St George Mining (ASX:SGQ) finds its ‘company maker’ in Brazil

When St George Mining (ASX:SGQ) announced last August that it was acquiring its Araxa project in Brazil, investors could be forgiven for saying ‘yeah, another niobium wannabe’, shrugging their collective shoulders, and moving on.

Why investors should’ve given St George Mining (ASX:SGQ) a closer look

You see, less than three months before that, SGQ’s fellow West Australian explorer WA1 Resources (ASX:WA1), had seen its share price go over $22 a share, thanks to a massive discovery of niobium in Western Australia. WA1 Resources at its peak had re-rated over 160 times its share price prior to the October 2022 announcement of the discovery, and by August 2024 was capitalised at well over a billion dollars. And now other ASX-listed explorers were seeking to cash in on investor interest in niobium with various exploration plays.

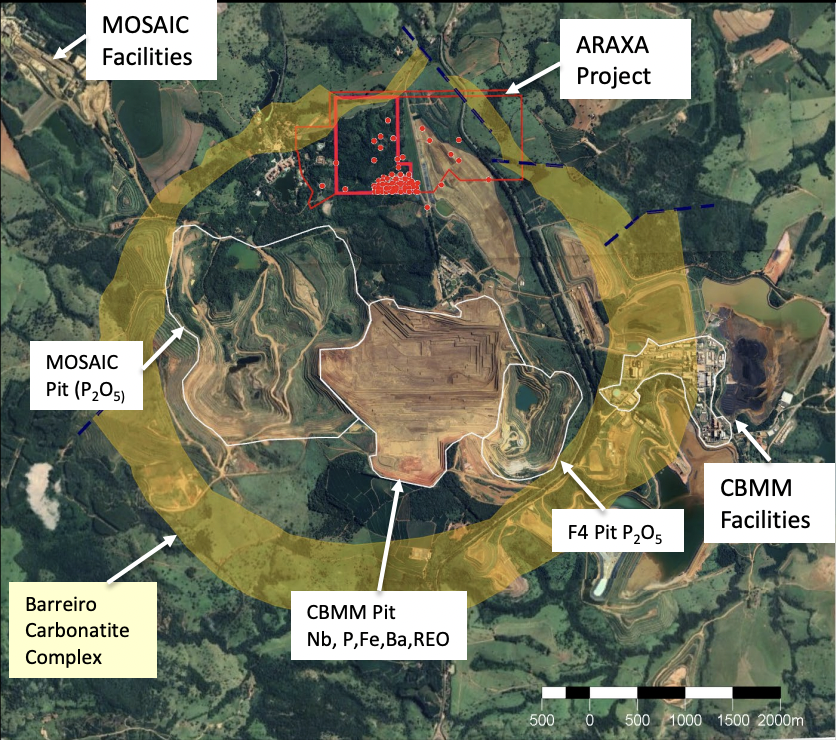

St George Mining, however, was different. This company had just negotiated the acquisition of an established, high grade, niobium resource in Brazil, which has some high grade rare earths as well. And not just any resource. St George’s new project was right next door to the Araxa Niobium Mine in the Brazilian state of Minas Gerais.

Source: Company

Minas Gerais currently produces around 70-80% of the world’s niobium – and is abundant with rare earths generally. So, there was no exploration risk. Unlike WA1 Resources, the deposit wasn’t in the middle of nowhere. And all the shareholders were taking on was the usual risks associated with getting a new mine up and running within a well-known and highly pro-mining jurisdiction.

Check out our recent interview with Executive Chair John Prineas HERE!

Backing an important battery mineral

Niobium, Atomic No. 41, is one of these metals which until recently investors didn’t know much about. They really didn’t need to. Demand for it may have risen around 6% p.a. for the last couple of decades thanks to its use in making High-Strength Low-Alloy (HSLA) steel, but supply was more or less taken care of by CBMM, the Brazilian company which owns the mine next door to St George and had been supplying the vast majority of the world’s supply since the 1960s. Unusually in the world of metals, China had no domestic source, but CBMM plus two other mines – Anglo American’s Boa Vista, also in Brazil, and the Niobec mine in Canada – took care of it. And so it remains to this day.

