Superior Resources (ASX:SPQ) goes hunting in north Queensland ‘elephant country’

Stuart Roberts, June 14, 2024

You’ve got to hand it to Superior Resources (ASX: SPQ) for ambition. Some time ago this Brisbane-based explorer started pursuing the idea that the Macquarie Arc, one of the most mineral-rich parts of New South Wales, didn’t stop in that state but kept arcing into Queensland. The Macquarie Arc is the part of the Lachlan Fold Belt that gave us Newmont’s Cadia-Ridgeway and Evolution’s Northparkes, amongst other monster mines. It’s a collection of Ordivician-age mafic to intermediate volcanic and volcaniclastic rocks, as well as limestones and intrusions, that are highly prospective for porphyry copper-gold.

An island arc porphyry copper-gold belt

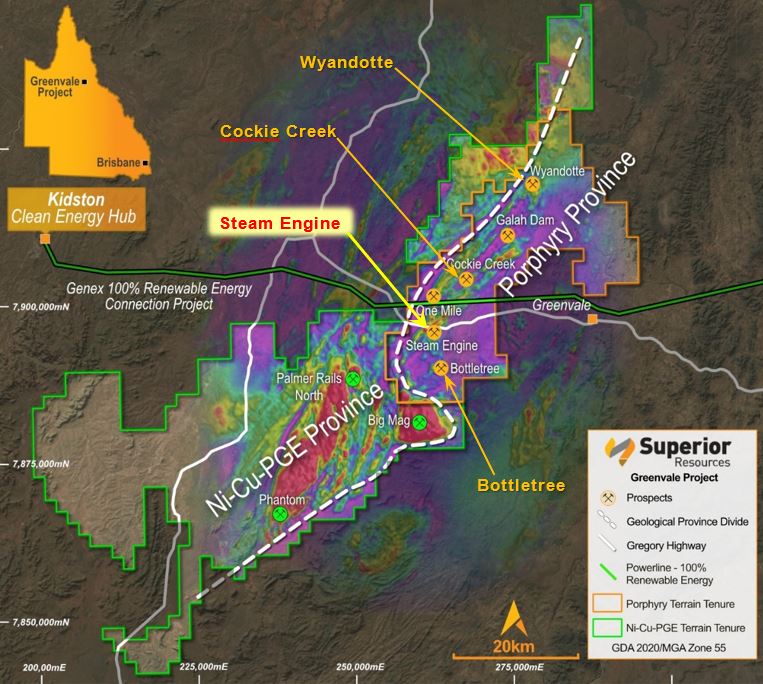

Superior Resources identified the district around Greenvale in northern Queensland, the town three hours’ drive west of Townville that used to have a lateritic nickel mine, as a place where the Arc could potentially show up again. The result was a massive 2,650 sq km exploration project, around half of which covers what we now know to be an island arc porphyry copper-gold belt and the other half securing an entire proven nickel-copper-PGE province, with systems of the kind you’d find at Canada’s Voisey’s Bay or Russia’s Norilsk.

Source: Company

So far, so good at Greenvale

Superior Resources is pretty pleased by what it has found so far in its Greenvale Project. Take the Bottletree prospect as a good example. Back in 2018 when the first diamond holes went into this huge soil copper anomaly, guided by some geophysical modelling, up came hundreds of metres of visible coarse-grained chalcopyrite, pyrite and pyrrhotite, with one notable intersection of 18.7 metres grading 1.12% copper from 328 metres.

Hole 4 in 2021 cut through in excess of 600 metres of porphyry-style mineralisation at an average grade of 0.21% copper and included 224 metres grading 0.40% copper, and other holes have also proved interesting. By early 2023, a few holes later, Superior Resources reckoned it had identified a large porphyry system at least a kilometre deep and wide that wasn’t just good for copper but also molybdenum. Element No. 42 at the time was spiking upwards and is still pretty high by historical standards.

The little Steam Engine that could

Bottletree hasn’t been a one-off. When a hole at a prospect called Cockie Creek registered 248 metres at 0.28% copper, 0.06 g/t gold and 44 ppm molybdenum from 56 metres all the way down to 303.7 metres, Superior Resources knew to get excited, particularly since the hole ended in mineralisation. The company now considers that there are at least another two large porphyry prospects in Greenvale that are yet to be tested. And then there’s Steam Engine…

Roughly midway between Bottletree and Cockie Creek, Superior found gold at Steam Engine in a high-grade gold lode and ore shoot system. There’s a rapidly growing JORC-compliant Resource here, which currently stands at 2.72 million tonnes at 2.0 g/t gold for 171,000 ounces. This resource accounts for only 1.2 kilometres of lode strike length down to shallow depths and there’s at least an additional 10 kilometres of untested lode potential. It’s open pittable and at the current high prices of gold it could be the starter mine that Superior Resources has been looking for.

