Revascor’s FDA approval sends the Mesoblast rollercoaster upwards

Ujjwal Maheshwari, January 24, 2024

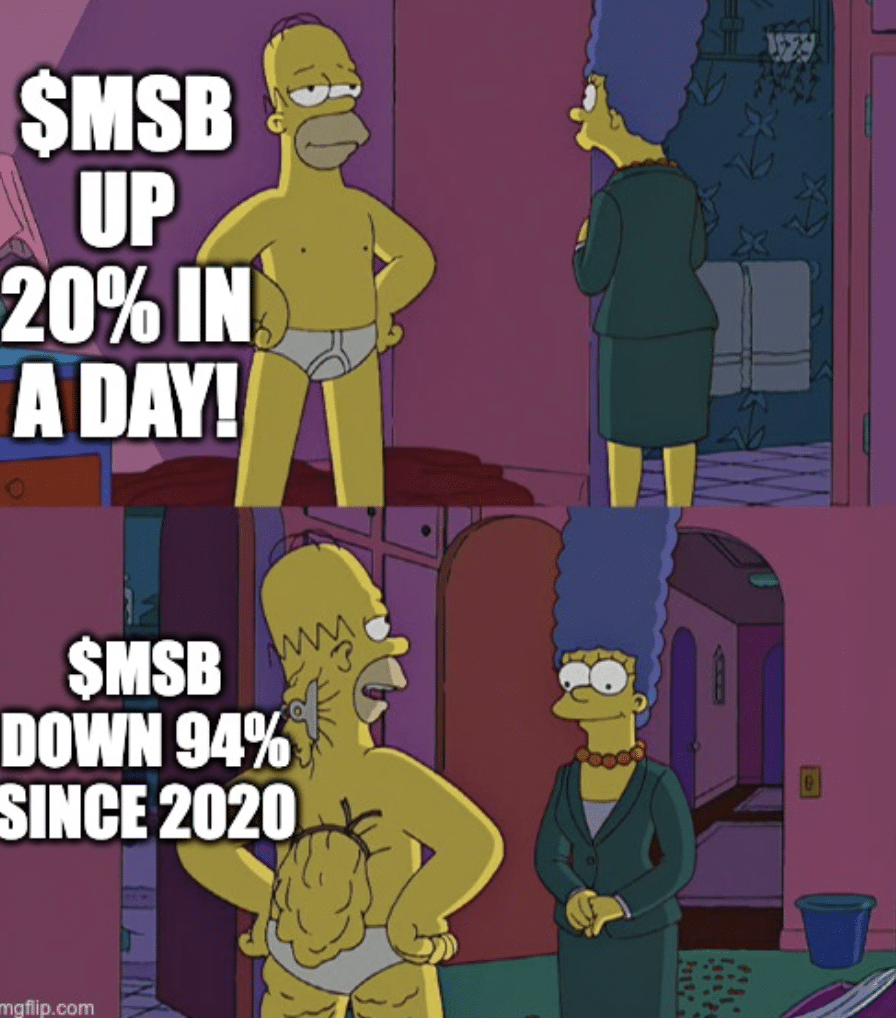

Its been a rollercoaster ride for Mesoblast (ASX:MSB) shareholders, and although its been mostly downwards, the FDA approval of Revascor sent shares in the other direction. Is this a dead cat bounce, or a new beginning for the company? Long suffering shareholders would be scoff at the latter question, although there is no denying there was good news.

Revascor: A Hope in Pediatric Cardiology

Revascor, also known as Rexlemestrocel-L, is at the forefront of a major medical breakthrough. It’s designed to tackle a rare but serious heart condition in children called hypoplastic left heart syndrome (HLHS). In HLHS, the left side of the heart doesn’t develop properly, leading to critical health challenges.

Mesoblast sees this drug as more than just a new product on the shelf. It’s a beacon of hope, a potential game-changer for young patients with few other options. HLHS, though not common, brings severe complications, putting Mesoblast’s efforts at a crucial juncture in the field of pediatric healthcare.

A Huge 21% Jump!

Right after the announcement about Revascor last Friday, the market reacted positively. Mesoblast’s stock value soared, climbing 20.8% to 32 cents in just the first hour of trading. We can’t blame investors for getting excited, but neither can we scorn naysayers.

To be clear, this was not the full green light to start selling Revascor in the USA. Instead, it was a ‘rare paediatric disease’ designation. This is given to drugs that offer major advances in treatment for rare diseases – diseases that affect fewer than 20,000 people.

It means that Mesoblast may be eligible to receive a priority review voucher which would be redeemed for priority review of a subsequent marketing application for a different product or sold to other companies. So it could get to market earlier but this is no guarantee. If Revascor gets to market, investors will look back at this day as a major step to that day, although ‘that day’ is some time away.

Most long-suffering shareholders just want some longer term appreciation in the share price. In our view, the best chance for shareholders to recoup their losses would be if and when the current clinical trial for Remestemcel-L is complete and the FDA is actually satisfied with it (which it was not last time around). When that will occur is anyone’s guess.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…

Here’s Why ASX Mineral Sands Stocks Are Gaining Momentum & Our Top 2 Picks

Mineral sands are naturally occurring materials that are made up of heavy minerals like zircon, ilmenite, rutile, and more. These…