Albo’s labour hire laws: Here are 4 ASX stocks that could lose from Same Job, Same Pay

One of the biggest gripes amongst the Australian business community has been the labour hire laws passed by the Albanese government that have been called ‘Same Job Same Pay’.

In a nutshell, the law ensures that labour hire workers get the same rate of pay and conditions as those directly employed at a company. Argument from the government and unions are that companies are using labour hire workers predominantly to pay lower wages for the same job.

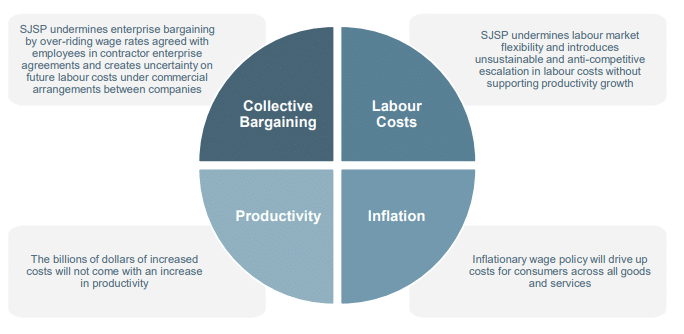

Businesses argue that this law is too broad and will require workers new to the business to be paid the same by law as a worker with decades of experience. They argue that it will compound productivity challenges, disincentivise the creation of permanent jobs, risk performance-based pay and erode Australia’s competitiveness as an investment destination.

Source: BHP Presentation, November 2023

Only time will tell if this happens in the broader economy, but there’s no doubt that some individual companies will be hit by the new labour hire laws, and here are a few of them.

4 ASX stocks that could lose from Albo’s labour hire laws

BHP (ASX:BHP)

If you don’t want to take our word for it, that’s fine – just take BHP’s word. It has been one of the most vocal critics of Same Job Same Pay, telling investors it could cost up to $1.3bn, although it has not formally quantified it and the Albanese government has rebuffed its claims.

The company employs 4,500 of its production and maintenance workers in Australia by a wholly owned ‘Operations Services’ division, which is essentially an in-house labour hire firm. While denying this is a division just to pay people lower wages for the same job, it claims this could be at risk as well as its training pathway Future Fit, which it claims could help its plans to increase female and Indigenous employment by taking on apprentices and trainees.

Woodside (ASX:WPL)

We promise this won’t be a list of entirely resources and energy stocks, but Woodside had to be on the list of stocks that could be hit by the new labour hire laws, because it has been a vocal critic too. Specifically its HR head Julie Fallon warned it would hit productivity. She did not say the company would go out of business, but essentially said the company would need to be careful when contracting out work and hat consequently, it would just add bureaucracy.

PeopleIn (ASX:PPE)

You are less likely to have heard of this company than BHP or Woodside, especially because it only adopted its current name two years ago, prior to that known as People Infrastructure. This company is our bourse’s largest recruitment and staffing business.

This company has actually claimed the labour hire laws might help things in the longer-run, notwithstanding its admitting that there was confusion in the short term. ‘We believe this will create an opportunity for PeopleIN as a large reputable labour hire business, given that we have the established infrastructure and capability to solve this complexity for our clients, especially those that have limited internal human resources/industrial relations resources’, CEO Ross Thompson told investors at its AGM last November. There is some merit to the argument, given it makes the bulk of its revenue from labour hire in nursing and aged care, and many agency staff actually get paid more. At the same time, if businesses rely less on labour hire, this is bound to hit the business.

Qantas (ASX:QAN)

Over the past 2 decades, Qantas has split its workforce across several subsidiaries and external companies. We all know how it fired its baggage handlers at 10 Australia Airports, replacing them with contractors on less pay, although its history of using labour hire expands long before that. The TWU has pledged to fight to lift pay and conditions when these laws are in place, as has the FAAA. The airline has appeared before the Senate inquiry on the labour hire laws, arguing that it had to do this be remain competitive in its industry and could have even gone out of business had it not evolved.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…