Source: Company

Then came the Electric Vehicle revolution, and suddenly all bets were off because it turns out niobium, in the anode of a battery, can markedly increase the range of a battery, its useful life, and the speed with which it can be recharged. Which explains why investors reacted so favourably when WA1 Resources discovered the massive Luni niobium deposit in the West Arunta region of Western Australia. Here was a commodity set for a step-change in demand where more mines were likely to be needed.

A significant niobium resource

St George acquired its potential niobium mine from a Canadian company called Itafos. That company was more interested in phosphates than in niobium, which is one reason why it is prepared to sell to St George. In early 2013 Itafos published a Preliminary Economic Assessment of Araxa that valued the project at US$967m on a 10% discount rate. The Internal Rate of Return was an attractive 30%.

That 2013 PEA was based on close-spaced drilling over less than 10% of the project area but it still covered an NI-43-101 Measured and Indicated resource of 6.32 million tonnes at 5.01% TREO and 1.02% Nb2O5 plus an Inferred Resource of 21.94 million tonnes at 3.99% TREO and 0.64% Nb2O5. In each case the cut-off level was a very high 2% TREO.

St George delivered its maiden Independent JORC Mineral Resource estimate in early April 2025. It now has 41.2 million tonnes at 0.68% Nb2O5 and a Rare Earths Resource of 40.6 million tonnes at 4.13% TREO (41,300 ppm TREO). The MRE contains 280,000 tonnes of niobium oxide and 1.7Mt of TREO.

Having defined this resource, the next step will be to undertake further studies to expand this resource and convert existing inferred resources to a higher confidence category.

Importantly, Araxa may not just be a niobium mine. Araxa looks very similar to the Mt Weld carbonatite-hosted rare earths deposit in Western Australia which was the company-maker for Lynas Rare Earths (ASX: LYC). And the Itafos drilling gives ample evidence of neodymium and praseodymium, the main rare earths.

Currently, St George’s new project is around half the size Lynas’s deposit was just six years ago, but if the drilling campaigns of 2025 also increase this we think it will add to St George’s appeal given the ongoing need to develop non-Chinese sources of rare earths.

There’s significant upside

Our friends at Pitt Street Research have just published an initiation report on the company. It has estimated that Araxa could be worth US$1,281.5m or A$2,066.9m in a base case scenario and US$1,978.6 or A$3,191.2m in an optimistic case, assuming production starting in 2029 and then using PEA assumptions regarding opex and capex as a starting point while accounting for inflation and productivity improvements.

Pitt Street suggested that the company could re-rate to 25% of that NPV which is $516.7m in a base case and $797.8m for the bull case which equate to $0.14 per share and $0.21 per share. Looking further ahead, a 50% NPV could be applicable once the company has a Feasibility Study out, and at 100% when it enters commercial-scale production.

If all goes to plan, the company won’t be trading at its current valuation for much longer.

Disclosure: Pitt Street Research staff and directors own shares in St George Mining

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

WiseTech Global (ASX:WTC) CEO Buys $1m of Shares, Here’s What It Signals

WiseTech $1m Insider Buy, The Synergy Curve Is the Thesis WiseTech Global (ASX: WTC) has just given investors a simple…

Block (NYSE:SQ) Up 28% as a 40% Headcount Cut Rewrites the Earnings Outlook

Jack Dorsey Goes Lean, The Market Pays Up Block shares surged 28% following the announcement that the company intends to…

AML3D (ASX:AL3): Order Book at $16.5m, The Growth Runway Stays Intact

A $150m to $200m Navy Opportunity, But Execution Comes First AML3D has reported its interim half-year results, and while revenue…