Predictive Discovery (ASX:PDI): It’s got a 4.2Moz gold deposit, but should you buy now?

![]() Nick Sundich, January 21, 2025

Nick Sundich, January 21, 2025

Few stocks have ever gained more than 700% in a day, but Predictive Discovery (ASX:PDI) did just that back in April 2020. And it was for good reason, it looked like it stumbled across a monster of a gold discovery at its Kaninko project in the African nation of Guinea.

Nearly 5 years on and Predictive Discovery has a 5.4Moz resource at the project. Shares are well ahead of where they were a few years ago and while 2024 was a slower growth year, shares still are 30% ahead of where they were 12 months ago. Where to next? Will it take Kaninko into production or will it be taken over? And if the latter, will 19.9% shareholder Perseus Mining (ASX:PRU) have the company all to itself, or could it face competition?

Meet Predictive Discovery

Predictive Discovery first listed at the end of 2010 and spent nearly a decade prospecting a number of African projects. It was far from an easy period – highlighted by the kidnapping and murder of a senior employee of its joint venture partner at a project in Burkina Faso.

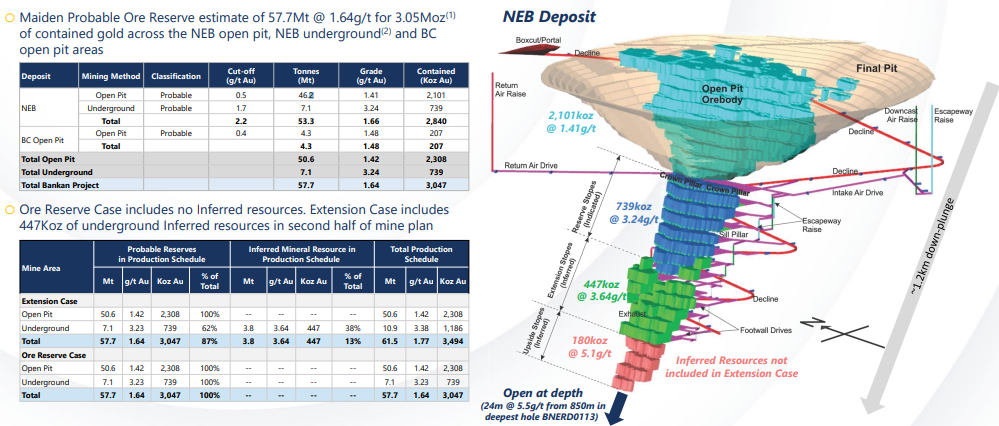

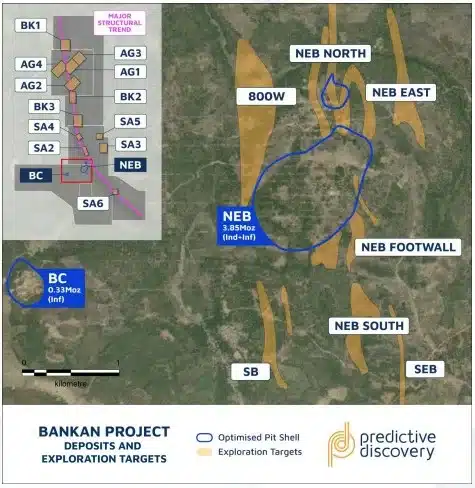

It only picked up its holdings in Guinea during 2018. But it hit the jackpot in 2020, finding numerous gold intercepts and one very, broad gold-rich zone at least 450m long. The rest is history. By October 2021, Predictive Discovery had a Maiden Resource of 3.6Moz of gold and this was further upgraded to 4.2Moz (76.8Mt @ 1.69g/t gold) in August 2022. The most recent update was to a 5.38Moz Mineral Resource, including a 3.05Moz Ore Reserve.

For those wondering ‘open at depth’ means the company doesn’t know where the mineralisation ends just yet. And this is just the main deposit – there could be satellite deposits in the surrounding vicinity of the project.

