Should you invest in aged care stocks? Here are 4 reasons to consider them, and 4 reasons to avoid them

![]() Nick Sundich, September 17, 2024

Nick Sundich, September 17, 2024

Should you invest in aged care stocks? There are plenty of things to like about this sector, including government funding, resilience to tough economic times and the growth in demand that will come as the Baby Boomers age. But it is not all.

Should you invest in aged care stocks? The Yes case

1. Ageing population

Australians are living longer than ever before. By 2062-63, the old-age dependency ratio (i.e. each person 65 and over for every 100 people between 15 and 64) will rise from 26.6% to 38.2%. Moreover, the number of people over 80 years of age is expected to triple. So there will be demand for aged care. Not only will there be more people needing aged care, but people will need it for longer.

2. Government funding

The Australian Government’s own Task Force showed spending on aged care in 2021-22 was $24.8bn, or 1.1% of GDP. By 2062-63, this is projected to be 2.5% of GDP. When investing in a stock, it is ideal to have a revenue base that is very sticky, from customers who need to spend that money because they need those goods or services. This is exactly the case here.

3. The sector is rebuilding its reputation now

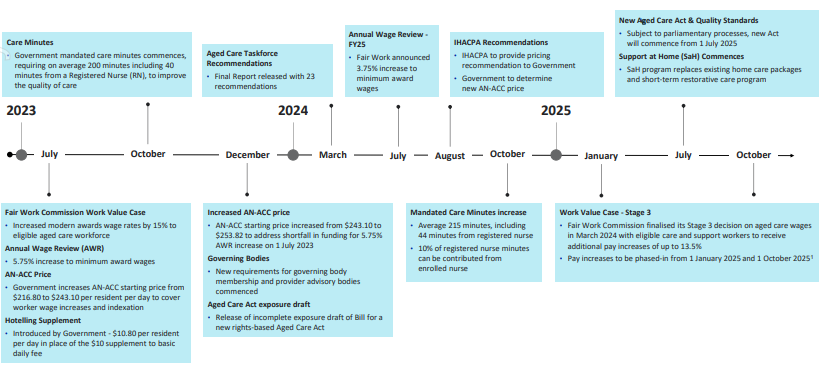

Aged care no longer encompasses just nursing homes, but home care options too. And even aged care facilities are gradually rebuilding their reputation through Industry Reforms and Sector changes that are taking effect between 2023 and 2025.

Source: Company

4. Companies on the ASX are profitable

There aren’t many aged care stocks on the ASX, but the few that are on the bourse are mature, profitable companies. These include Ramsay (ASX:RHC) and Regis (ASX:RGS). There are also a handful of microcaps such as PainChek (ASX:PCK) and Intelicare (ASX:ICR) that could play a role in the sector in the coming years. PainChek has an app that can detect pain and medical conditions through a smart phone app, whilst Intelicare has a smart home and predictive analytics program.

Should you invest in aged care stocks? The no case

1. Regulatory scrutiny

Any company in any sector can be scrutinised and have negative publicity. But this has always been particularly true with aged care stocks. Anything negative going on in aged care can make media headlines, and have an impact on the valuation of any company. Just imagine if St Basils’ in Melbourne had been publicly listed.

2. Operational challenges

According to analysis from UTS, the aged care sector needs to invest $55-72bn over the next decade to meet forthcoming demand. There have been only 4,300 net new beds built in the last 3 years. Moreover, 35% of providers are not profitable and 64% are not meeting minute targets due to workforce challenges. The duty for investors is to look in depth at the operations of any aged care companies.

3. Few stocks to choose from

There are a few ASX stocks in aged care, but there are only a couple of larger players. This means less choice for investors and more scrutiny on these companies. The list has grown shorter in the last 12 months, following Bain’s buyout of Estia Health last November.

4. People will need to pay more

Last week, the government unveiled reforms to the aged care funding system. In an attempt to control spiralling budget costs, there is a shift to a user-pays model. Retirees will have to pay up to 80% of everyday living costs and 50% of so-called independence costs (i.e. transport). The government will save $12.6bn over the next 11 years. It remains to be seen what impact this will have on the sector – if any. Perhaps it’ll be a case of Better to make more money from less people than make less money from more people. Then again, anyone in aged care on or before July 1 next year will be exempt as well as anyone on the waiting list as of September 12.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…