Resouro Strategic Metals (ASX:RAU): What other ASX rare earths developer has a 1.7 billion tonne deposit?

To say Resouro Strategic Metals (ASX:RAU) has got a monster of a rare earths deposit is an understatement.

Resouro just unveiled its maiden Mineral Resource Estimate (MRE) for its Tiros project in Brazil. The Resource is an impressive 1.7 billion tonnes at 3,900 ppm Total Rare Earth Oxide (TREO), 1,100 ppm Magnet Rare Earth Oxides (MREO) and 12% titanium dioxide. And when it comes to reasons why you might want to take a close look at this company, the MRE is just the tip of the iceberg.

Tiros is spectacular

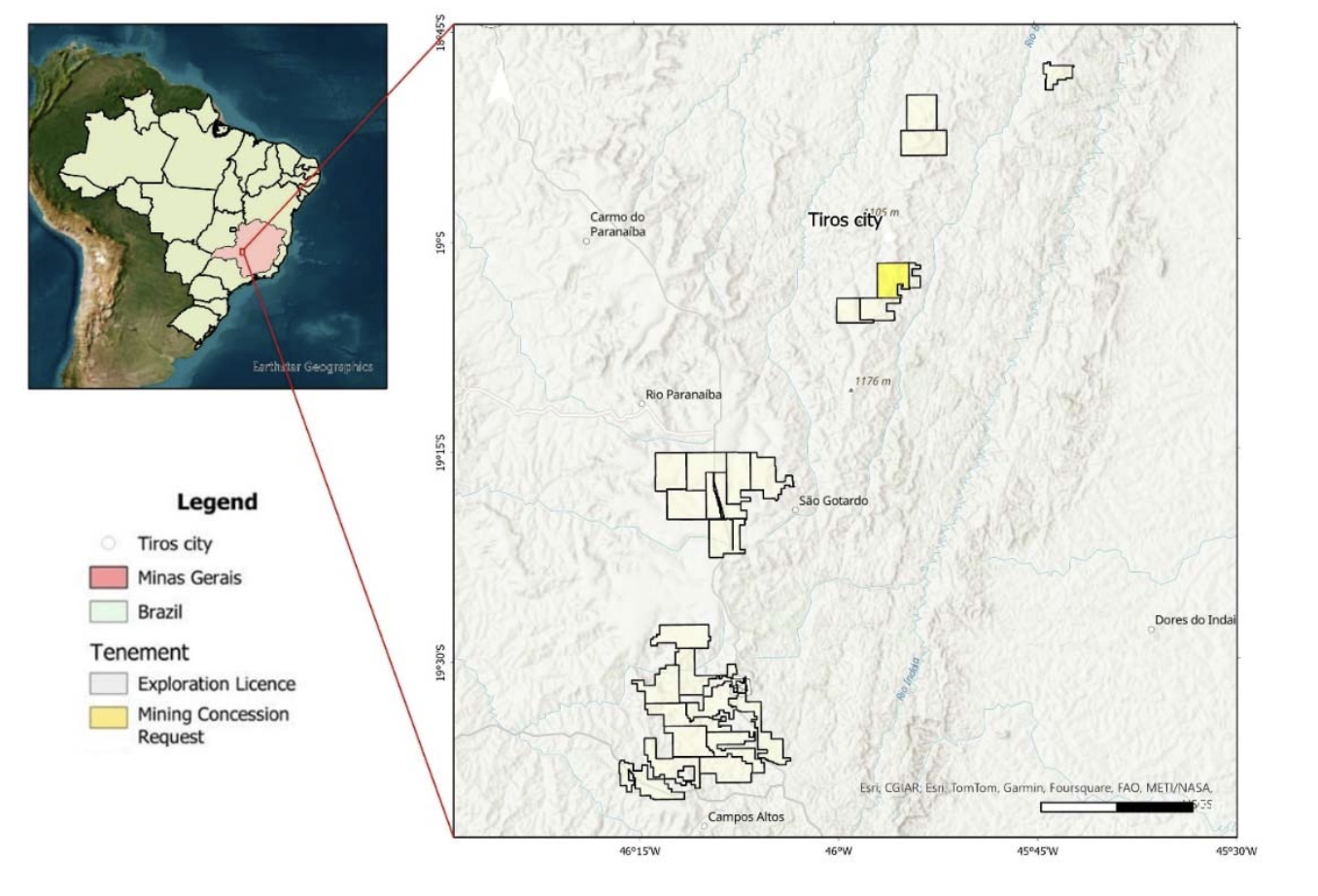

The Tiros project lies in northern Minas Gerais, Brazil, 350km west-north-west of Belo Horizonte. It is near a town called Tiros with 8,000 people. The project lies in close proximity of major federal highways, high voltage power lines and major rail infrastructure. Brazil has a reputation as a mature mining jurisdiction with a stable regulatory regime. World leading companies such as BHP, Anglo American, Vale and Rio Tinto have all operated there for decades.

Source: Company

The project covers an area of 45,048ha and only 7% has been explored. It was explored for over a decade prior to Resouro first acquiring the project in 2022 – initially to acquire a 33% stake with an ability to earn up to a 90% stake in the project, which it has achieved.

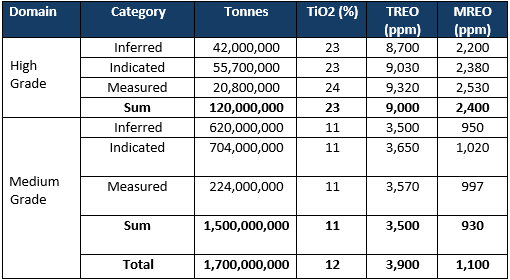

After several months of drilling, Resouro unveiled its first Mineral Resource Estimate. Tiros has 1.7 billion tonnes at 3,900 ppm Total Rare Earth Oxide, 1,100 ppm Magnet Rare Earth Oxides (MREO) and 12% titanium dioxide in all three resource categories. Just over 1bn of this is in the higher confidence Measured and Indicated categories across the High Grade and Medium Grade Domains, and covers only 7% of the total project area. 120Mt are in the Higher Grade Domain across Inferred, Indicated and Measured. From drilling done so far, it appears the deposit is very homogenous (in other words consistent) in its grading. That is to say, it is not the case that some drill holes deliver spectacular results, while others are poorer. Virtually all drill holes show similar grading.

