Recce Pharmaceuticals (ASX:RCE): Taking the fight against superbugs to the next level

![]() Nick Sundich, May 20, 2024

Nick Sundich, May 20, 2024

Recce Pharmaceuticals (ASX:RCE, FSE:R9Q) is a Sydney-based company fighting the battle against superbugs, with a legitimate chance of succeeding if the data to date is any guide. Bacterial infections have become an increasing problem as bacteria develop resistance to conventional antibiotics causing life threatening conditions such as sepsis. There is an urgent need for treatments that can tackle these diseases head-on, and Recce just might have a candidate that can take up the battle.

Recce’s name is no coincidence

Recce’s name is pronounced ‘reh-key’ and was chosen because it is the standard military shortening of the word ‘reconnaissance’. Recce is fighting a war against ‘superbugs’, which is a fancy word for bacteria that can resist conventional antibiotics.

There are many examples, but one particularly notorious disease is sepsis, often caused by infections from superbugs. Sepsis occurs when the body’s immune system has an extreme response to an infection, leading to tissue damage, organ failure, lowered blood pressure and death. The World Health Organisation estimates that there are 48.9m cases annually, almost half of which are children under 5. The average hospitalisation cost is more than US$32,000, making it the most expensive condition treated in US hospitals. There are 11m deaths annually due to sepsis, more than deaths from prostate cancer, breast cancer and HIV/AIDs put together.

There are no drug therapies approved specifically for the use of sepsis, with approximately 1/3 patients presenting with unspecific symptoms, leading to delayed treatment and a high mortality rate. Early treatment with an effective antibiotic is key to the patients’ outcome.

RECCE® 327 is the company’s lead candidate

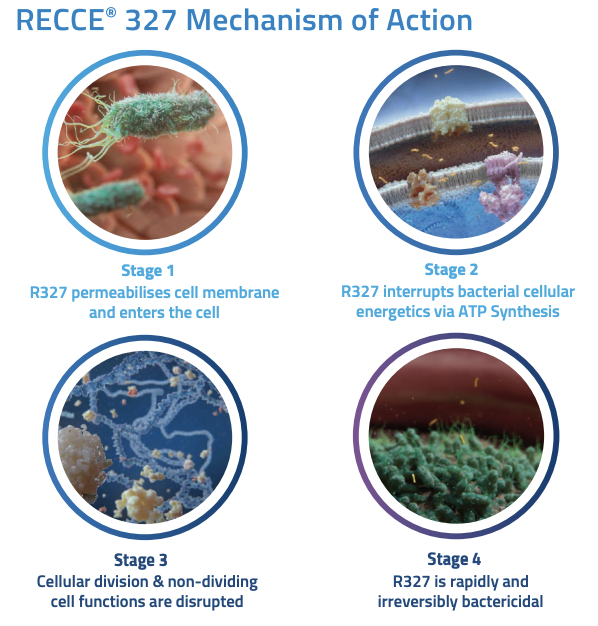

RECCE® 327 (R327) is the candidate that is most advanced, it can be administered both intravenously and topically. It has a unique Mechanism of Action (outlined below), working fast and continuing to work just as effectively with repeated use. Endurance is something existing antimicrobial solutions tend to stumble at, especially when bacteria mutates. Mutation is where the sequence of bacteria alters and one of the consequential effects can be resistance to antibiotics.

Source: Company

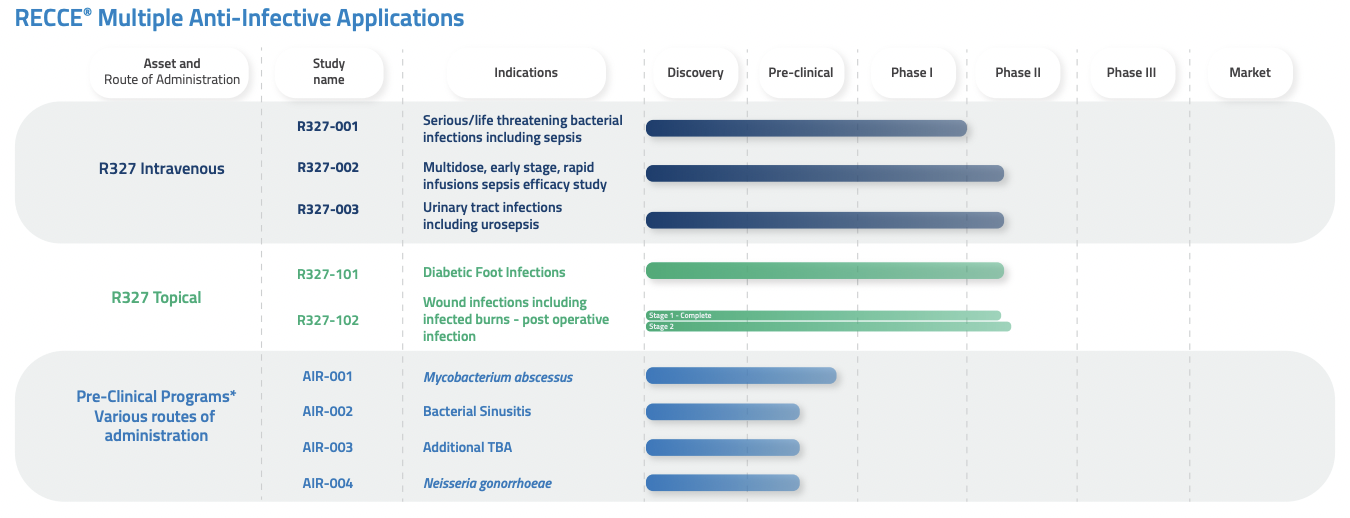

R327 is either in or has completed several clinical trials for multiple indications. The three most important trials currently underway are:

