Best Stocks to Short if Trump Wins in November? Here are our top 3 picks!

![]() Ujjwal Maheshwari, June 11, 2024

Ujjwal Maheshwari, June 11, 2024

What are the best stocks to short if Trump Wins in November? We’re not talking stocks to buy if Trump wins (although we have before), but stocks to short – in other words, stocks where you essentially bet they will fall.

Whatever happens in early November, it is inevitable that the media, analysts and certain fundies will focus on the short-term fluctuations of major market indices, particularly the Dow Jones and Nasdaq. But most retail investors will be pondering what the result will mean for the stocks in their portfolio longer term. Which sectors will benefit and which will suffer?

As you ponder these questions, let’s identify the stocks that might take a hit under a potentially new Trump administration and thus present opportunities to short. But to help us, let’s first identify three policy areas where there is likely to be a 180-degree turn from the current Biden administration.

Policy areas likely to be different under Trump

1. Environmental Regulations

One of the key areas where politics influences the stock market is through environmental regulations. Different administrations have varying approaches to handling environmental issues, which can drastically affect certain industries. For instance, a Trump administration would tend to favour deregulation, particularly in the fossil fuel industry. This could lead to lower operational costs for companies involved in oil, gas, and coal, potentially boosting their profitability. With fewer regulatory hurdles, these companies might invest more in exploration and production, anticipating higher returns. Conversely, renewable energy companies might suffer if subsidies and incentives are rolled back, reducing their competitiveness against fossil fuels.

2. Energy Policy

Energy policy is another crucial area where political influence is significant. The Trump administration has historically promoted fossil fuel production and reduced support for renewable energy initiatives. This approach may lead to a boost for traditional energy companies like ExxonMobil and Chevron, who will likely benefit from policies that favour increased drilling and relaxed environmental standards. But on the flip side, renewable energy firms such as NextEra Energy and Enphase Energy could face setbacks if federal support for clean energy projects wanes. Reduced investment in renewable infrastructure might slow down the growth of these companies, while energy policies can lead to market volatility as investors react to changes in regulations and potential shifts in energy prices. You could argue that even traditional energy companies seeking to diversify could be losers, because it might be harder to secure funding to build potential projects.

3. International Trade

International trade policies also play a significant role in shaping the stock market. The previous Trump administration’s approach to trade often involved renegotiating trade deals and imposing tariffs, and we find it difficult to imagine things being different the second time around. Tariffs and trade barriers can disrupt global supply chains, affecting companies that rely on international trade. For example, industries such as automotive, technology, and manufacturing might face increased costs and operational disruptions. Trade tensions can create uncertainty in the market, leading to fluctuations in stock prices. Companies heavily dependent on international markets might see their stock prices affected by changing trade policies, with certain sectors more vulnerable to these changes. For instance, tariffs on imported solar panels and wind turbines could hinder the growth of the renewable energy sector.

So, which Stocks to Short if Trump Wins in November?

NextEra Energy (NYSE:NEE)

You can consider shorting NextEra Energy if Donald Trump wins the presidency. As we noted, A Trump administration is likely to roll back policies supporting renewable energy, such as the Inflation Reduction Act. This could lead to reduced federal support and investment in renewable energy projects, negatively impacting companies like NextEra Energy. Trump’s focus on deregulating the fossil fuel industry could further disadvantage renewable energy firms by increasing competition from fossil fuels. These factors could lead to a decline in NextEra Energy’s stock price, making it a potential candidate for shorting.

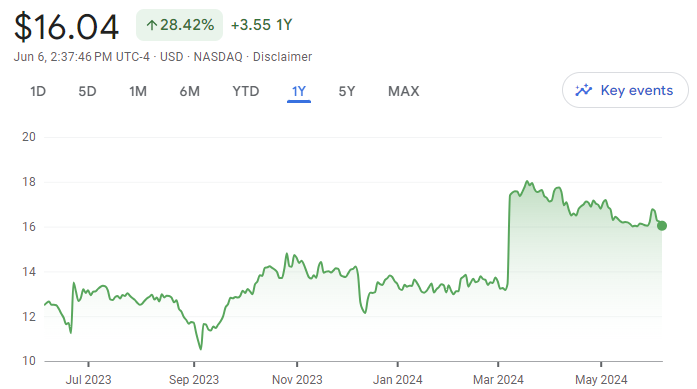

Smith & Wesson Brands, Inc. (NDQ: SWBI)

Smith & Wesson, a prominent American firearms manufacturer, presents another intriguing case. The firearms industry often experiences a counter-cyclical relationship with political changes. Under Democratic administrations, fears of stricter gun control laws typically drive up gun sales. Conversely, under Republican administrations, especially one as gun-friendly as Trump’s, this anxiety diminishes, leading to lower demand.

