Propel Funeral Partners (ASX:PFP): The last surviving funeral provider on the ASX

![]() Nick Sundich, October 24, 2023

Nick Sundich, October 24, 2023

It is said the only certainties in life are death and taxes and Propel Funeral Partners (ASX:PFP) is the set to be the only ASX company that makes its money from the former.

Its larger rival Invocare (ASX:IVC) is set to be taken over by TPG Capital for $1.8bn after a difficult few years. Propel has had good fortune and is 20% above its pre-pandemic level…but what does the future hold? Could it be going the way of Invocare?

Introduction to Propel Funeral Partners (ASX:PFP)

Despite this company being the second largest funeral provider, you may not have its name before, because it is an owner of several franchises and you are likely have heard of some of them – White Lady Funerals and Simplicity Funerals just to name a couple.

Propel only came into existence in 2012 and was listed in 2017 at $2.70 per share. Many of its franchises go back several decades, however. It is 14.8%-owned by co-founders Fraser Henderson and Albin Kurti.

Australia’s 2nd largest provider

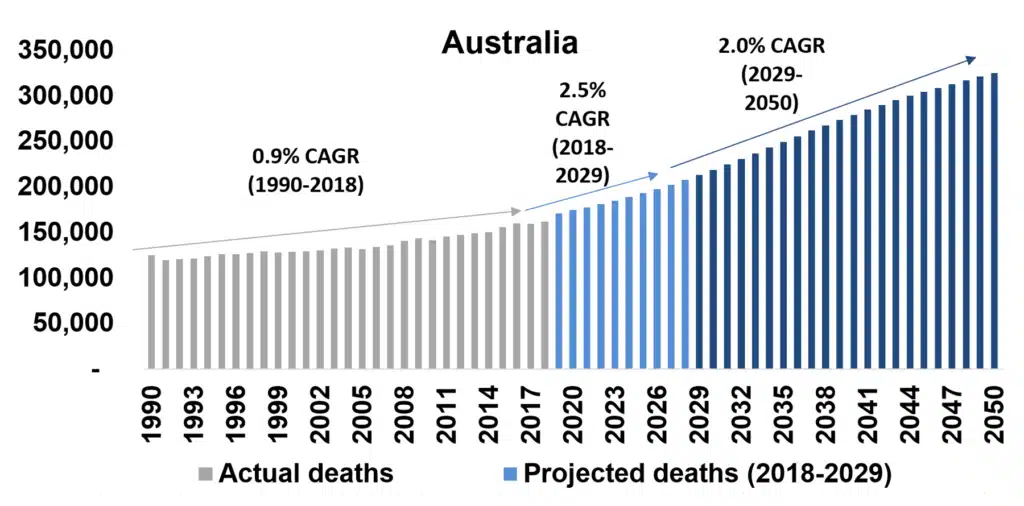

We’ve already noted that death is one of life’s two certainties. But it is also worth noting that funerals are a 24-hour, labour-intensive business with extensive planning and various facilities. And none of this comes cheap. Deaths in Australia are set to continue to grow in the years ahead. And Propel is the 2nd largest provider in the market with operations in 144 locations.

