4 of the strangest reasons directors sell shares in their company

![]() Nick Sundich, December 1, 2023

Nick Sundich, December 1, 2023

What does it take for directors to sell shares in their company? Given it can be perceived as a sign of no confidence in the company, you would think there would be good reasons. Some of the most common include paying tax bills or selling to institutional shareholders. But, every now and again, there are some reasons directors sell shares that raise eyebrows – and here are 4 of them.

4 of the strangest reasons directors sell shares in their company

Kirsty Carr from Bubs – buying a house

Nearly 4 years prior to the day of her unceremonious exit from the company she founded, Mrs Carr netted $5.8m from selling shares in the company. The reason given? To buy a house. ‘Mrs Carr has advised that the sale of the shares was for entirely personal reasons to acquire a new family home,’ the company told investors.

Miriam Adelson from Las Vegas Sands – buy Dallas Mavericks

This was the whole inspiration behind this article. Mrs Adelson is the widow of the former boss of Las Vegas Sands Sheldon Adelson, who died in 2021 and held a majority stake in the company. Mrs Adelson does have a reputation of her own, as prominent medical doctor and philanthropist, focused on causes that improve Jewish relations in the United States. Last week, the company announced that it would sell US$2bn of shares, equating to 10% of her stake to buy the Dallas Mavericks.

OK, it didn’t specifically mention the Mavericks. ‘We have been advised by the Selling Stockholders that they currently intend to use the net proceeds from this offering, along with additional cash on hand, to fund the purchase of a majority interest in a professional sports franchise pursuant to a binding purchase agreement, subject to customary league approvals,’ Las Vegas Sands said in the filing. However, with Mark Cuban recently announcing he would sell the Dallas Mavericks, it is difficult to see what other franchise it would be given how few others are on the market. The company agreed to buy US$250m of those shares.

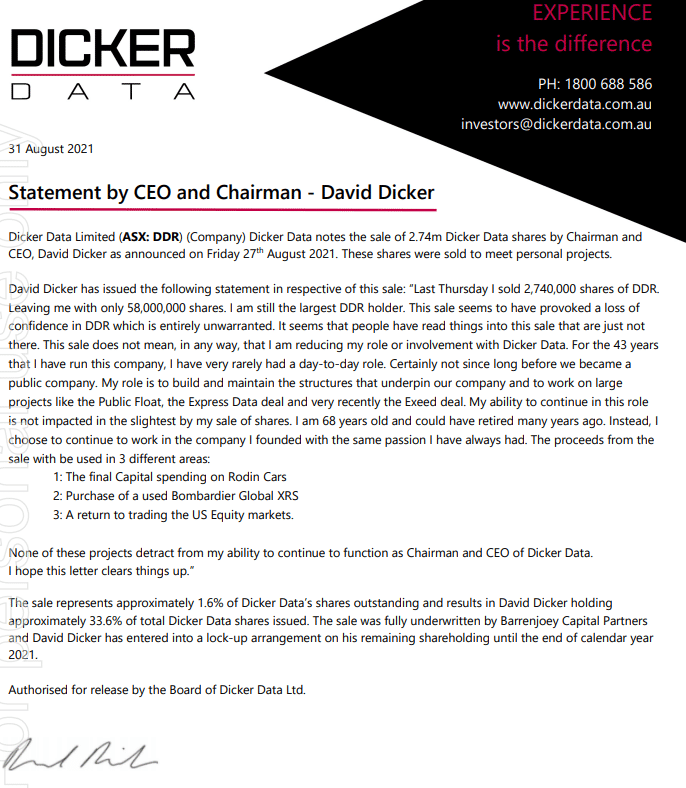

David Dicker from Dicker Data – buying cars, a private jet and US shares

This made the Sydney Delta lockdowns bearable. It is said that a picture is worth a thousand words and in our view, there is no better a case study of the truth of that statement than here.

Source: Company

As you can see, the sale caused some panic amongst shareholders that the founder was stepping away from the company. So, Mr Dicker felt the need to ‘correct the record’ and so he did with a touch of honesty you usually don’t see. After all, surely at least some directors who sell to institutions may’ve done one or two of those things, especially when they say they are ‘diversifying’ their portfolios.

Kelsian director Neil Smith – charity venture.

These shares were not directly owned by Mr Smith, instead by a trust in which he is a beneficiary. A $5m package was sold, apparently for a good cause. “The principal use of the proceeds of the disposal will be to further support charitable projects undertaken by a UK registered charity called The Relay Trust of which Mr Smith is a trustee,” the announcement said.

“The projects supported by The Relay Trust are educational and community infrastructure projects in Sudan, South Sudan, Madagascar, Mozambique, Angola and Sierra Leone.”

Furthermore the announcement said Smith participated (through Relay Australia Pty Ltd as trustee for The Relay Trust Australia) in the recent KLS capital raise associated with the proposed acquisition of All Aboard America! Holdings, Inc. “Mr Smith has advised Kelsian that there are no changes in Kelsian’s circumstances influencing his decision to dispose of these shares,” the announcement said.

Smith was one of the founding shareholders and former chair of the Transit Systems Group before the acquisition by Sealink.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Archer Materials Cracks Quantum Readout Challenge as Stock Surges 12%

Archer Materials Just Solved One of Quantum Computing’s Hardest Problems Archer Materials (ASX: AXE) jumped 12% today after unveiling two…

NVIDIA’s Blackwell Chips Ignite Record Demand in Q3

NVIDIA’s Blackwell Surge Tech investors and growth-focused funds will be breathing a sigh of relief after NVIDIA (NASDAQ: NVDA) delivered…

REA Group (ASX:REA): Here’s why it succeeded over Domain Group at home, but hasn’t done that well abroad

REA Group (ASX:REA) is best known in Australia as the owner of realestate.com.au. For so long, the company (which is…