During Trump’s previous term, Smith & Wesson’s stock dropped about 60%, contrary to what one might expect given his pro-gun stance. This phenomenon can be attributed to reduced consumer urgency to purchase firearms when their rights are perceived to be secure. If Trump wins again, the absence of a perceived threat to gun ownership rights could result in subdued demand for firearms, putting downward pressure on Smith & Wesson’s stock.

Investors betting on this cyclical trend might consider shorting Smith & Wesson, anticipating a decline in sales and stock value under a Trump administration. The historical performance and market dynamics suggest that Smith & Wesson could face another challenging period with Trump in the White House.

Western Union (NYSE:WU)

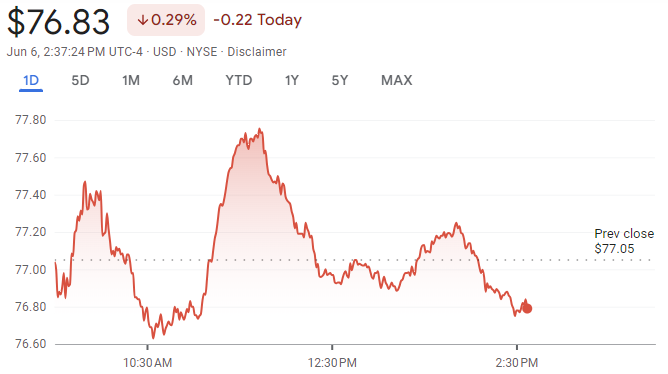

Western Union, one of the world’s top companies facilitating cross-border money transfers, could also be negatively impacted by a Trump victory. The company’s performance is closely tied to immigration policies and trade relations.

Money transfer companies rely heavily on the flow of remittances, which are closely linked to immigration. Tighter immigration controls and reduced immigration levels under Trump could lead to a decline in remittance flows, directly impacting Western Union’s revenue. The stock underperformed the market during Trump’s presidency, with a return of just 22%.

It closed down in Cuba before

During Trump’s first term, restrictive immigration policies and travel bans created significant challenges for Western Union’s business model. Indeed, the company was forced to shut up shop in Cuba altogether in 2020, although it has since resumed under Biden. It is not just the prospect of outright bans on money transfers between countries, but also restrictions that may make would-be consumers decide it is not worth the effort. Some of Trump’s restrictions on Cuba haven’t been removed such as the inability to send payments online, a $2,000 per day limit and a requirement to pick money up with a Cuban ID card.

If Trump takes things further so far as immigration policies are concerned, Western Union could face further problems. Investors might consider shorting Western Union’s stock, anticipating reduced remittance volumes and revenue declines due to stricter immigration regulations.

How could the Market React to the US presidential election result?

The financial markets are likely to react swiftly to the election results, either way. A Trump victory could lead to initial volatility as investors reassess the policy landscape. Maybe a Biden victory would lead to less volatility in the short-term, but the market might be volatile over the next 4 years as investors ponder whether or not he will serve the full term.

Takeaway

As election day approaches, investors need to think strategically about how political outcomes might impact their portfolios. Shorting specific stocks could be a viable strategy if one anticipates a Trump victory, or maybe even a Biden victory. In this article, we’ve identified 3 potential stocks, although there’s nothing stopping investors identifying their own.

What are the Best Stocks on the ASX?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Are CBA shares overvalued at $300bn? Here’s 4 arguments why they are, 4 reasons why they aren’t and our judgement

Are CBA shares overvalued? This has a hotly contested question for many months and particularly now that it is capped…

How to stop the ASX decline? ASIC and investors have some radical ideas

Addressing the ASX decline is a question that has been considered for many months now. In 2023-24, more companies left…

Why Equity Investors Are Exploring Forex in 2025

Everyone has been talking about the stock market in recent months due to the volatility brought on by Donald Trump’s…