Redbubble is now Articore (ASX:ATG). But does that mean there’s a better future ahead?

![]() Nick Sundich, November 8, 2023

Nick Sundich, November 8, 2023

Redbubble is now Articore

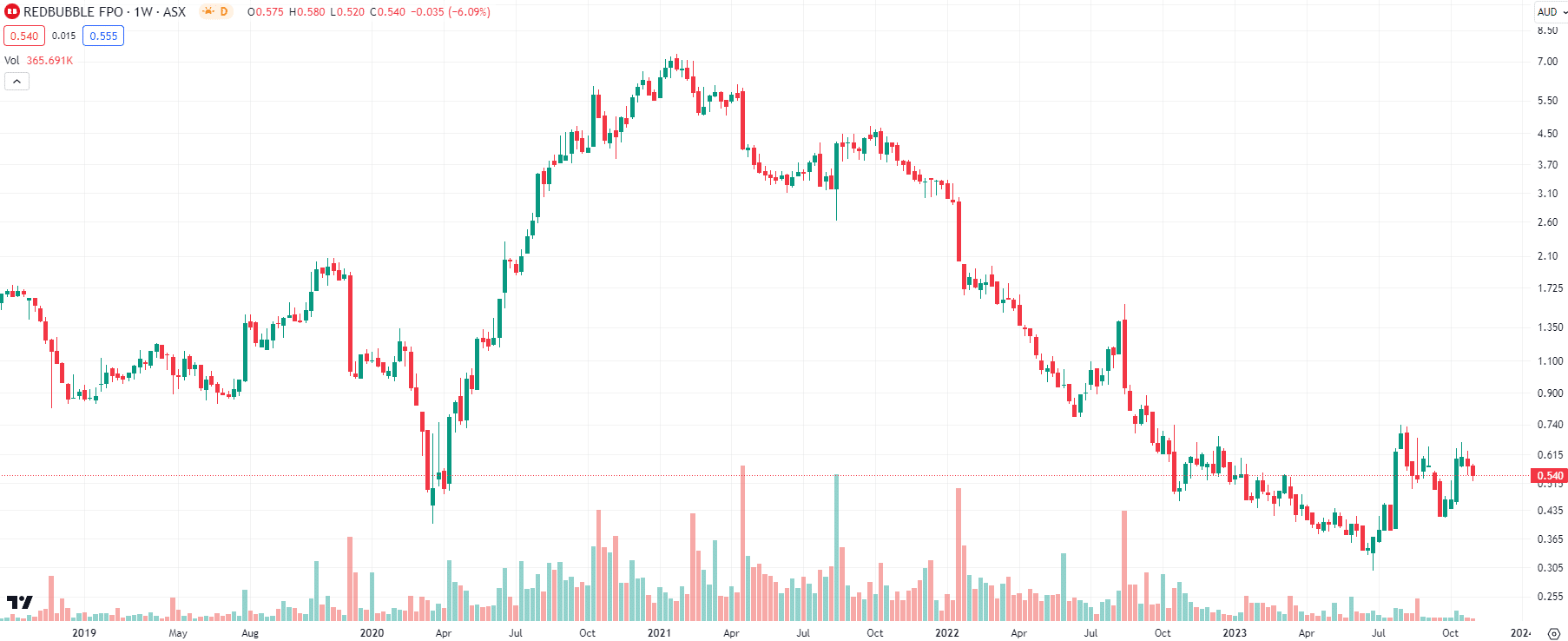

Since last Friday, Redbubble is know as Articore (ASX:ATG). The eCommerce stock, focused on selling items designed by independent artists ranging from phone cases to hoodies, skyrocketed from 50c to over $7 in the last 9 months of 2020. Even though the company may appear back to square one, with a share price of 58c, it is sitting on a gain of nearly 50% in 6 months.

Articore (ASX:ATG) share price chart, log scale (Source: TradingView)

So, is this name change signifying a better future for the company? Or is it just ‘same shit, different day’ – in other words, a desperate IR move?

