Santos (ASX:STO): Is this the ASX’s best positioned oil and gas stock?

![]() Nick Sundich, October 9, 2024

Nick Sundich, October 9, 2024

Santos (ASX:STO) looks to the best of the Big 3 ASX oil and gas stocks (the other 2 being Woodside and Beach Energy). The company’s shares are flat in the last 12 months, whilst its peers have gone down. And if you didn’t know its cash balance, you’d know it has some ‘cash to splash’ as a sponsor of rugby union. But why has Santos outperformed its peers? And how vulnerable is the company to decarbonisation?

Santos (ASX:STO): Building an LNG Future

Santos was founded in 1954 in South Australia, made its first significant discovery of natural gas in the Cooper Basin in 1963, has remained there to this very day and has picked up additional projects over the years. Back in 2021, it merged with Oil Search, cementing its position as one of the Top 3 petroleum companies on the ASX together with Woodside Petroleum (ASX:WPL) and Beach Energy (ASX:BPT).

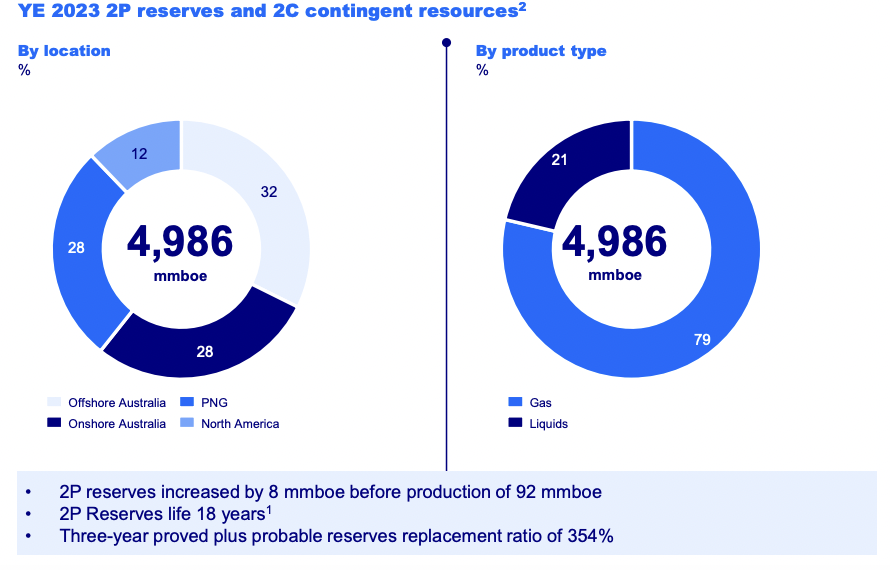

Santos has assets across Australia (at Gladstone and Darwin), East Timor, PNG and Alaska. It has best estimate contingent resources of just under 5MMboe (millions of barrels of oil equivalent). Santos produces energy and sells it to energy companies that provide it to consumers. Santos sells into the domestic energy market and export markets such as South Korea, Japan and China.

Source: Company

As we outlined when we looked at Woodside a few days ago, the oil giants are looking to LNG as their future. LNG is perceived to be part of the solution to decarbonisation as it is less carbon intensive, and is a like-for-like replacement for traditional oil. Demand for LNG in the Asia-Pacific is expected to grow 69% over the next decade, and although it is being driven by China now, developing nations are expected to account for an ever increasing share of the market.

Can it deliver and can it standout?

How is Santos different from its competitors? Because its assets are close to key Asian markets. A typical oil tanker can reach Asia from Australia in just a week while it would take more than 2 weeks to reach it from Qatar and more than 3 weeks from North America. This provides lower emissions before nations even receive their gas. Moreover, the company has a capacity of ~7.7Mtpa right now, and this could increase as it increases production. Key customers for its Australian LNG assets (at Darwin and Gladstone) include Mitsubishi, Kogas and Petronas.

