Plant based food stocks: Why did all the hype come to nothing and is there any hope left?

![]() Nick Sundich, December 5, 2023

Nick Sundich, December 5, 2023

The rise and fall in popularity of plant based food stocks, particularly Beyond Meat, has caused quite a stir in the stock market. With consumers becoming more health-conscious and environmentally aware, many believed that this trend would continue to grow and lead to big profits for investors. However, despite all the hype surrounding these stocks and their potential for growth, they ultimately fell short of expectations. So, what caused this sudden downfall, and is there any hope left?

Why plant based food stocks disappointed

One of the main reasons for the disappointment in plant-based food stocks was due to their high valuation. Beyond Meat, for example, was trading at over 60 times its sales, which is much higher than the average for most stocks. This meant that investors were paying a premium price for shares with no guarantee of earning a return.

Additionally, competition in the market also played a role in the underperformance of these stocks. As more companies began to enter the plant-based food industry, the market became oversaturated, causing prices to drop and profits to decrease. Crucially, some companies entering were well-established and profitable companies that could easily pivot their operations to see off younger competitors like flies.

Another factor that contributed to the failure of these stocks was consumer behaviour. While there has been a growing interest in plant-based foods, many consumers have not fully committed to making the switch from traditional meat-based products. This lack of demand ultimately affected the sales and profits of these companies.

Furthermore, the COVID-19 pandemic played a significant role in disrupting the growth of plant-based food stocks. With many restaurants and fast-food chains shutting down or reducing their operations, it resulted in a decrease in demand for these products, which heavily impacted their sales.Back in 2019, Goldman Sachs estimated that plant-based foods would hit US$13.6bn by 2023. Not 2030, but 2023. It is clearly nowhere near that…yet.

The hype around Beyond Meat and other plant-based food stocks

Only a handful of stocks ever got into this space on the ASX, including Roots (ASX:ROO), now a penny stock not even worth $1m, and Wide Open Agriculture (ASX:WOA), which has had some limited commercial success.

But let’s be honest, it was all about Beyond Meat. This company began in 2009, launched its first product the Beyond Burger in 2016 and listed on the NYSE in 2019, in a successful IPO that saw its share price double. This was followed by partnerships with major retailers like Walmart and Whole Foods, making its products widely available to consumers.

