Happy birthday to us! Stocks Down Under Concierge just turned 1

Marc Kennis, May 18, 2023

Stocks Down Under Concierge is one year old and the performance is amazing

On May 17 2022, we launched Stocks Down Under Concierge, our ASX stock picking service. The idea was to provide a service for retail investors that would help them pick the right stocks at the right time. And equally important, tell them to sell when that time comes.

And all this had to fit within our risk management framework, so subscribers wouldn’t be exposed to excessive risks.

We’re now one year later and we’re over the moon with how Concierge has performed with an average performance across all trades of 17.9%. The ASX200 (+0.26%) and the All Ordinaries (+0.65%), meanwhile, were essentially flat in the last 12 months!

We are currently getting these performance numbers formally audited by an accountant so you don’t just have to take our word for it!

Breaking down the Concierge performance

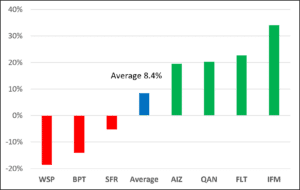

Our closed trades generated 8.4% on average. The 7 trades we opened and closed in the last 12 months generated an average performance of 8.4%. Out of the 7 trades, 4 were profitable (AIZ, QAN, FLT and IFM), while 3 trades saw the stop loss triggered (WSP, BPT and SFR). Despite these 3 losses, the overall return on our closed trades still came in at 8.4%.

Performance of closed trades since 17 May 2023

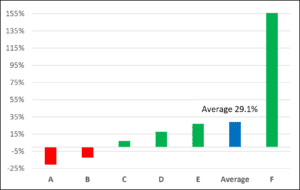

The trades that are currently still open, stocks A through F, have delivered us 29.1% on average through yesterday. And including today’s trading, we’re looking at more than 31% up! If you want to know which stocks these are, we invite you to get a FREE trial subscription to Concierge.

Performance of trades currently still open

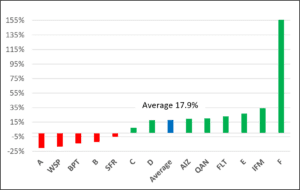

All trades combined generated 17.9% in the past year

When we look at all trades combined, closed and current, we get a performance of 17.9% in the past year, which we are extremely happy with. Remember, the broader market was up just a fraction during that time, so our so-called Alpha (our excess returns compared to our benchmarks) exceeded 17%.

Performance of all trades, open and closed, combined

In summary, we believe Concierge’s first year has been a resounding success and we would like to thank our subscribers for believing in us and putting their money where our mouths are.

Concierge is going international

To celebrate the success of year 1, we will soon be launching our first overseas stock. This will be a trial run with the aim to launch a formal international stock picking service in a little while.

You may know, we historically have quite some expertise in the Life Sciences and Technology sectors, semiconductors in particular. Our first international Concierge pick will be in one of those sectors. In other words, you could say we’ll be sticking to our knitting.

So, subscribers should keep their eyes open for our first Concierge International pick. And yes, we’ll try to come up with a better name for this service 😉

Improve your investment performance!

You too can try out Stocks Down Under Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…