Source: Company

But fortunes don’t always favour it

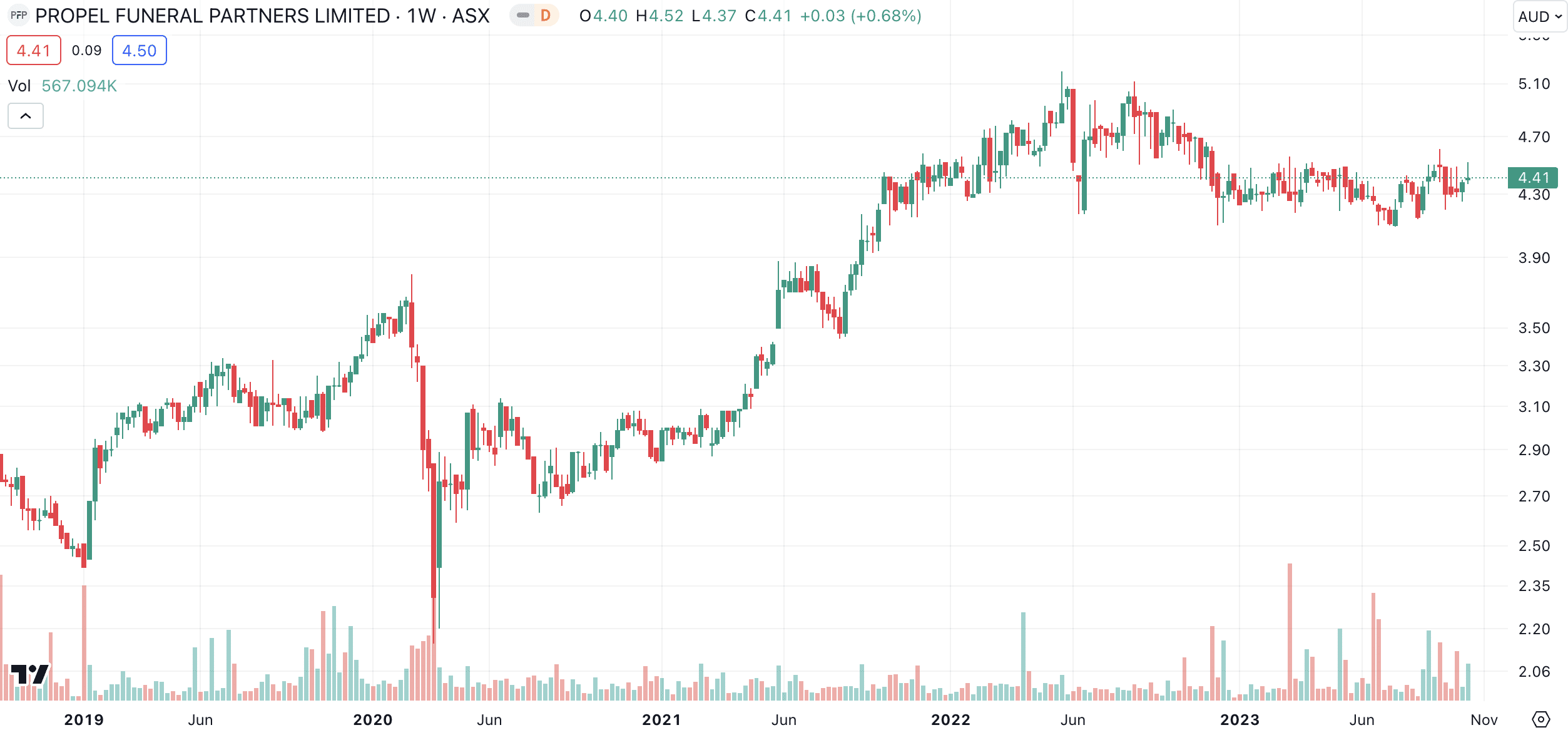

However, deaths can fluctuate from year to year. The 2019 flu season was a good time for Propel. The start of the pandemic actually ended up being a bad time for the company because social distancing meant less deaths from the flu. Things changed once social distancing measures were dropped, however. And it showed in the company’s share price and results.

Propel Funeral Partners (ASX:PFP) share price chart, log scale (Source: TradingView)

In FY22, the company delivered $145.2m in revenue (up 21%) and a profit of $16m (up 53%). It followed up this result in FY23 with $168.5m in revenue (up 16%) and a $19m profit (up 11%). In the latter year, Propel paid a dividend of 14c per share (yielding 3.3% at the time and representing a 79% payout of distributable earnings). It closed the year with $87m in available funding capacity and net leverage ratio of 1.7 times (well below its covenant limit of 4x).

Good times to come, maybe?

Consensus estimates for FY24 call for $212.4m in revenue (up 26%) and a $22.4m profit (up 18%). For FY25, a $231.4m in revenue (up 9%) and a $24.8m profit (up 11%). This places the company at a P/E of 23.3x for FY24, a figure slightly above the ASX 200 average, and the mean price is $5.10 per share (a 16% premium to the current share price of $4.41).

Our own DCF valuation of the company is $5 per share, a slightly lower 13% premium to the current share price. This is using a DCF valuation with consensus estimates and a WACC of 8.46%. This being said, if you wanted to value Propel on a takeover basis, it would be worth $8.14. This is using a P/E multiple of 37x, the implied takeover multiple of Invocare.

Getting offers of its own

Now, the company told investors only very recently it received takeover offers without being specific as to who were bidders and what they offers. As a consequence, the share price has not moved that much, but don’t be surprised if it moves if binding offers are made and revealed to investors. There is evidently some growth in this one, but not as much potential as other ASX small caps we have covered in recent weeks unless you want to assume it will be taken over.

And if history with this company is any guide, it will depend on death volumes during flu seasons. A bad flu season in 2024 will be good for PFP but a ‘good’ flu season will be bad for PFP and its investors.

One for Invocare investors, but for other investors?

The Invocare deal is set to be closed in November. At this point, those investors wanting another funeral parlour stock have no other choice on the ASX but this one. And we don’t think those investors will be disappointed. As for other investors, it might be a safe hold for a few months. But whether or not it can reach consensus estimates will depend on the severity of the 2024 flu season.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…