Source: Company

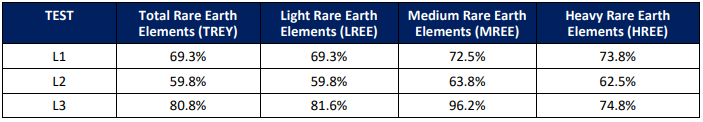

The results of metallurgical testwork have been positive too. Resouro is working with laboratory partners to optimise REE leaching and titanium conditions, and also to determine the economically feasible recoveries. Work commenced immediately after the July 2024 release of Tiros’ JORC Resource. A composite sample of 50kg, premixed by Resouro was air dried and milled to 100% passing 0.05m. The following result was generated.

Source: Company

This indicates that Resouro could not only extract REEs viably, but could achieve the highest rare earth extractions known across the industry to data.

A lot of work in a short space of time

Resouro has achieved a lot considering it only came into possession of the project in May 2022. The company was incorporated in a reverse takeover bought the private company that then owned Tiros – ISON – before listing on the TSX in the same month.

Although there had been pre-drilling exploration work in the decade before Resouro acquired the project, exploration drilling only began in September 2023. The company has drilled 25 auger drill holes totalling 257 metres, 31 Aircore holes totalling 1,562m and 26 Diamond holes totalling 634m.

Many may be surprised at how much Resouro has achieved in barely 2 years since the company was incorporated. But given the track record of the company’s management, the feat becomes more believable. The company is led by President and CEO Chris Eager, who has a proven track record in taking resources companies from exploration to late-stage feasibility studies and creating shareholder value in doing so. Of particular note on his resume was Monterrico Metals PLC which built up a resource at Peruvian Rio Blanco copper project and sold it for US$200m to Chinese conglamorate Zijin. Mr Eager has significant skin in the game, owning over 23% of shares, making him the company’s largest shareholder.