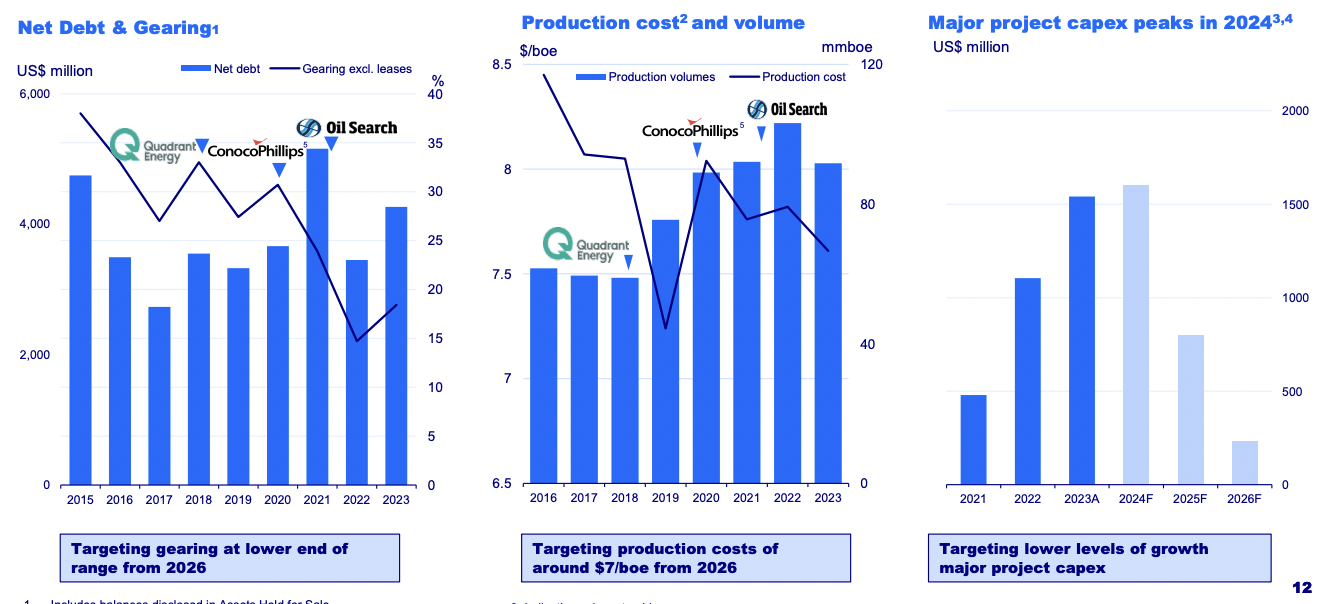

The company has told investors that its major project capex has peaked and is set to freefall over the next couple of years, thus increasing margins.

Source: Company

It has issued guidance of 84-90mmboe fand sales volume of 87-93mmboe for CY24. Further aiding the bottom line will be projects coming online with Barossa LNG by this time next year and Pikka in 2026 which will result in a 6% CAGR production growth over the next few years and US$14bn of total free cash flow from 2024 to 2028.

Moreover, Santos has a developing carbon capture business which could ultimately provide ~30Mtpa of storage capacity. By 2030, it is planning for Scope 1 and 2 emissions to be 30% lower and by 2040 to be net zero.

But it will all depend on oil prices

Yes, this goes without saying. Investors may regard Santos’ portfolio as superior, but prices have been subdued in CY24, even with the Russia-Ukraine war developments leading to concerns about gas supply. Further concerns are the risk of project cost blowouts and delays.

Analysts covering Santos have a target price of $8.37, 14% up from its $7.29 share price. But they expect CY24 and CY25 to be subdued years with revenue dipping from A$8.6bn to $8bn in CY24 and $8.2bn in CY25, followed by an advance to $9.7bn in CY26. The company’s profit is expected to retreat by 8% this year, be stagnant in CY25, followed by a surge to 15% ahead of CY23 levels in CY26.

The company is trading at less than 12x P/E for CY25, and is not facing the risk of delays and project uncertainty to the extent Woodside (ASX:WPL) is.

If you had to invest in an oil and gas company, you’d be less likely to go wrong with Santos compared to Woodside, but the better time to invest might be 12 months down the track.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Alvo Minerals finds itself a new Brazilian target

Every now and then in the mining game you meet people with a knack of finding more than one good…

Goodman Group (ASX:GMG): It looks expensive at A$65bn, but can its expansion into Data Centers make it worth its high price?

Goodman Group (ASX:GMG), the ASX’s biggest industrial property player, is making a shift into the world of data centres. On…

Here are 5 ASX resources stocks with a DFS unveiled in the last 12 months!

ASX resources stocks with a DFS (Definitive Feasibility Study) have the best possible chance for investors to profit. Companies in…