Prescient Therapeutics (ASX:PTX): About to take the plunge into a Phase 2 trial against T-Cell Lymphoma

![]() Nick Sundich, September 5, 2024

Nick Sundich, September 5, 2024

There’s plenty of ASX oncology biotechs conducting clinical trials, but Prescient Therapeutics (ASX:PTX) is one of the closest to commercialisation. The company is about to start Phase 2 for T-Cell Lymphoma and successful data here could suffice to appease the FDA without a Phase 3 trial, given the lack of treatment options currently available, but also because of how efficacious it has been shown to be. Success at the current stage would be good news not just for investors, but to sufferers of this terrible cancer.

Prescient Therapeutics’ journey

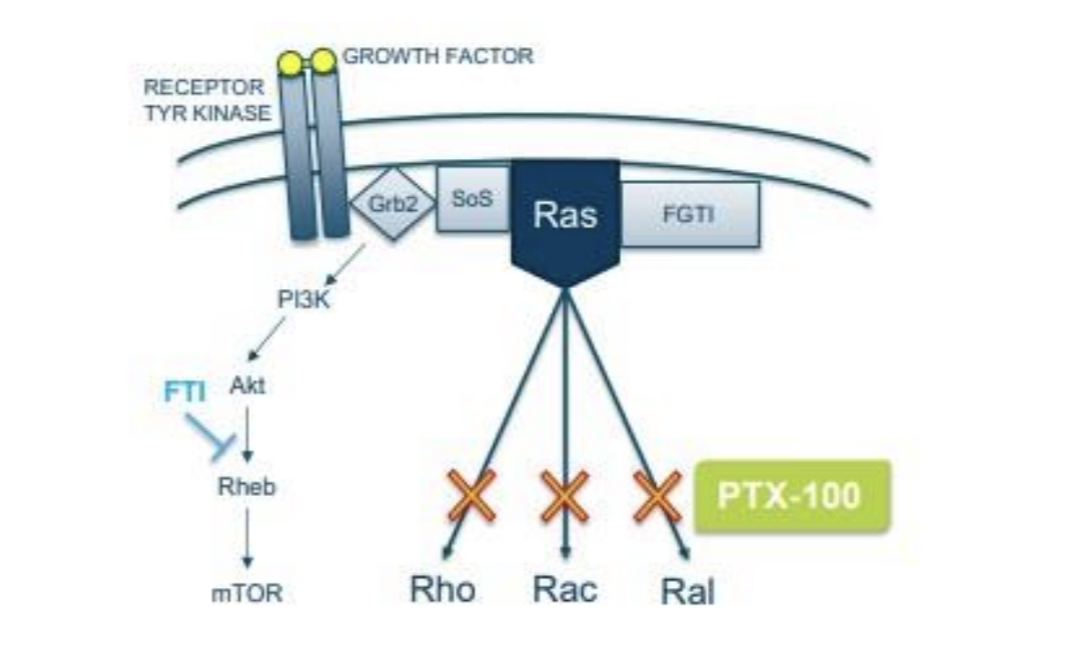

Prescient Therapeutics originated with PTX-100 and PTX-200 in 2014. Prescient listed on the ASX in a reverse shell transaction using the shell of a failed drug developer called Virax. PTX-200 is on the backburner, but PTX-100 is in a pivotal clinical trial. PTX-100 is small molecule that can attack cancer by disrupting a cellular signalling pathway called ‘Ras’.

Source: Company

Over the last five years Prescient has gathered some great data on PTX-100 in T-Cell Lymphomas. T-Cell Lymphoma is a rare but aggressive cancer with a low survival rate. While only around 5,000-6,000 people a year will be diagnosed with a T-Cell Lymphoma in the US the market opportunity could be in the billions, if Acrotech Biopharma’s Folotyn with its $842,585 per patient per year price tag is any guide.

In 2019 Prescient started a Phase 1 study of PTX-100, initially as a dose escalation study in a variety of tumour types. Phase 1b completed in July 2021 with an excellent safety profile and a clinical signal in T-Cell Lymphoma. An expansion cohort in T-Cell Lymphoma opened in April 2022 to focus on T-Cell Lymphomas and by October 2022 Prescient was reporting favourable clinical activity in this cohort. In July 2022 PTX-100 was granted Orphan Drug Designation by the US FDA for Peripheral T-Cell Lymphoma and for all T-Cell Lymphomas in March 2023. By that time seven of 10 patients T-Cell Lymphoma patients evaluated had durations of response exceeding the standard of care.

Now what?

The next step for PTX-100 is a Phase 2 trial, and the company aspires to open one during the current quarter (the September quarter of CY24). PTX is discussing with the FDA potential for such a study to be an Accelerated Approval Study. This would mean, subject to successful data, PTX-100 could be submitted for FDA approval if and when it passed this study without the need for a Phase 3 study. Merely entering Phase 2 is a major step where there is most potential for shareholder value creation, as the first step where efficacy of the drug is the primary focus.

Assuming success in all regards (FDA approval to the Phase 2 trial to be pivotal, successful Phase 2 results and FDA approval for commercialisation), commercialisation could occur in as little as 3-4 years from now, if Phase 2 initiation happened by the end of this calendar year and that it takes another 2 years to complete the study and read out the data. PTX is also expanding the current trial to create a more robust regulatory package.