Rare earths are important, and Brazil can play a big role in the market

Rare earth elements are important in modern technologies such as magnets, batteries and lasers and are used in electronics (cellular phones, computer hard drives, displays), defence systems (guidance and radar systems), electric vehicles and renewable energy products (solar, wind) due to their unique properties. They fulfil tasks ranging from enhancing the strength, heat resistance and heat dissipation capabilities of metals and glass; changing the colour brightness of computer monitors and filtering harmful light frequencies.

There is global demand for rare earths, but particularly for Western sources, given that China currently dominates mining and refining (with 70% of production and 85-90% of refined elements). Geopolitical tensions have led to Western nations desiring to establish their own supply chains. But this is easier said than done because rare earths are not mined individually and need to be refined. There is expected to be strong demand over the next decade as clean energy technologies are adopted.

Brazil has potential to be a big player in the future of the rare earths market. Right now, Brazil is a very small player by production, with only 80 tonnes of production in 2022 from 300,000 tonnes (210,000 of which came from China). But it boasts some of the world’s largest reserves, with 21 million tonnes and is in close proximity to key markets and to domestic demand.

It is true that rare earths prices haven’t been solid lately. This is because after a rapid growth in rare earths prices, driven by pandemic stimulus which increased investment into infrastructure and technologies reliant on REEs, prices declined in 2023 as interest rates rose, stimulus and consumer demand waned and the output of rare earth metals increased. However, rare earths have shown signs of recovery beginning in 2Q24, particularly in China.

Resouro has the opportunity to capitalise in the growing demand for rare earths in Western-friendly jurisdictions.

Progress has been made

Since August, Resouro has continued to lay the groundwork for eventual future production. These have included:

- The hiring of Alistair Stephens as CEO;

- The signing of an MOU with the Minas Gerais State Economic Development Department (SEDE) and the Integrated Economic Development Institute (Invest Minas),

- Continued Infill drilling for mine planning, and

- Consolidating its presence at Tiros by acquiring further land.

There’s a lot for investors to look forward to next year including

- Further exploration to define a further JORC compliant Resource.

- Applying for and obtaining a mining license. Resouro has commenced the process for application of a Mining License over the Central Block of Tiros.

- Further Metallurgical testing with laboratory partners to optimise rare earth leaching recovery and titanium extraction conditions.

- Technical and feasibility studies envisioning eventual production. A scoping study with Subject Matter Experts will happen in 2025 as a precursor to Prefeasibility Studies including a formal PFS, as well as economic and environmental assessments. Cocurrently, the company will undertake downstream studies and product testing to align the metallurgical flow sheet with potential offtake partners.

Even though it will be some time before we see Tiros as an operating mine, there is significant shareholder value to be unlocked before then. In fact, most companies to have successfully progressed a deposit from an exploration stage to an operating mine create most value on the journey to production, rather than in production itself. It would not be unrealistic for Resouro to be a takeover target prior to production.

Neither would it be unrealistic to see Resouro commence offtake discussions even prior to making a Final Investment Decision. Meteoric has commenced offtake discussions and has a preliminary deal to supply rare earth oxides to a separation plant in Estonia run by Neo Performance Materials.

Resouro Strategic Metals is one to keep an eye on

Resouro is not the only ASX-listed rare earths developer in Brazil, but it is the only one with a near 1.8 billion tonne resource. For comparison’s sake, Meteoric Resources (ASX:MEI) and Brazilian Rare Earths (ASX:BRE) have 619Mt and 510Mt respectively, and both have market capitalisations of over $280m. With a market capitalisation of barely over $45m, we think Resouro is significant undervalued and that it can close the gap as it continues exploration and development at the project.

Our parent company Pitt Street Research released a note on the company this morning, and observed that even at this early stage, it would not be unreasonable to see it trade at a market capitalisation of over $100m, based on its peers – Meteroic (ASX:MEI) and Brazilian Rare Earths (ASX:BRE) both trade at over $200m. Once Resouro has a study with an NPV on the project, it would be reasonable to expect it to trade at 10% of that NPV, again based on its peers/

Granted, there is some way to go for the company, and Brazil still needs to prove itself as a rare earths destination, but there are few (if any) other 1.7 billion tonne REE resources on the planet.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…