A 475-806% IRR?

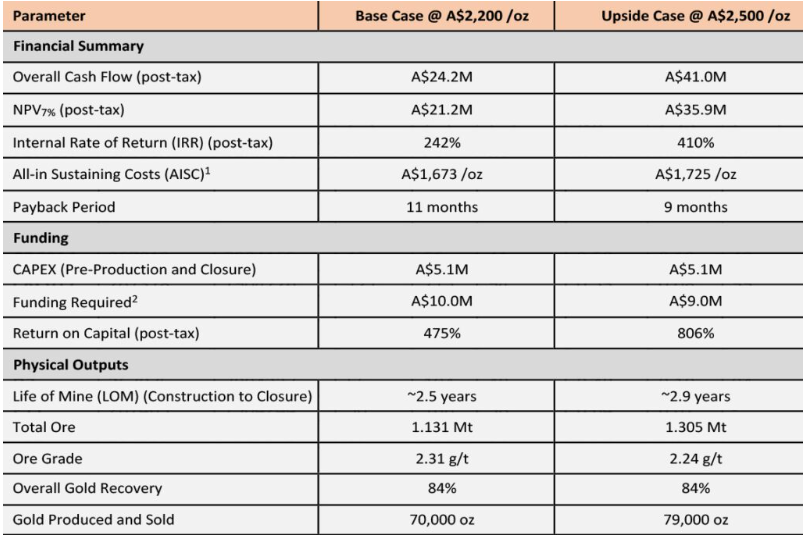

A 2021 Scoping Study that modelled only 70,000-80,000 ounces of production estimated that these ounces could be produced at an All-In Sustaining Cost of just A$1,673-1,725 an ounce. It comes in that low because the ore can truck down to the Ravenswood Gold Mine where there’s plenty of mill capacity. Based on a 2021 gold price of A$2,200, all it would take is $4m in capital costs to get started, and over a couple of years that would yield A$21-$1m in after-tax cash flows using a 7% discount rate, with an Internal Rate of Return of between 475% and 806% – yes, you read that right.

Source: Company

Superior Resources is now updating that study to take account of the markedly higher gold price of 2024, and the inflationary environment we’re in. Earlier this month the company reported the updated resource estimate to 171,000-196,000 ounces depending on whether Super builds its own plant and can therefore process lower-grade ore (4.18 million tonnes at 1.5 g/t Au for 196,000 ounces) or toll-treats and therefore only benefits from the higher grade ore (2.72 million tonnes at 2.0 g/t Au for 171,000 ounces). The important thing to note about Steam Engine is that the cash flows could fund more aggressive exploration at Greenvale to allow it to go after the big copper or nickel money.

Nickel stocks are doing it tough, but now could be a buying opportunity

Sure, very few investors want to hear about nickel right now, but the current bear market won’t last forever. And there’s potential for a nickel-copper-PGE discovery in the medium term for Superior Resources. In the 2,000 sq km of the Greenvale project where the Norilsk/Voisey’s Bay type sulphides predominate, the company has identified something like 40 intrusions to follow up. Certainly, some of the bigger intrusions have been proven to be the right type of sulphide systems and nickel sulphide mineralised. This is virtually virgin territory when it comes to nickel-rich sulphides, and Superior Resources has speculated that maybe it’s the next Gonneville.

Gonneville? Yes, the company-maker Chalice Mining (ASX: CHN) famously discovered in Western Australia in early 2020. Superior Resources thinks it may have found the next one. Really and how so? Well, all those intrusions hint at the possibility of a Julimar-style ‘chonolith’ – an irregular pipelike igneous intrusive – in the neighbourhood not unlike what you’d find at Norilsk, where one had not been suspected previously. The next steps are now to pinpoint where large volumes of nickel-copper and PGE mineralisation may be located. So far there’s only been nine drill holes which found a lot of low-grade magmatic sulphide mineralisation that hinted that something interesting is out there.

And don’t forget that countless discoveries have been made in bear markets for the commodity or for stocks generally. Look no further than Chalice’s Gonneville, found during the Corona Crash. Another example is Sandfire Resources (ASX:SFR), which stumbled across the DeGrussa mine in the depths of the GFC in early 2009. And much of Gold Road’s (ASX:GOR) exploration progress occurred in the late 2000s and early 2010s when gold prices were stagnant.

Superior Resources (ASX:SPQ) is one to look at

In 2023 and into 2024 the market hasn’t been interested in the kind of copper and nickel play Superior Resources represents, but the downtrend has now reached the stage where the current market capitalisation is undervaluing the in-ground value of Steam Engine, let alone its potential as a mine. Superior Resources is therefore, in our opinion, worth a look. Those crazy geologists who thought you’d find the Macquarie Arc in Queensland might just have found even more than they looked for.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…