Source: Company

Source: Company

PDI is 19.9% owned by Perseus Mining, making it the most likely acquirer in any M&A scenario given Perseus’ interest and specialty in African gold projects. The company has A$42m in cash, is in the ASX 200 and is capped at over $500m.

The PFS estimated 269koz gold production per annum over a 12-year mine life. The company claims this makes the project the largest of all advanced gold development projects in Africa, as deducted by ‘capital intensity’ – in other words, pre-production capital over Life of Mine average annual gold production. The pre-production capex is US$456m and the All-in Sustaining Cost is US$1,130/oz.

What’s the jurisdictional risk?

Predictive Discovery’s Bankan project lies in Guinea, in the Birimian Greenstone Belt – an area of the country that has been significantly under explored until recent times. But there are other projects in production there including from Nordgold and AngloGoldAshanti. The western part of the country has a lot more deposits in production, particularly from Rusal, although other companies with projects there include Rio Tinto and Alcoa. But the most notable is the Simandou project in the South that is a joint venture between Chalco and Rio Tinto which is the largest mining project in constructions globally.

Mining contributes 31% of Guinea’s GDP, 78% of export revenue and 30% of tax revenues. Corporate tax is 30%, royalties are 6% (including a base rate of 5% and a 1% contribution to local development) and the state is entitled to a 15% free-carry. Of course, you can never be 100% sure with Africa as the case study of Leo Lithium (ASX:LLL) in Mali depicted. The country, an ex-French colony, has been governed by a military faction since 2021, following a decade or so of democracy, and it suspended the constitution. So far the regime has not touched the mining sector, but it could take just one outrageous tax claim against one big miner to kill sentiment for all companies operating in the country.

But the signs have been good so far – only earlier this week, the country’s Environment ministry approved the Environmental & Social Impact Assessment (ESIA) and issued a Certificate of Environmental Compliance. This did result in the company having to relinquish permits in a particular zone that was close to a conservation area of a national park, although the entire development zone lay outside of here.

What does 2025 hold?

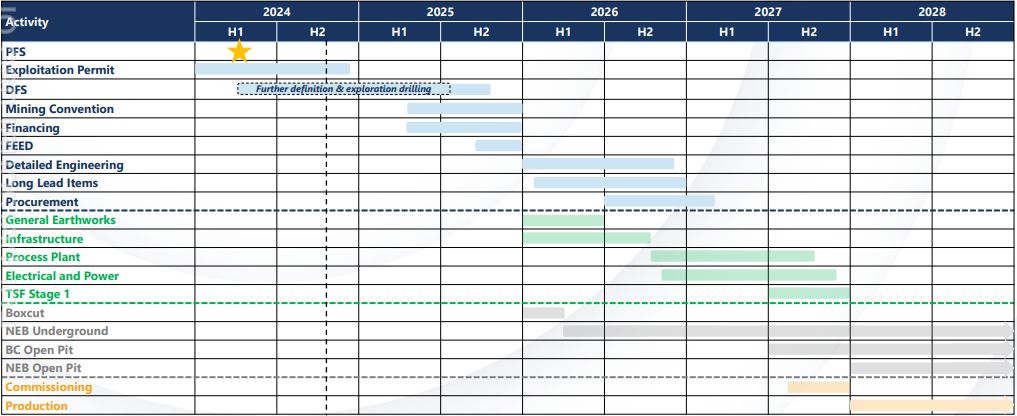

The company is working on a Definitive Feasibility Study, a process that will involve further exploration work and could see the Mineral Resource increase. Completion of this is anticipated for the second half of 2025, and the company has told investors that it is advancing according to schedule. The company will also work on financing and engineering for the project. Production is anticipated in 3 years, in early-2028.

(Source: Company)

PDI is not the closest gold developer to production. But it is in the right commodity at the right time, in a jurisdiction that appears safe (at least for now) and has a DFS due later this year. Things are looking on track for PDI.

What are the Best ASX stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…