Recce Pharmaceuticals investors are excited despite the market volatility – and there’s good reason

Recce Pharmaceuticals investors are amongst the few investors in ASX stocks that have a reason to smile right now. Their company has significantly outperformed the broader ASX, sitting in positive territory while the rest of the market has been volatile.

Although there weren’t any announcements out of Recce – other than the completion of its Share Purchase Plan – news of a major investment by one of the world’s biggest pharmaceutical companies excited investors. This is because Recce is one of the few companies in the same space this biotech behemoth is investing in.

Pfizer is investing $150m into fighting ‘the silent pandemic’

Pfizer announced it was investing A$150m into the fight against superbugs. Although the company has global headquarters in Manhattan and an Australian base in Sydney, it announced the upgrade of a facility in Melbourne to develop and produce new antimicrobial treatments. It already manufactures antimicrobial medicines in Melbourne, along with anaesthetics and anti-inflammatory medicines which are exported to more than 60 countries around the world and treat up to 15 million patients.

But Pfizer will be upgrading its facilities to host a new facility with lyophilisers. Lyophilisers are freeze-dying machines used in the antimicrobial manufacturing process. This site has also been selected for a trial of Artificial Intelligence (AI) technology designed to support key site processes. Pfizer’s new facilities are expected to be operational by mid-2025, with commercial manufacture commencing in 2026.

There’s a reason why Pfizer is making this investment. Namely, because of the damage that Antimicrobial Resistance (AMR) is causing. The World Health Organisation has recently declared AMR as ‘the silent pandemic’ and considers it a top 10 area of public concern. Without intervention, it is estimated that there will be 10 million global annual deaths from AMR by 2050. In unveiling this news, Pfizer Australia’s managing director Anne Harris declared that AMR was ‘one of the biggest global health threats of our time’.

This bodes well for Recce Pharmaceuticals investors

Recce is one of the few ASX companies fighting superbugs (bacteria that can resist conventional antibiotics), and arguably the most advanced ASX company at that. Recce’s flagship drug candidate is RECCE® 327 (R327). It has a unique Mechanism of Action that helps it work fast and continuously with repeated use. It can be administered in multiple formulations applicable to the indication – intravenously, topically as a gel, or as an aerosol for inhalation or intranasal administration. R327 is in multiple clinical trials for various indications, although it is cleared for use under the TGA’s Special Access Scheme, which allows physicians to access R327 for individual patients.

There has been extensive news flow from the company during the past few months, headlined by the company being added to the World Health Organisation’s List of Antibacterial Products in Clinical Development, becoming the only compound under its specific category.

But the biggest news of all was positive data from its recently completed Phase I/II clinical trial of R327 for UTI/Urosepsis Rapid Infusion. This study was positive not just because the drug proved its overall efficacy, but it worked faster than any other antibiotic to date, while still having an effect on bacterial growth lasting multiple hours post-dosing.

On the manufacturing front, Recce has enhanced its manufacturing output to produce 5,000 doses a week under Good Manufacturing Practice, providing ample product for an expanded clinical trial program.

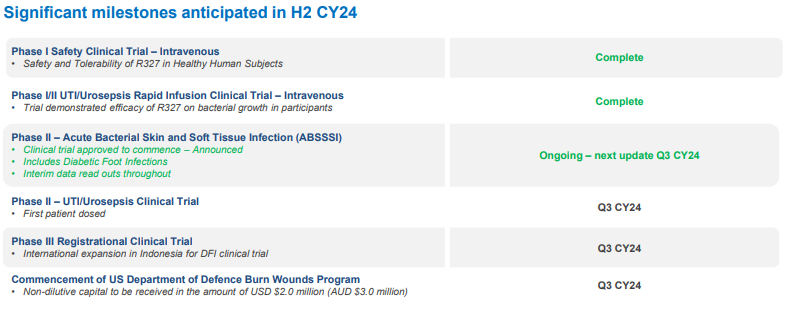

Shareholders have a lot to look forward to in the coming months. The company’s recent capital raising ensures it is fully funded to 1QY26.

Source: Company

Conclusion

This is not be the only time investors in an ASX small cap have been excited by a global pharmaceutical company battling similar diseases. Many investors may remember how Cogstate (ASX:CGS) investors were excited earlier this decade when Biogen’s anti-Alzheimer’s drug Aduhelm progressed through the clinic and was approved by the FDA – the first of its kind in nearly 2 decades at the time.

Investors in Recce have been excited over Pfizer’s $150m investment into its Australian facilities to fight superbugs. It gives confidence that major pharmaceutical companies are addressing the problem. As a company that is more substantially advanced than many of its peers, Recce is poised to continue its progress.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…