Proteomics International Laboratories (ASX:PIQ): It thinks its got a great DKD detection test, but do regulators agree?

Proteomics International Laboratories (ASX:PIQ) is one of the larger companies that will be presenting at next month’s Life Sciences Conference. Capped at over $100m, its flagship product is PromarkerD, a predictive test for Diabetic Kidney Disease (DKD). Like all up and coming healthcare stocks, it has a great idea, but execution is the key. And it has not all been smooth sailing.

Introduction to Proteomics International Laboratories (ASX:PIQ) and PromarkerD

The term Proteomics is mapping the structure and function of proteins. Promarker (called PromarkerD when commercialised for DKD) identifies protein biomarkers via a blood test and seeks to identify those who have DKD or are at risk of it. The test is the only low-cost, high-speed test capable of this.

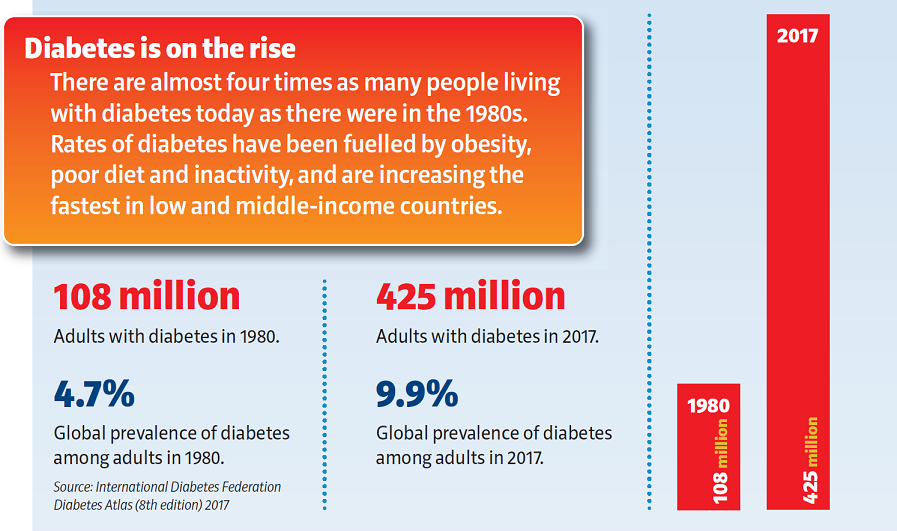

As the name implies, DKD is a kidney disease that can occur in people with diabetes. About a third of adult diabetics have it, and 10% of those without it right now will develop it in the next four years. Moreover, the presence of diabetes is only going in one direction.

Source: Company

DKD damages the kidneys and thus their ability to filter the waste and excess water in the blood. Existing tests can only detect DKD when it is present, but PromarkerD may be able to detect it four years earlier. This has been determined over multiple studies that have enrolled several thousand patients. What’s more, is that existing tests are not always accurate, but PromarkerD is. By detecting the disease early, it can be treated through medications, lifestyle modifications and dietary changes.

DKD could just be the tip of the iceberg in terms of what Promarker could do. It is being developed against other indications including endometriosis, oesophageal cancer and oxidative stress, although DKD will be first.

The difficulty in getting the test commercialised

It is easy to talk about how good a product is, but getting regulators to agree…not so much. It is common for a product to be rejected because it doesn’t work, but this is not the only reason regulators can hold it back.

PromarkerD has CE Mark approval for the EU and UK. It has a long-term agreement to sell the test in the UK market as well as for France where it secured Eurobio Scientific as a distributor. Finding partners for Spain, the Netherlands, Belgium and Italy remains a work in progress. In Latin America, the company has launched it in Chile, the Dominican Republic and Puerto Rico.

The TGA rejected the request to put the test in the Australian Register of Therapeutic Goods (ARTG) in September 2023, due to a change in the company’s manufacturer. Furthermore, our regulator could approve it, but it is unlikely to be sold here because Medicare reimbursement would not be as much as the US rate.

As for the US…PIQ does not have an explicit green light from the FDA, but the situation is more complicated than getting approval. Even in the absence of the green light, the company has won Medicare/Medicaid reimbursement, at a price well above what the company had expected – US$390.75 or A$590. So there should be no worries about having people afford it, because all patients accessing government healthcare have this rate. The most recent update was in the company’s quarterly update where Proteomics said that it remained in discussions with Sonic about the technical and commercial requirements for a proposed national launch of the test in the USA.

And PIQ has a partnership with Sonic to commercialise it in the US in exchange for royalties, which puts the ball in Sonic’s court to make the case. The most recent target of June 2024 was announced to be missed three months prior with the process taking longer than expected.

FY25 is expected to be a big year

Despite various ups and downs, the company’s share price has nearly tripled in 5 years. Although it has been an up and down FY24, and its has been reflected in the share price, FY25 is set to be a major year.

Proteomics (ASX:PIQ) share price chart, log scale (Source: TradingView)

Proteomics hopes to launch PromarkerD in the USA and Europe. It may be conceded that revenue generation in the USA may take some time after Europe, but there is still a market opportunity in Europe for the company. Moreover, the company has licensing deals remaining to be signed for uncovered jurisdictions (particularly in Europe), and these could generate upfront payments in addition to the promises of royalties later on. Proteomics will also continue clinical activities with Promarker against other indications, particularly endometriosis, with the goal of eventual commercialisation. The broader Promarker platform could also develop new Diagnostic tests.

For these reasons, we’re looking forward to hearing more from Proteomics at next month’s Stocks Down Under Life Sciences Conference on September 19. More details are coming soon.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…