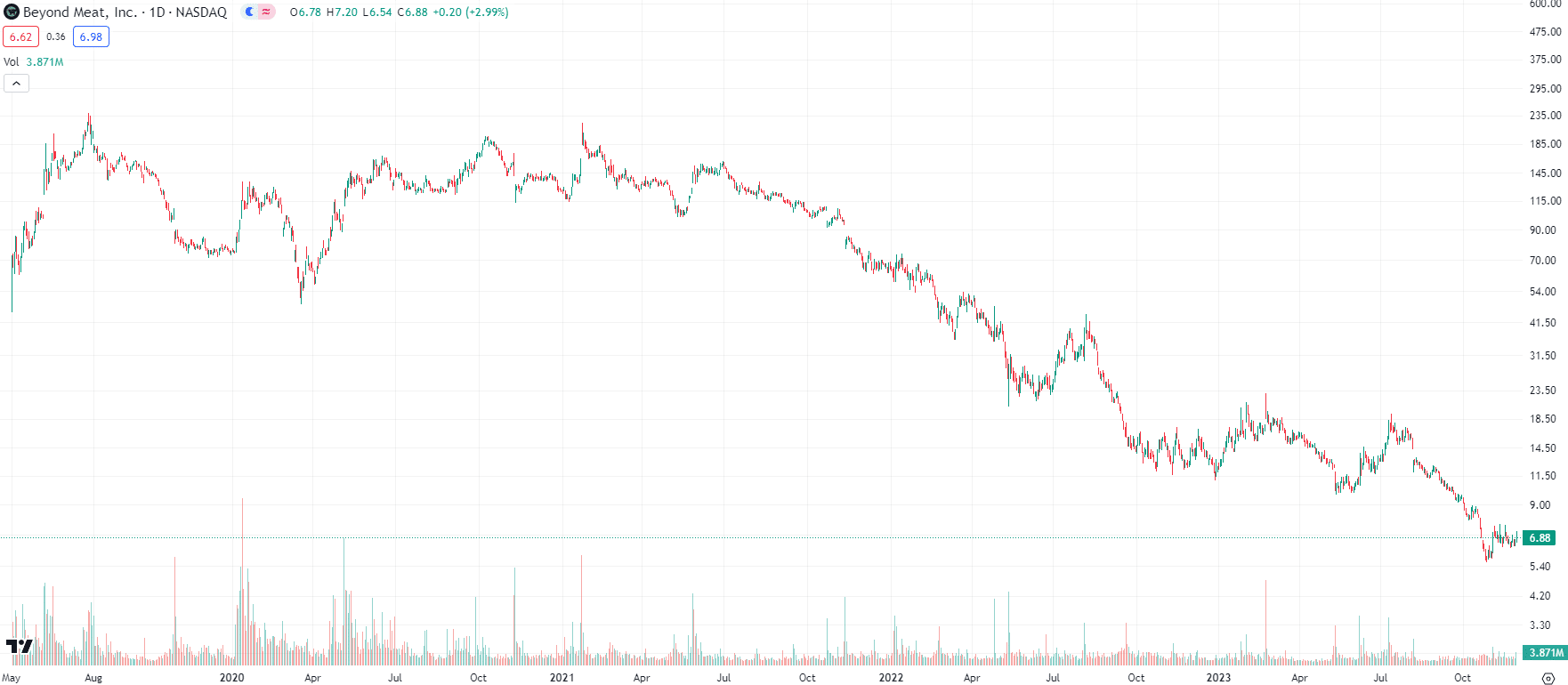

Beyond Meat (NYSE:BYND) share price chart, log scale (Source: TradingView)

Things have all gone downhill since then, as you can see above. We mentioned all the various factors above that have hit plant-based food stocks – Beyond Meat has been hit worst of all. It has not shut down or sold itself. But it is no longer growing and is laying off staff.

And with high interest rates, venture capitalists are unwilling to invest in these companies, nor are consumers willing to pay a premium for these products. AgFunder found that global investment in food and agritech companies fell 44% in 2022.

On top of all this, service provider are unwilling to have patience with them. Plant & Bean, a UK based company that was an up and comer, went into administration due to soaring food and energy prices just two years after opening a mega factory in Lincolnshire. US companies to have gone bust included Unreal Food, Cows Gone Coconut, Sun Milk, OceanTastes and Noops. Even larger companies that are at no risk of going under are retreating when it comes to plant-based meat. Nestle pulled its products from UK supermarket shelves and JBS SA discontinued its entire unit.

There are still projections that demand is still growing and will into the future. ADM for instance expects the alternative-protein market to reach $100bn in sales by 2030. And countless surveys that show a significant proportion of young consumers ‘are planning’ to spend more, although of course we all know people say things and do others with their wallet (especially when they haven’t got any money). And besides, the few companies reporting are painting a different picture. Beyond Meat’s revenues decreased 31% year on year, and sales in the entire industry fell 1% in the US in 2022 following a year of zero growth in 2021.

Investors are more skeptical after what happened last time, not wanting to be fooled twice.

Conclusion

In conclusion, the hype around plant-based food stocks like Beyond Meat came to nothing due to a combination of high valuation, increased competition, consumer behaviour, and the COVID-19 pandemic.

However, this does not mean that there is no potential for growth in this industry. As technology and innovation continue to advance, it is possible that at least a few companies will be able to address the issues they face. Nonetheless, the best bet for investors is to buy more established companies that are early players in this field. This is because they are best equipped to capitalise and dip their toes in the water, as well as take them out if and when the management of these companies can see it is not working out.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Directors duties: Here’s what ASX company directors owe their investors

Some investors may think the only Directors duties are to ‘create shareholder value’. Maybe in their eyes, but not the…

Gorilla Gold Mines (ASX:GG8): Its skyrocketed from a minnow to a $300m company

Gorilla Gold Mines (ASX:GG8) has had a run in 12 months that its shareholders could only have dreamed of. The…

Alvo Minerals finds itself a new Brazilian target

Every now and then in the mining game you meet people with a knack of finding more than one good…