St Barbara (ASX:SBM) is on the hook for $210m from the PNG tax office

Gold miner St Barbara (ASX:SBM) has been in the spotlight lately due to a significant tax demand from the Papua New Guinea (PNG) government. This development raises critical questions: How did a company with a longstanding presence in the mining industry get itself into this position? And how will this situation end?

Company Overview

St Barbara, founded in 1969, is a well-known Australia-based gold mining company. listed on the Australian Securities Exchange (ASX) under the ticker SBM. St Barbara’s Australian operations have historically centred around the Western Leonora region of Western Australia. The company’s core asset, is Gwalia underground mine which it picked up in 2005 as part of a ‘fire sale’ from Sons of Gwalia. SBM actually picked up 3 assets but sold 2 of them, and freshly commissioned Gwalia in 2008.

In 2012, SBM looked offshore with the acquisition of the Simberi gold mine in Papua New Guinea. The mine, situated on the Simberi Island it is named after, is an open pit and has made a remarkable contribution to the company’s gold output. In 2019, it bought Atlantic Gold Corporation for C$722 million, picking up the Touquoy open-pit mine in Nova Scotia, Canada.

In 2023, it parted ways with the Australian assets (selling Gwalia to Genesis Minerals for $628m) and opted to focus on its assets in PNG and Canada, flushing those projects with that cash.

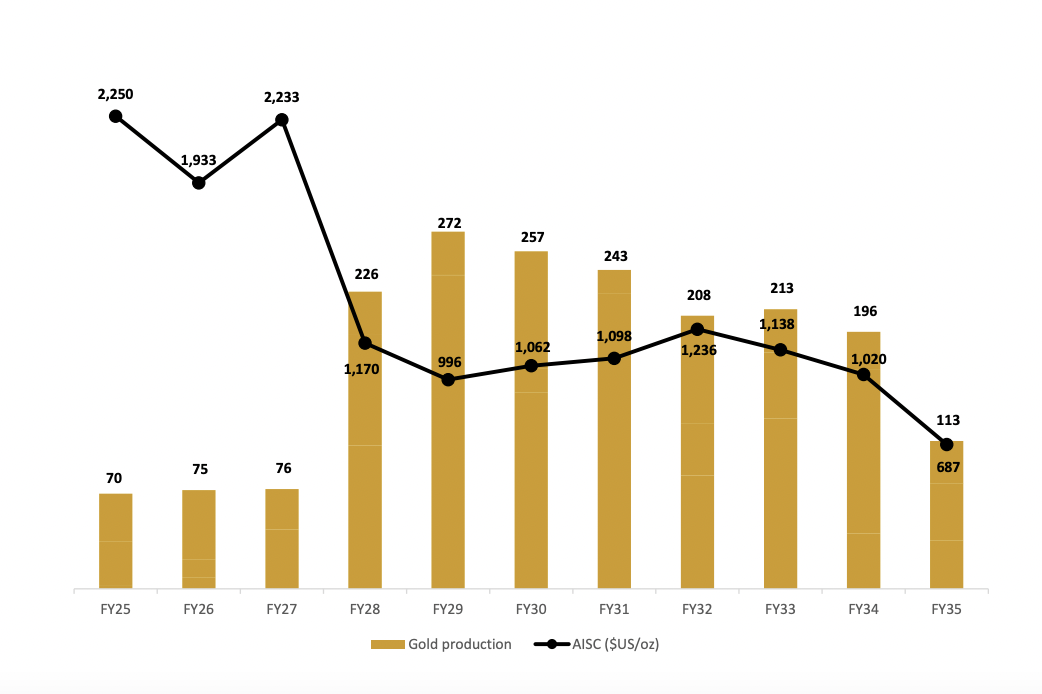

The company’s Simberi mine has 5Moz in Mineral Resources and 2.8Moz in ore reserves. The company guided to 65-75koz production in FY25. In the longe-run, it anticipated a 10-year mine life with 230koz production from FY28 onwards. It has an AISC of US$1,000/oz and modest capex of US$213m.

Source: Company

SBM’s Canadian operations were not as far advanced, but with 2Moz in Mineral Resouces and 1.4Moz in Ore Reserves across all its development projects, the future looked bright there too. But PNG was where it was at…until recently.

The $210 Million PNG Tax Demand

In December 2024, St Barbara subsidiary, Simberi Gold (which has the PNG mine), received a tax determination from Papua New Guinea’s Internal Revenue Commission (IRC) requiring around PGK 523 million (A$210m) to be paid. Once the assessed amount is considered, a 200% fine will be deducted, with PGK 435 million being costs connected with the alleged income tax miscalculations resulting from asset valuations from 2006 and depreciation claims from 2017 to 2021.

An additional PGK 88 million pertains to a deemed dividend withholding tax assessed on a debt-to-equity transaction during the recapitalisation of Simberi Gold in 2018. St Barbara disputes these claims, asserting that the IRC has overstepped the five-year statutory limit for amended assessments by alleging fraud to justify reopening prior tax returns.

The company plans to appeal the assessment within the 60-day objection period, firmly rejecting any suggestions of dishonest conduct. It also noted they are beyond the five-year statutory limit for amended tax assessments. The appeal deadline is set for 17 February 2025.

Implications for St Barbara

The substantial tax demand has had immediate repercussions:

- Share Price Impact: Following the announcement, St Barbara’s shares suffered a setback of more than 34%, the lowest since 1990, wiping out almost A$100 million from its market capitalisation.

- Financial Stability Concerns: The significant tax liability has placed the company in an uncomfortable position, questioning its financial well-being and its ability to be profitable, especially at the Simberi mine.

- Investor Confidence: Such a dispute has led to a lack of confidence among investors, consequently giving rise to increased market instability and closer scrutiny of the company’s corporate and financial practices.

Broader Industry Context

This development highlights a broader trend of stringent tax enforcement in resource-rich regions in the developing world. Mining companies operating in such jurisdictions are increasingly pressured to ensure compliance with local tax laws and maintain transparent accounting practices. Fair enough in our view, and PNG’s demand is nothing what Tanzania demanded Barrick Gold to cough up in 2017 – US$190bn in case you were wondering. Leo Lithium (ASX:LLL) in Mali is another case study, Leo was all but forced out.

But the situation underscores the importance of monitoring sovereign risk. In other words, doing businesses in countries where regulators can suddenly issue you tax bills at any time based on potentially retrospective laws or on targeted discretionary conduct.

So now what?

It doesn’t seem like St Barbara will exit PNG. But its immediate focus is on resolving the tax dispute with the PNG authorities. We’ll be watching with fascination to see if it ends up paying the money, or if it comes to some revised settlement, or maybe even the government cracks down.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…