Seek (ASX:SEK): One of the best ASX tech stocks, but strongly overvalued

![]() Nick Sundich, April 5, 2024

Nick Sundich, April 5, 2024

Online employment marketplace Seek (ASX:SEK) may be formally categorised as ‘Media and Entertainment’ by the ASX, although it is difficult to argue that this company is not a tech company.

This time last year, it seemed to be in the right place at the right time given the state of the labour market, still struggling with post-COVID labour shortages. But now, the tides have turned.

Who is Seek?

Seek is a provider of online employment classifieds in over 18 countries globally. It runs multiple websites, including the Seek website – covering Australia and New Zealand – JobStreet, Catho and occmundial.

The company makes money from prospective employers that pay to have advertisements on the site. Seek also has a stake in the Seek Growth Fund that has interests in Chinese job seeker website Zhaopin and recruiting software company JobAdder. After several years of sitting under the same corporate umbrella, the Growth Fund now operates independently, albeit still owned by the parent company.

Seek was founded in 1997 by Matt Rockman, Paul Bassat and Andrew Basset. Only Andrew Basset remains on the company’s board today, although he is no longer CEO, having handed the reigns to ex-CBA boss Ian Narev. Seek was listed on the ASX in April 2005 with a market capitalisation of $587m, a figure that has grown to $9bn nearly 20 years on.

Benefited from the re-opening of the economy and labour shortages

FY21 and FY22 were solid years for Seek as the economy re-opened from pandemic hibernation. During FY22, the company made $1.1bn in revenue (up 47%) and $509.1m in EBITDA (up 53%). The company’s NPAT from continuing operations $245.5m and 81% up from FY21, although statutory NPAT from total operations was $168.8m, down 78% from the year before.

The latter set of numbers took account of discontinued operations including Zhaopin (a Chinese job site) and the Seek Growth Fund, which won’t be reflected in future results. This is because Zhaopin has been substantially sold down by Seek (but not completely), while the Seek Growth Fund will operate as a standalone business. Seek paid a dividend of 44c per share, reflecting a payout of 85% of cash NPAT less Capex, and a yield of 2.1%.

A more difficult FY23

FY23 was more difficult. The company initially issued guidance of $1.25-$1.3bn in revenue (up ~16%), $560-$590m in EBITDA (up 13%) and $250-$270m NPAT (up 6%). This guidance assumed that largely positive economic conditions continued, and that costs were in line with expectations.

In early April 2023, however, it cut its revenue guidance for FY23. It was only a 1.2% reduction, from $1.26bn to $1.245bn, but enough to send shares down 5% that morning. This was the ultimate revenue result, yet it was up 10% from the year before. The company’s reported NPAT was $202.7m, down 16% from the year before, although the adjusted figure was $255m, excluding the Growth Fund. Job volumes moderated in FY23 and job market is tight with record low unemployment.

In 1HY24, it recorded $596.8m in revenue, down 5%, and an adjusted NPAT of $107.5m (down 24%), but reported NPAT of $32.5m (down 74%). It issued full year guidance of $1.15-1.21bn and an adjusted NPAT of $190-220m.

What does the future hold?

For FY25, consensus estimates (drawn from a grand total of 14 analysts) suggest a return to growth with $1.3bn in revenue and a $264m profit, followed by $1.4bn in revenue and a $321m profit in FY26. The mean share price is $26.53 – a 7% premium to the current price. It is trading at 34x P/E for FY25 and a PEG of 2.9x.

Our own DCF models derive a value of $16.30 per share, over 30% below the current share price. It is worth noting that this assumes modest revenue growth of 5% per year, cost inflation moderating from FY25 onwards to 3% per year and it uses a 10.2% WAAC (a 4% risk free rate of return, a 6% equity premium and a 1.3 beta).