It is plausible that the company may have to undertake a subsequent Phase 3 trial, as per conventional drug development paths. Phase 3 trials are more comprehensive, time-consuming and expensive. Nonetheless, PTX should still be an attractive company for investors of all kinds because there are few other (if any) oncology stocks with a drug in Phase 2 and with such encouraging Phase 1 and pre-clinical results.

Developers of orphan drugs are able to obtain substantial benefits that non-orphan drug developers get including tax credits, long-term periods of market exclusivity and even waiving of certain fees. Orphan Drugs can also fetch premium prices (several hundreds of thousands of dollars for example), and this is often reflected in the valuation of companies. One example Horizon Therapeutics – it has Tepezza, the only approved treatment for thyroid eye disease, and was bought by Amgen’s in October 2023 for a staggering US$27.8bn. This followed over $3.5bn in sales in the first two full years on the market (2021 and 2022). A figure of US$27.8bn might be too high for PTX at this stage.

Nonetheless, it is not unreasonable to imagine there could be M&A or partnering interest for this drug – the latter could occur even prior to commercialisation. Consider that Neuren Pharmaceuticals (ASX:NEU) tripled in value to ~$2.6bn over CY23 after a partnering deal and commercialisation for its Rett-syndrome treatment during that year. This occurred following its FDA approval, although Dimerix (ASX:DXB) depicts that it is not impossible for deals to be struck prior to approval and even during Phase 3. Such a deal would not only facilitate royalties on sales, but likely provide for payment of certain R&D and commercialisation costs as well as potential upfront payments that could help fund development of OmniCar and CellPryme. Neuren’s initial payment, received in July last year, was US$100m.

CellPryme and OmniCar have potential too

PTX has also been progressing its work with CellPryme and OmniCAR, both platforms to assist with CAR-T (Chimeric Antigen Receptor T-Cell) therapy. CAR-T therapy is a therapy that utilises the body’s own T-cells, which are isolated from the patient’s peripheral blood, endowed with enhanced specificity and killing efficacy towards the patient’s cancer cells, and then reinjected into the host, where they aid in tumour clearance. The treatments on the market today show very encouraging remission rates – of over 80%2. Many CAR-T therapies, however, remain inaccessible to many due to high costs and have some challenges holding them back, particularly efficacy, durability of CAR-T cells, multi-targeting and post-infusion control. This is where CellPryme and OmniCAR come in.

CellPryme is a cell therapy enhancement platform, with two applications (CellPryme-M and CellPryme-A) that can be used separately or concurrently with significant power together and in their own right. CellPryme-M, through the introduction of molecules during a cell manufacturing process, allows better kinds of cells to be produced, which improves cellular therapies like CAR-T. CellPryme-A is an intravenous drug administered alongside cellular immunotherapy and allows the tumour microenvironment to be overcome.

OmniCAR, in simple terms, operates as an immune receptor platform and a molecular binding system. Binders recognising cancer cells are administered intravenously after the administration of CAR-T cells and activates these cells resulting in on-demand tumour killing.

PTX is nearing completion of pre-clinical development of CellPryme and is preparing regulatory packages for both CellPryme-M and CellPryme-A so that these may enter the clinic in due course. The advantage of these platforms is that they can integrate easily into partner programs without highly disruptive changes to manufacturing processes or protocols mid-stream.

PTX is progressing platform optimisation of OmniCAR to investigate unarmed T-cell activity and improving control features. As a unique and multi-modal platform, this program is involving domain experts across protein and cell engineering and other areas.

This company is grossly undervalued

Currently Prescient stock is seriously undervaluing a potential near-term payday with PTX-100. Prescient Therapeutics had a market capitalisation on ASX of less than $50m, which is only US$32m. Whatever currency you use, we think the current market capitalisation of Prescient does not begin to take account of the way in which clinical success with PTX-100 in T-Cell Lymphoma can yield a marketed drug in only around three years, where that drug’s market opportunity is at least in the hundreds of millions.

Prescient Therapeutics (ASX:PTX) share price chart, log scale (Source: TradingView)

Our friends at Pitt Street Research have been covering the company since November 2023, and most recently published a note on it earlier this week. Pitt Street valued the company at 11.6c per share in a base case and 16.4c per share in an optimistic (or bull) case. We encourage readers interested in hearing more about the company to check out Pitt Street’s reports for free.

Prescient is an exciting company that investors should keep an eye on. There are very few (if any) biotechs fighting cancer with such optimistic data and about to enter Phase 2.

Prescient Therapeutics is a research client of Pitt Street Research.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Its reporting season in New Zealand in May and these 5 ASX companies are about to report annual results

Its always reporting season in New Zealand in May as well as November, because many companies there follow an April…

Immutep (ASX:IMM): Set to commercialise its lung cancer treatment by 2027

Developing a cancer drug is a long journey, but Immutep (ASX:IMM) is more towards the end than the start. A…

OPEC’s Decision to Increase Output by 411,000 Barrels: What This Means for Global Oil Prices

The decision by OPEC (Organisation of the Petroleum Exporting Countries) to increase oil production by 411,000 barrels per day (bpd)…