CY24, and successful data could lead to a major re-rate

It has been less then a year since Antisense Therapeutics changed its name to Percheron Therapeutics (ASX:PER). It is common for biotech companies to change their name when they pivot to new indications and/or to new assets, but this was not the case with Percheron. It is still focused on Duchenne Muscular Dystrophy (DMD), a genetic disease causing muscle weakness that occurs predominantly in young males. It has been an extensive journey for investors who have been around for the long-haul, but a major step could be coming later this year when initial Phase II data is released.

Introduction to Percheron Therapeutics and ATL1102

Percheron’s flagship asset is ATL1102. ATL1102 is a novel antisense drug that is administered by subcutaneous injection (i.e. under the skin). It is an antisense oligonucleotide therapy that works by inhibiting CD49d expression on lymphocytes, thus reducing inflammation.

DMD is caused by a mutation in the muscle dystrophin gene leading to severe progressive muscle loss and premature death. It impacts one in every 3,500 to 5,000 males under 18 worldwide. The only approved treatment is corticosteroids but they only suppress muscle inflammation (just one symptom of the condition) and this is just the tip of the iceberg with the problems it can cause. They have insufficient efficacy, can cause serious side effects and cost up to US$300,000 per treatment year. There is an urgent need for new therapeutic approaches and Percheron thinks ATL1102 can be it.

A pivotal trial is set to report by the end of this year

Percheron completed a Phase 2a trial at the end of 2019. It has taken a long time (5 years) to get to the point of expecting results for a Phase 2b trial. It was a long journey to this point which involved meeting regulators in North America, Europe and Australia, manufacturing the clinical supplies for the trial and raising the necessary capital. The company also looked into other types of muscular dystrophy and other indications. One setback came in November 2022 when long-serving CEO Mark Diamond retired. He was replaced by another well known figure in the ASX biotech space – James Garner.

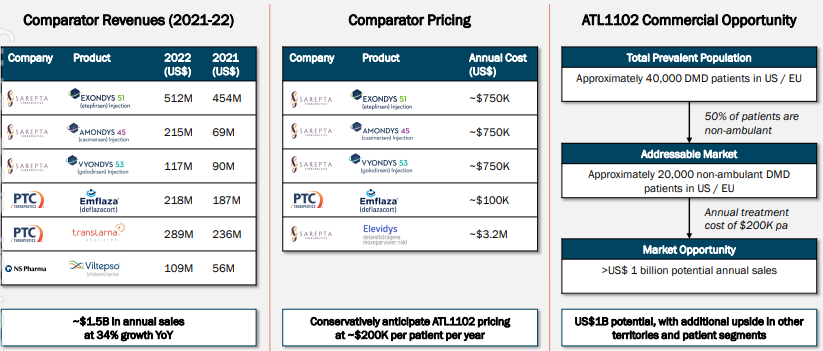

The study finally got underway in mid-2023, and it enrolled 48 boys in 16 hospitals across 5 countries. The primary endpoint of the study is the change in PUL2.0 score at six months, which is a measure of upper limb muscle function. The study has completed recruitment, and initial data is expected in December 2024. 12-month data is expected in mid-2025 with final data by the end of that year. All the while, the company will discuss with regulatory agencies regarding potential authorisation pending positive results. It could well be that no further trial would be required. Another possible catalyst could be a licensing deal for ATL1102’s future commercialisation. In January 2022, Capricor CAP-1002 drug for DMD was licensed for US$735m. Later that year, Merck bought Imago’s Myeloproliferative disorder drug Bomedemstat for US$1.4bn, while Novartis bought Gyroscope’s GT005 drug for geographic atrophy for US$1.5bn. Both were in Phase 2.

The company claims to have a cash runway into the next year, with $11.9m in the bank as of June 30, 2024. Investors have every right to be confident given the data to date (including in Phase 2a) has been overwhelmingly positive, the lack of existing effective treatments as well as a need for them.

Source: Company

The payoff could be worth the wait

It has been a long wait for Percheron shareholders, but there is not too much longer to wait – there will be data before this year’s end. And the potential payoff for the stock could be worth it – subject of course to results being successful.

The key risk with the company is that the results do not turn out favourable for the company, something that could lead to a major ‘de-rating’ of the company. That’s a risk of investing in any clinical stage biotech, albeit to differing degrees dependant on how much ‘eggs in the basket’ the company has on that asset. In other words, whether or not the company has any other assets or indications to fall back on. In this instance, Percheron is more risky than a company like Telix that has commercialised assets, but less so than companies only focusing on one indication. If the trial fails, Percheron could focus on another type of muscular dystrophy, but it will be a far longer wait than if the trial was successful.

But success in the current trial will likely generate a major re-rating of the company’s shares, and be a major win for those suffering from DMD.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…