Transurban (ASX:TCL): Is it at risk of losing its valuable monopolies?

![]() Nick Sundich, March 15, 2024

Nick Sundich, March 15, 2024

Transurban (ASX:TCL) is a unique stock on the ASX. No other stock has such long-term monopolies as Transurban does on its toll roads. Nor is any other stock arguably as hated as much as Transurban, given the constant toll increases. Of course, if you’re a monopolist it doesn’t matter if you’re liked as long as you’re making money.

However, it looks like toll road reform in NSW might actually be happening – for real this time. Could this be a threat to the company’s results and cause a Corona Crash-like panic? To make a long story short, it will depend on what ends up being proposed and if there is courage on the part of the state government to implement any changes.

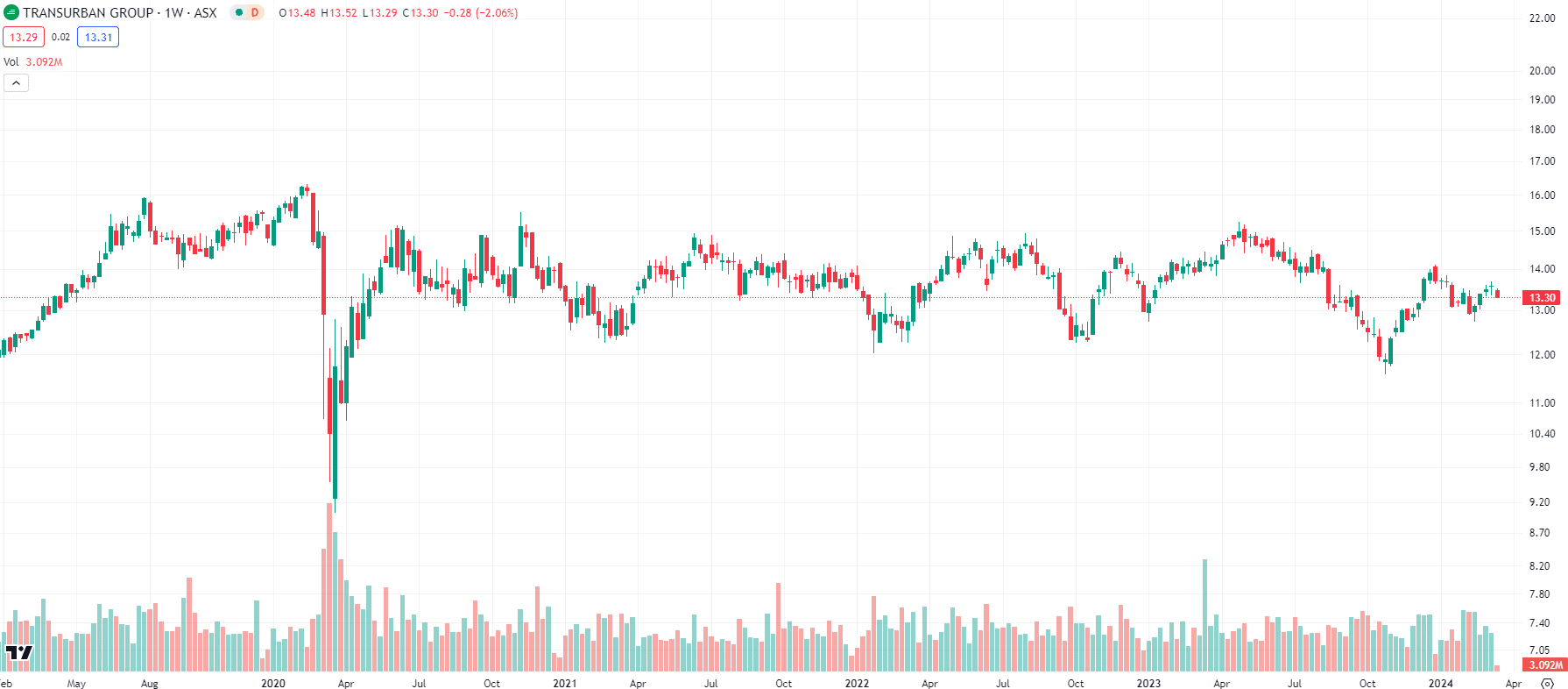

Transurban (ASX:TCL) share price chart, log scale (Source: TradingView)

Who is Transurban?