What even is this company?

Articore consists of two operating companies – Redbubble and Teepublic. The company told investors the name change ‘more accurately reflects the operations of the Group as a collective of branded marketplaces and our ambitions to expand over time by adding new operating companies’.

The original business was founded in 2006 by Martin Hosking who has been at the helm for most (but not all) of the company’s history. Hosking first stood down from the hot seat in 2018, only to step back up in early 2020 after the termination of his replacement Barry Newstead. Hosking served until January 2021 when former Seek executive Michael Ilczynski was hired, but returned in March 2023. Despite cashing out 6m shares for $33.1m when the share price was at its peak in late 2020, he has a stake of over 10% in the business and is the largest shareholder.

Articore was in a good position prior to the pandemic with a solid foothold in North America and the best option for independent artists to take their designs into the mainstream. Two key steps for the company were its 2016 IPO, and its 2018 acquisition of Teepublic for US$41m, seven years after that company was founded.

A COVID boom that waned

When the pandemic struck, bored consumers engaged in eCommerce, and Articore was a beneficiary. Its revenue grew 132% year on year in the 12 months to June 2020. In the 12 months to June 2021, marketplace revenue rose by a further 58%.

However, conditions normalised over the next couple of years. Articore’s marketplace revenue fell 13% in FY22 and a further 3% in FY23. The company was profitable on a Gross Profit basis but not EBTIDA or NPAT. Indeed, its EBITDA loss blew out from $11.2m to $40.7m and its NPAT loss exploded from $24.6m to $54.2m.

Even so, the company boasted that it reduced operating expenditure by $45m on an annualised basis and that it achieved ‘neutral underlying cash flow’ in July 2023. According to the company (because this is not an accounting metric), it is ‘operating’ EBITDA less payments for capitalised development costs, leases and property, plant and equipment (PPE), which actually are cash outflows.

For FY24, the company has warned trading conditions would remain soft. However, shareholders were promised to expect ‘positive underlying cash flow for FY24’ as well as a 23-26% gross profit margin.

Consensus estimates for FY24 expect $441.7m in revenue, $9.5m EBITDA (an improvement from the $40.7m loss in FY23) but a narrow $3m NPAT loss. Looking to FY25, $483.7m in revenue (up 10%), $16m in EBITDA and a $3m profit.

Our problems with Articore

Should you consider investing in Articore? We suggest there are 3 problems that would make us uncomfortable to suggest so.

First, eCommerce is a highly competitive field to begin with and it is hard to stand out. Yes, Articore may be geared towards independent artists, but there’s nothing to stop independent artists marketing on Amazon – a platform with a lot more people.

Second, Redbubble is heavily reliant on Google search traffic, officially blaming it on some earnings misses.

Third, Articore has even lower margins than most eCommerce businesses. It gives a cut not just to the artists but to the fulfillers too – it has been estimated that it keeps only 30% of its revenue.

As long as these 3 issues persist, the only scenario we see causing the company to grow to $7 again would be another pandemic leaving people stuck at home. We accept that it is not entirely unreasonable to expect there is upside if it makes progress towards profitability, but we think there’s quite a while to wait there.

Addressing briefly the scenario that it could engage in M&A activity. Could this lead to a re-rate? Not in our opinion. This would have to be paid for, inevitably in part with either dilutive scrip (in other words shares) or debt. And investors have become less keen on non-profitable companies engaging in roll-up activity.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Some ASX stocks could be hit by Trump Tariffs: Here are 6 in the Firing Line!

Trump Tariffs: They’re back with a vengeance and even worse than last time. During the first Trump administration, tariffs were…

Ramelius Resources (ASX:RMS): A $3bn gold miner, trading at a very cheap P/E

Ramelius Resources‘ (ASX:RMS) $3bn market cap may suggest it is expensive, but its P/E (7x for FY25 and 10.9x for…

Help: I own a delisted ASX company! What can I do?

If you own shares in a delisted ASX company, you’re probably wondering what to do. Some stocks have a happy…