SGH (ASX:SGH): A $20bn family-owned industrial conglomerate with a strong outlook

![]() Nick Sundich, February 16, 2025

Nick Sundich, February 16, 2025

3 months ago, the former Seven Group Holdings (ASX:SVW) changed its name to SGH (ASX:SGH). Companies change their names when they want investors to forget about a troubled past and/or to look for a brighter future. It was the latter that was the company’s focus.

But many may wonder how this company has done well when so many industrials have struggled to keep their heads above water, just what is in its portfolio and what does the future hold? Let’s look at these questions.

The evolution and composition of SGH (ASX:SGH)

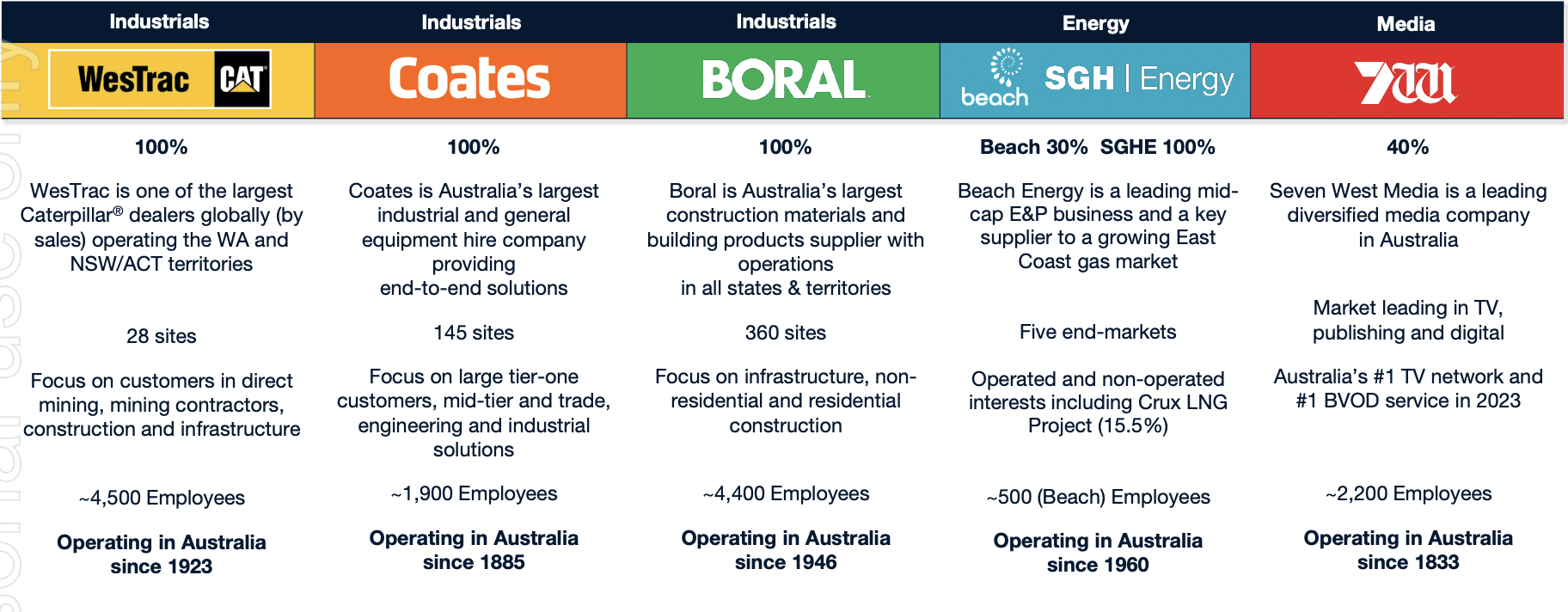

SGH is essentially the investment vehicle of the Stokes’ family – a family led by Kerry but with his son Ryan being CEO of the company. It was named Seven after the media group that it had a 40% holding in. The name ‘Seven Group’ was adopted in 2010 when 7 and WesTrac Holdings merged, the latter company being one of the world’s largest dealers of Caterpillar vehicles.

SGH’s other holdings include a 30% stake in Beach Energy (ASX:BPT), ownership of construction materials business Boral, equipment hire business Coates and lightning & power solutions group Allight. These days, Seven West Media is capped at ~$270m, meaning it is a small part of the portfolio. Whilst the name is powerful, it is the other businesses that are the bigger revenue generators.