Transurban is a toll road operator with interests in 22 roads. These include nearly every one of the 13 tolls roads in Sydney except the Harbour Bridge and Tunnel. It owns Melbourne’s CityLink and West Gate Tunnel, half a dozen roads in Brisbane including the AirportlinkM7, as well as half a dozen in the USA (most of which are in the Greater Washington area). In many instances, Transurban has monopoly concessions lasting several decades.

In 1HY24, it generated $1.76bn in toll revenue and just $464m in proportional costs, leading to $1.33bn EBITDA and a near ~75% margin. What’s more is that there are clear tailwinds showing the need for more roads, including population and employment growth in all of its markets. Even if no more concessions were granted, this means more cars on existing roads. Or so it will be in theory.

Will the future really be rosy?

There has been growing resentment over the high toll levels, especially in Sydney. For so long, little was done about it, but now it looks like action is being taken. The Minns Labor government commenced a $60 weekly cap on tolls from January 2024, with claims beginning from April 2024.

And a recently released independent review led by former ACCC chair Allan Fels and David Cousins revealed Sydney motorists would pay $195bn in tolls up to 2060 (a significant proportion of which would be for WestConnex that would be paid for ‘three times over’) and made recommendations to reduce the burden. In particular, the report recommended the government take control of tolls and set prices for itself.

Nothing to see here!

Transurban is not worried enough to publicly panic – and believe us, companies do publicly panic when there’s a legitimate threat to their business model. ‘Transurban is committed to working with its investment partners and the NSW Government to deliver greater value to customers and further improve the safety and efficiency of the broader Sydney road network,’ the company said through its PR department.

However, this is just an interim report that did not make specific recommendations as to toll pricing. The Minns government has promised to assess the findings and recommendations. No doubt if it decides to act on some and Transurban doesn’t like them, we’ll hear about it.

Now, anything the government does may not necessarily be bad news. It might involve extra charges for some drivers. And the report also found motorists are withdrawing from toll roads and clogging up others to avoid paying them, so Transurban could be making back lost revenue. Ultimately, only time will tell what eventuates here.

What does the future hold?

As important as Sydney is, it is not the only jurisdiction in which it holds roads. The company owns assets in North America and wants to buy more. It tried to buy Denver’s $1.3bn Northwest Parkway but ultimately pulled out. It may well spend this money on other assets. It had been rumoured that it would try and buy Melbourne’s EastLink completely (it only has 55% right now), although it appears to be dead in the water after the ACCC publicly said it didn’t want TCL owning it.

And although recent results weren’t that bad, investors appeared disappointed at the lack of an increase to its full year guidance and it failed to raise its dividend as expected.

What the market thinks

Consensus estimates do expect growth in the years ahead with $4.2bn in revenue in FY24, $4.3bn in FY25 and $4.4bn in FY26. The EBITDA line is expected to be $2.3bn in FY24, up from $2.1bn in the year before. Thereafter, $2.6bn in FY25 and 3bn in FY26. But presumably, this is predicated on little to no changes to the toll road arrangements.

Transurban is a company all people, investors or not, will be watching with interest in the months ahead.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here are the biggest tax implications of investing in stocks and how to slash your bill

The tax implications of investing in stocks are not often considered when you first start investing, although you may get…

Nufarm (ASX:NUF): Hit by lower commodity prices, adverse weather and Trump’s tariffs

Have some sympathy for Nufarm (ASX:NUF). Companies capped at over $1bn rarely plunge 30% after reporting results unless the results…

US Credit Downgrade 2025: Safe Havens or Sell-Offs for Investors?

The US credit downgrade in 2025 has sent ripples through global financial markets, raising serious questions for investors worldwide. When…