Is Telstra benefiting from Optus and its struggles? And could this be a good opportunity to buy Telstra shares?

The Optus debacle might have you believe that we’re seeing Telstra benefiting from Optus and it is therefore a good chance to buy Telstra shares. We’d say, not so fast.

What went wrong at Optus

Earlier this month, Optus had a disastrous network outage. It lasted for 14 hours and was that bad an outage, that customers could not even make emergency Triple-zero calls. The company’s handling was arguably just as bad, admitting that it had never envisioned a scenario like the one that eventuated and openly rejected calls for compensation initially – it has since made payments to some but pushed back against calls for mandatory compensation. Eventually, it claimed the scalp of CEO Kelly Bayer Rosmarin.

What’s the most logical thing to do when you’re angry at an oligopoly that let you down? Switch to another. So it is with the big banks, it is so with telcos too. Only difference here is that Telstra is the only one of the major Aussie telcos that is listed on the ASX. We are not counting Tuas (ASX:TUA) or Spark (ASX:SPK) as Aussie telco because they do not provide services to Australia. And we do note that Optus’ parent company Singtel is listed in the Lion City, but again, we are not counting it.

Is Telstra benefiting from Optus? And should you invest in Telstra shares as a consequence?

Telstra has claimed it is. At its recent investor day CEO Vicki Brady claimed that Telstra had seen some customer inflow. Critically, it did not expect it to last, or materially change its share price prospects. If the company itself has said so, we see no reason why investors should think so too. Another thing worth noting is that even though there have likely been retail customer exits, there have not (yet) been any major government contract losses. If this occurred, and Telstra pounced on it, then there would be a bigger financial loss for Optus.

But, as with any stock, investors should always think about the long-term rather than short-term. They should also consider the risks of investing in stocks – it is possible that such an outage could happen to Telstra as well, and its shares could suffer as a consequence.

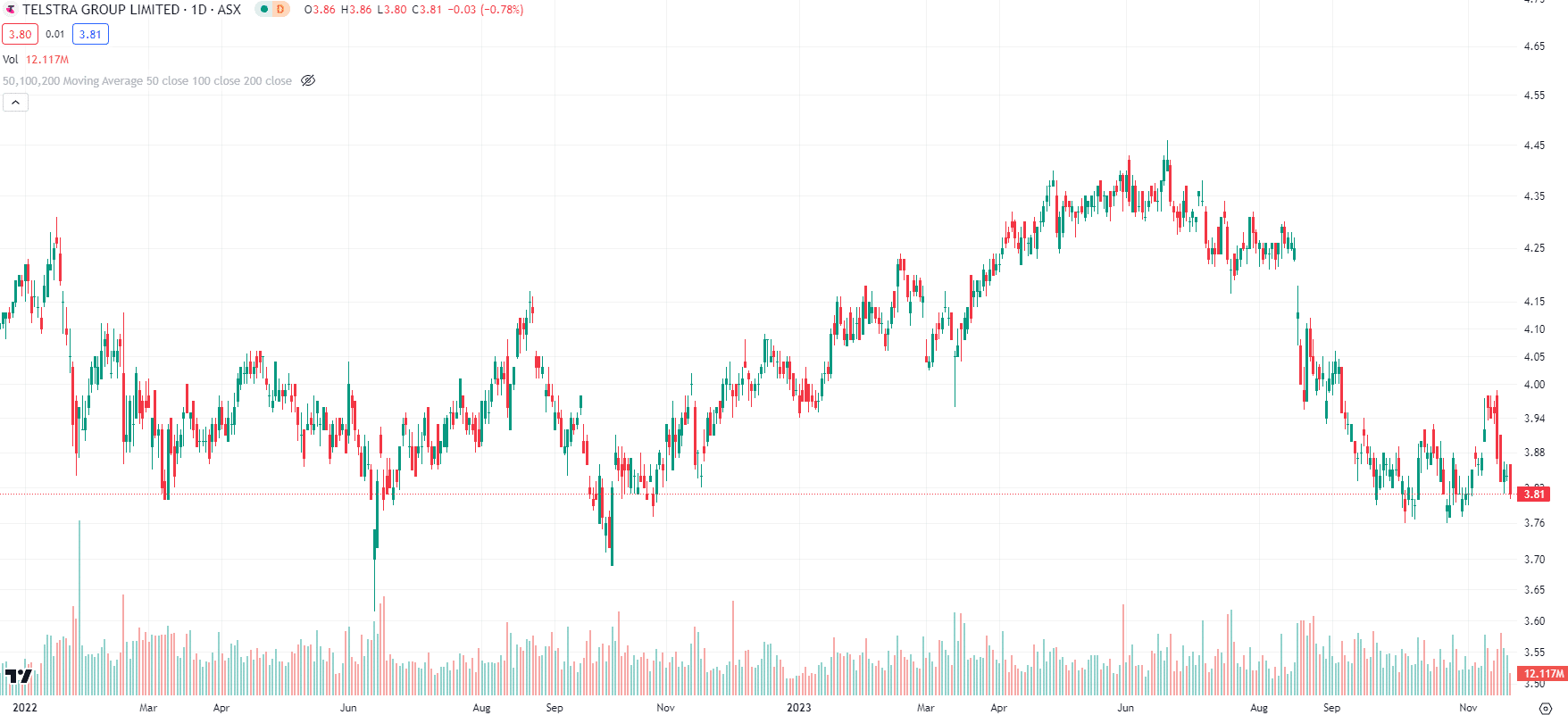

Telstra shares are flat in the last year, even though there has been significant volatility along the way.

Telstra (ASX:TLS) share price, log scale (Source: Trading View)

This being said…

…analysts covering Telstra are optimistic about its future. There are 15 of them, and the mean share price is $4.51, an 18% premium to the current share price. This optimism doesn’t appear to be borne out in their financial projections. For FY24, they expect 3% revenue growth and flat profit growth. In FY25, however, they expect 10% profit growth but only 2% revenue growth.

Nonetheless, the company is investing in its future. It is making significant investments in high-speed fibre, Cloud and AI activities. Most notably, it has laid 400km of low-latency cable since early 2022 and is promising 55 terabit per second Internet speeds once the entire network between all major Australian cities is completed. It also plans to service customers in Asia from data centres on Australian shores by linking up with subsea cables.

By all means, investors should consider Telstra shares if they can trust the company can execute and will benefit as a consequence. Perhaps as well if they believe Optus will lose major government contracts in due course. But investing in Telstra shares in the immediate fallout of the Optus debacle? That is something we would not do.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…