- Phase I for Sepsis/Urosepsis – Completed

- Phase I/II for Urinary Tract Infection (UTI)/Urosepsis infections – Ongoing

- Phase I/II for Burn Wound Infection (BWI) – Ongoing (Stage 2 to be initiated)

- Phase I/II for Diabetic Foot Infections (DFI) – Ongoing

The first two of these trials involves R327 being administered intravenously, while the other two see topical administration.

Source: Company

Very good efficacy

The Company completed a Phase I human clinical trial assessing a 1-hour intravenous infusion of R327 in healthy male subjects as a single ascending dose. The drug was well tolerated and no serious adverse events were reported. Pre-clinical results for R327 so far have been staggering in terms of efficacy. The drug has proven effective against the full suite of ESKAPE pathogens, including their Multidrug-Resistant Forms, within mere minutes of exposure.

The ESKAPE acronym stands for six different commonly found antibiotic-resistant bacterial pathogens: Enterococcus faecium (E. faecium), Staphylococcus aureus (S. aureus), Klebsiella pneumoniae (K. pneumoniae), Acinetobacter baumannii (A. baumannii), Pseudomonas aeruginosa (P. aeruginosa) and Enterobacter species – they are the leading cause of nosocomial infections throughout the world.

Cleared by the TGA

In Australia, R327 has been cleared for use under the TGA’s Special Access Scheme, which allows physicians to access R327 for individual patients. Recce Pharmaceuticals’ entire portfolio has been awarded nearly $55m in an Advanced Overseas Finding – an underwritten guarantee provided by the Australian Government, to cover R&D applicable activities undertaken by the Company anywhere in the world for a period of three years.

This finding does not constitute a grant, or an upfront payment of the amount awarded. In the US, R327 has been awarded a Qualified Infectious Disease Product (QIDP) designation. This would enable the drug fast tracked product designation when going for clinical approval, plus 10 years of market exclusivity post approval. R327 has extensive patent protections in all key pharmaceutical markets, with many not expiring until 2037.

Recce has its manufacturing facility in Sydney’s Macquarie Park. The company has an automated manufacturing process and recently announced it that can produce 500 doses per hour to Good Manufacturing Practice (GMP) standards, with a 99.9% product yield and a low cost, given raw materials are plentiful and cheap. As the company continues to push R327 through larger clinical trials and towards commercialisation, this will be critical.

The past 12 months has represented a rollercoaster year with several feats accomplished

As at mid-May 2024, Recce shares are 15% higher than 12 months ago. Shares declined in September 2023, following an $8m capital raising, only to recover in April 2024. There was substantial news flow out of the company in April as well as the first half of May, and most of it bodes well for the company’s future.

Recce Pharmaceuticals (ASX:RCE) share price chart, log scale (Source: TradingView)

Among them:

- Dosage of R327 in the Phase I/II UTI/Urosepsis clinical trial has been increased to 4,000mg infused over 20 minutes. Minimum Inhibitory Concentration (MIC) activity against bacteria was identified among existing clinical samples.

- An expansion of clinical trial sites for the Phase I/II Diabetic Foot Infection (DFI) trial including in Australia and Indonesia. The company is moving towards the initiation of a Phase III registrational trial scheduled to commence in the September quarter of CY24.

- The company proved its patented manufacturing process could produce 5,000 GMP (Good Manufacturing Practices) doses of R327 per week.

- A$11.2m in non-dilutionary cash was received as an R&D Advance, reflecting three years’ worth of past and anticipated future expenditure between FY23 and FY25.

- Positive results from a pre-clinical, pilot study on the efficacy of nebulised R327 for treating lung infections (Mycobacterium abscessus) in a mouse model.

- Multiple ongoing pre-clinical programs exploring new research development opportunities in a range of therapeutic indication including but not limited to: bacterial sinusitis (Streptococcus pneumoniae), Mycobacterium abscessus and Neisseria gonorrhoea.

Investors’ eyes should be awaiting Recce’s Phase II results

The key catalysts for Recce are the results from the three ongoing clinical trials. Looking ahead, the company plans to file an Investigational New Drug (IND) application with the US FDA in the second half of CY24, with initiation of a pivotal clinical trial (that is to say, the final trial before the company applies for regulatory approval) in the US to occur in the first half of CY25.

Investors should watch Recce with eager interest in the months ahead. With the Biotech Bear Market well and truly behind us, and historical precedent for positive Phase II results to be company defining and create substantial shareholder value, we think the company has a bright future.

This is a sponsored article.

What are the Best ASX Life Sciences Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…