Small-cap Stocks Vs. Mid-cap Stocks: Why you need to know the Difference

![]() Ujjwal Maheshwari, May 13, 2024

Ujjwal Maheshwari, May 13, 2024

Building a strong investment portfolio requires diversification, and understanding market capitalization is a crucial step. Simply put, it’s the total value of a company based on its outstanding shares (number of shares multiplied by current price). This metric tells us a company’s size and, to some extent, the risk involved in investing in its stock.

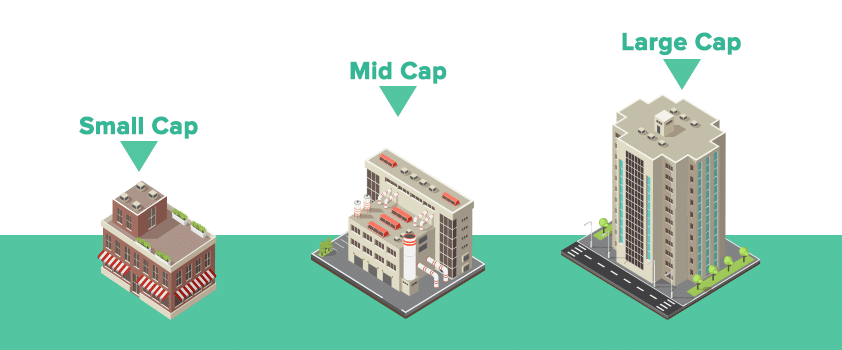

Here’s where things get interesting: stocks are typically categorized into three groups based on market capitalisation – large-cap, mid cap, and small cap. Each category has its own characteristics and plays a distinct role in your investment strategy.

Why is understanding the difference between small cap and mid cap stocks so important? Because it directly impacts your investment decisions and risk management.

Pick the right building blocks

Small-cap stocks represent smaller companies. They often boast higher growth potential, which can translate to significant returns. However, this potential comes with increased risk – their stock prices can be quite volatile.

Mid-cap stocks, on the other hand, typically belong to companies that are actively expanding. They offer a nice balance between the stability of large-cap and the growth potential of small cap. This sweet spot makes them a popular choice for investors seeking a blend of growth and reasonable stability within their portfolio.

Imagine you’re building a house. You wouldn’t use only lightweight materials, nor would you want everything to be so heavy it restricts movement. By understanding market capitalisation, you can choose the right “building blocks” for your investment portfolio – a mix of stable, mid cap companies with the potential for some exciting growth from smaller players.

The bottom line? Knowing the difference between small-cap and mid cap stocks empowers you to make informed investment decisions. So lets start.

Defining Market Capitalisation

Market capitalization (market cap for short) is a fancy way of saying a company’s total market value. It’s calculated by multiplying the current stock price by the total number of outstanding shares. This number helps us categorize stocks into small-cap, mid-cap, and large-cap.

Understanding Mid-cap and Small-cap Stocks

Small-Cap Stocks

- Growth Potential: Small-cap companies are often younger or operate in niche markets with room to expand. This translates to the potential for explosive growth, which can be very exciting for investors. Imagine getting in on the ground floor of the next big thing!

- Agility: Think of a small business owner who can quickly adapt to changing customer needs. That’s the advantage of a small cap company. Their size allows them to be nimble and capitalize on new trends or technologies faster than larger, more established companies.

- Volatility: Small-cap stocks can be quite volatile, meaning their prices can swing wildly in a short period. This volatility can be nerve-wracking, but it also presents opportunities for savvy investors who can time the market well.

- Liquidity: There are typically fewer shares available for trading, so buying or selling large quantities can significantly impact the price. This can lead to wider bid-ask spreads (the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept) and potentially higher transaction costs.

The bottom line? Small cap stocks can be a great way to add some growth potential to your portfolio. However, the higher volatility and lower liquidity require a higher tolerance for risk.

Mid-Cap Stocks

- Market Capitalization: Mid-cap companies fall within a market capitalization range of roughly $2 billion to $10 billion. This signifies their size – larger than small cap firms but not yet reaching the heights of large-cap corporations.

- The Sweet Spot: Many investors consider mid cap stocks the “sweet spot” for their portfolios. These companies have already established themselves and demonstrated their viability for growth. They’re not risky startups anymore, but they still have the potential to expand and innovate. This translates to potentially significant returns without the same level of volatility associated with smaller companies.

- Growth with Stability: The key advantage of mid cap stocks is the balance they offer. While they may not experience the explosive growth potential of small-cap stocks, they tend to exhibit steadier, more predictable growth. This is often combined with a more mature and established business model, offering some level of stability and security for your investment.

- Portfolio Diversification: Including mid cap stocks in your portfolio can be a strategic move. These companies operate across a diverse range of industries and sectors. This diversification helps spread your risk and reduces the impact of a downturn affecting a single sector or market segment.

Differences Between Mid-cap and Small-cap Stocks

- Growth Potential: Small-cap stocks might boast higher growth potential due to their smaller size and room for rapid expansion. However, this comes with increased risk. Mid cap stocks offer a good balance – still presenting considerable growth opportunities, but with a more established business model providing some stability.

- Risk Levels: Small-cap stocks are inherently riskier due to their smaller size and lower liquidity. Investors should be prepared for greater price fluctuations and the possibility of higher losses. Mid cap stocks, while not immune to market movements, generally exhibit lower volatility and a more comfortable risk profile compared to small-cap stocks.

- Market Stability: Mid cap companies often strike a balance between growth potential and market stability. They’ve typically passed the initial stages of growth and established themselves within their respective industries. This translates to a degree of stability in the market while still offering the opportunity for future growth.

How to Choose Between Mid-cap and Small-cap Stocks?

When deciding between small-cap and mid cap stocks, there are several crucial factors investors should carefully weigh. These considerations can significantly impact investment outcomes and align them with individual goals and risk tolerances.

- Risk Tolerance: Understanding personal risk tolerance is paramount. Small-cap stocks typically carry higher risk due to their smaller size and greater susceptibility to market volatility. On the other hand, mid cap stocks generally offer a balance between risk and potential reward. Investors comfortable with higher risk may lean towards small cap stocks, while those seeking a more moderate risk profile might prefer mid cap stocks.

- Investment Horizon: The length of time an investor plans to hold onto their stocks is essential. Small cap stocks may be more suitable for investors with longer time horizons, as they often require patience to realize substantial growth. Mid-cap stocks might appeal to investors with shorter horizons, as they may offer quicker returns while still possessing growth potential.

- Market Knowledge: A solid understanding of market dynamics and company fundamentals is crucial. Small cap stocks can be less researched and understood compared to their larger counterparts, requiring investors to conduct thorough due diligence. Investors confident in their ability to analyze and uncover opportunities may find success in small-cap stocks. Conversely, mid cap stocks may offer more familiar terrain for investors who prefer to rely on established companies with a track record of performance.

- Diversification: Diversification is a cornerstone of sound investing. Combining both small-cap and mid cap stocks within a portfolio can help spread risk and enhance potential returns. Since small cap and mid cap stocks often behave differently in various market conditions, a diversified approach can provide stability and mitigate the impact of volatility on overall portfolio performance.

Conclusion

Understanding the differences between small cap and mid-cap stocks is crucial for investors seeking to build a balanced and diversified portfolio. While small cap stocks offer higher growth potential but come with increased risk and volatility, mid cap stocks provide a balance between growth and stability. Investors should carefully consider their risk tolerance, investment horizon, market knowledge, and the benefits of diversification when making investment decisions.

What are the Best ASX Small Cap Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…