Resolute Mining (ASX:RSG): The government of Mali strikes again

Resolute Mining (ASX:RSG) is not the first resources company to have been targeted by the government of Mali – just ask Leo Lithium. But while Leo Lithium was able to walk away from its project, Resolute has had its CEO and two other employees detained in Mali by government officials. And the company’s shares have shed over 40% of their value in the last week.

Resolute Mining (ASX:RSG) share price chart, log scale (Source: TradingView)

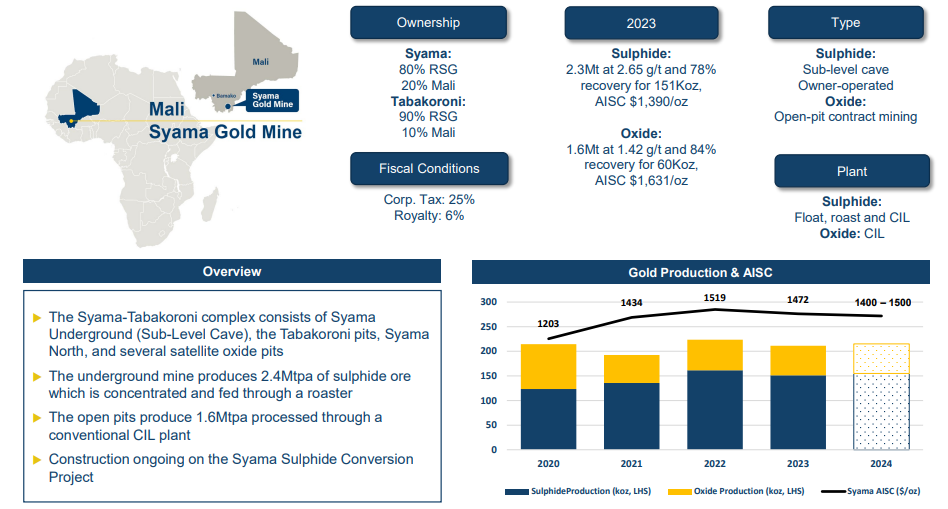

Resolute Mining’s assets

Resolute has the Syma Gold Mine in Mali and the Mako Gold Mine in Senegal. But with the latter having 0.9Moz Resource and the former having 10.3Moz, there’s no questioning which is important. We imagine if this was reversed, there would have been no more than a 5% hit to the share price at best. Resolute also has exploration assets in Guinea, Cote dÍvoire and it has a 20% stake in Toronto-listed Loncor Gold which has assets in DR Congo.

Source: Company

As an operating miner with gold prices at record highs, the company is cash-rich and profitable. Resolute produced 85,043oz in the September quarter of 2024, albeit down 6% due to the impact of heavy rain in Senegal. Resolute has $146m in net cash, $61m in operating cash flow in the most recent quarter – $188m in the past 9 months, with capex of just $26.6m. It upgraded its MRE for two of its exploration assets.

Its objectives with Syama were to expand the oxide plant and the mine life, thus taking the company from 345-365koz per year (as it has guided to for CY24) to >500koz.

Mali: A risky country

The biggest risk with this one was always sovereign risk. We mean, this country has had multiple coups in the last decade, problems with terrorism and can see legal contracts torn up at a moments’ notice. You need look no further than Leo Lithium to see this. Leo Lithium was hoping to operate the country’s first lithium mine.

The latest Mining Code, established in 2023, enables the government to take a stake of 10% in the project, an option to buy an additional 20% within the first two years of commercial production and a further 5% could be ceded to locals. It also abolished certain tax exemptions. Leo Lithium decided to exit the country, negotiating a US$60m settlement.

Mali has also scruitanised arguably the most important gold miner there in Barrick Gold. The government sought CAF300bn (US$52m) in outstanding taxes and dividends – a fair bill, but likely penny change for such a large company, at least compared to the $190bn bill Acacia Mining got from Tanzania in 2017. Its staff were detained briefly in September, but then released after an agreement was struck. Long story short, it wants more money and a higher stake in projects – to 35%.

What does this mean for Resolute?

We think Resolute’s staff won’t be detained for too long – they’ll likely be released following some kind of settlement that will see the government with an even higher stake than the 20% it has already. We don’t imagine the government wants to shut down the industry entirely – after all, gold accounts for 25% of the national budget, 75% of export earnings and 10% of GDP – and maybe that might prevent the government from going too far.

But ultimately, it is scary to have employees detained by the government just because they could not come to some sort of agreement on the spot, which appears to be what has happened here.

We hope this lesson has reiterated to investors that sovereign risk is one of the key risks investors need to consider when looking at mining & resources companies, regardless of whether they are micro-cap explorers or multi-billion dollar miners.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…