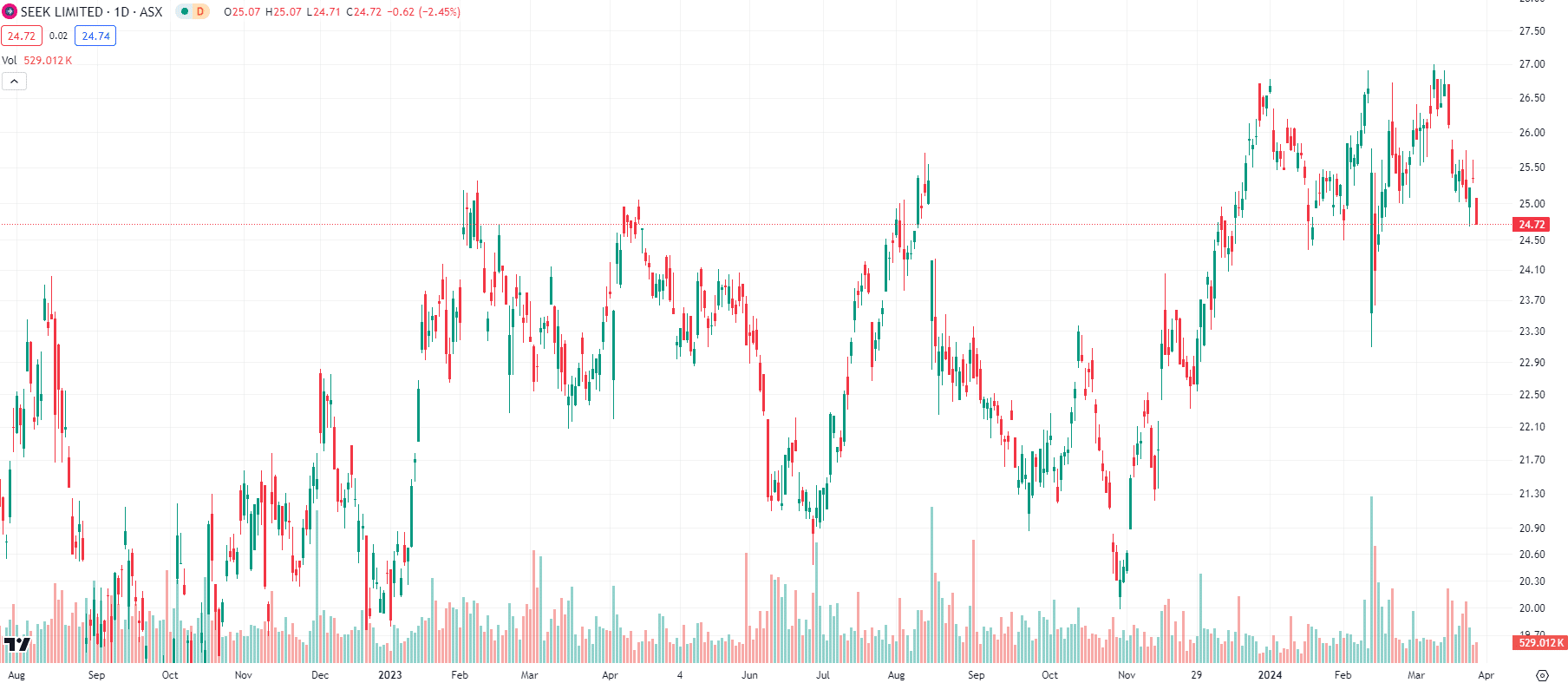

Seek (ASX:SEK) share price chart, log scale (Source: TradingView)

There are risks, but some of the risks could also be an opportunity

The biggest risk with the company is macroeconomic conditions continuing as they are, meaning less jobs on the platform, and the company’s revenues and earnings as a consequence. Seek’s shares fell by nearly two thirds between October 2007 and March 2009, between the ASX’s pre-GFC peak and its GFC low. During the Corona Crash, in February and March 2020, Seek suffered a 40% share price plunge.

Nonetheless, it may not be all bad. Remember that Seek exploited the GFC to start buying into JobStreet, a move that gave the company its first major step into the broader Asia-Pacific region. Notwithstanding those two potentially mitigating factors, we still think investors should be aware of this risk.

More risks!

We see three further risks to Seek:

Firstly, a cyber attack, something would likely impact the company worse than Medibank considering its global reach and higher user base. Secondly, increasing industry competition. Unlike some comparable ASX companies that have the market virtually to themselves, such as REA (ASX:REA), Seek faces competition from other platforms such as LinkedIn, CareerOne and Indeed. And thirdly – and ironically – the tight labour market could be something that impacts Seek itself, making it difficult to attract and retain staff.

Tough to see it outperforming

Ultimately, as long as the labour market remains as tight as it is, we cannot see it recording the revenue and profit growth at levels that would justify a higher valuation than the stock is valued at right now.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

What is a REIT’s Funds From Operations (FFO) and how can investors use this metric to their advantage

ASX REITs often use the metric Funds From Operations (FFO). Investors new to investing in REITs may wonder what it…

Microsoft (NDQ:MSFT): There’s still a lot more growth left in this one

Microsoft (NDQ:MSFT) is our International Stock of the Week, but it really needs no introduction. We all use its products…

ASX Dividend Shares or Term Deposits? Here’s Why These 5 ASX Shares Make More Sense Right Now

ASX Dividend Shares or Term Deposits – what is the better way for investors to grow their wealth? Historically, term…