Source: Company

Good financial results

The company delivered its results for the first half of FY25 earlier this week. Making the headlines were Ryan Stokes’ comments about the ‘State of States’ and essentially saying Victoria wasn’t in the best of shape.

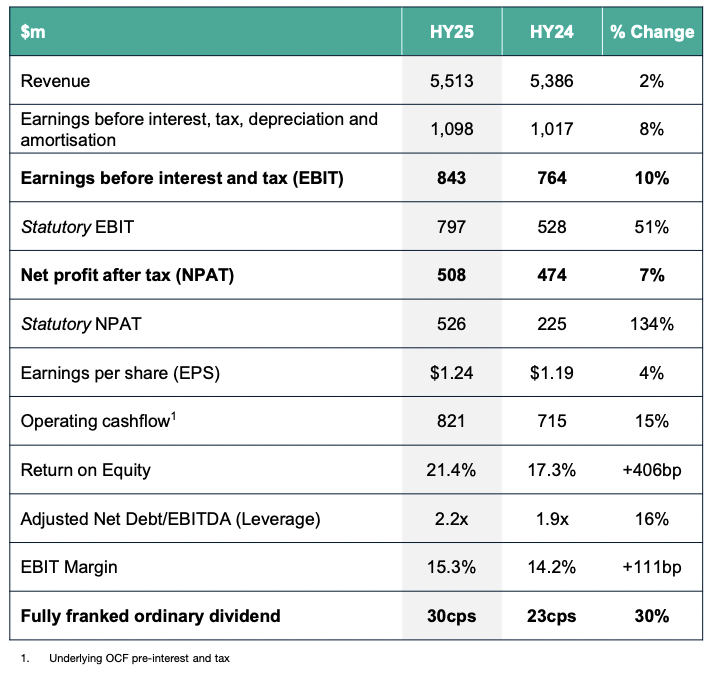

But SGH generated $5.5bn in revenue (up 2%), but $1,098m EBIRDA and $843m EBIT (up 8% and 10% respectively). It paid an interim dividend of 30c per share and EPS of $1.24 per share. Investors appear to be pleased by the results.

Source: Company

The key event was the company’s acquisition of the balance of Boral that it did not already own. Although Boral’s segment revenues were down, the company was able to record a higher bottom line due to pricing traction and cost controls. Its segment EBIT rose 29% to $259m.

WesTrac saw strong momentum too with revenues up 8% and EBIT up 5%, although margins fell slightly. This was enough to make up for a decline in revenues and profit in Seven West Media.

It boasts 19% EBIT CAGR over the last decade.

More growth to come

For the full year, it had guided to ‘high single-digit EBIT growth’. Nothing to snuff at in a difficult environment for industrial companies.

SGH told investors WesTrac’s outlook would be supported by growth in services activity, coupled with a strong capital sales pipeline. With Boral, volume would be under pressure, but cost discipline, operating efficiencies and improved customer service would support the outlook. At Coates, trading conditions in the south would remain challenging but the other regions could make up for it.

In the longer-term, SGH claims that the difficult conditions are only temporary and that there is a good outlook for the sector. It anticipates that $1.8tn will be spent over the next seven of years. This includes 240,000 homes that will need to be built every year just to meet government targets. Coal and iron ore export growth is expected and there is a $65bn committed investment outlook. And turning briefly to energy, SGH has noted there is a strong demand for gas domestically and LNG internationally, but supply is tightening.

Conclusion

SGH has achieved impressive growth in the last couple of years, thriving when so many industry peers have barely been surviving. The risks with this one is potential for industrial accidents and a continued downturn in the sector. We also note that the company has net debt of over $4.6bn and will need to reduce it. To be fair, the company is doing this in refinancing certain facilities so there are no maturities until FY29.

We observe that analysts are up in the air over this stock with a mean target price of $50.41 but a range from $35.50 and $61. Btu the company has an FY26 P/E of 19.3x and a PEG of 0.64x – reasonable multiples, in our view.

SGH is one of the top companies to at least watch on the ASX because of its high exposure to industrials. It is impressive for how it has performed at a difficult time for the industry. We think there’s every reason to expect it to continue to perform.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…