Universal Store (ASX:UNI): Benefited from Millennials and Gen Z spending with a vengence in FY25; set for more growth in FY26

Let’s take a look at Universal Store (ASX:UNI), a chain of casual fashion stores aimed at Millennial and Gen Z customers (think 18-35 year olds). It is a good business, but was hit by perceptions that its customers would cut back their spending because they have been the worst hit by the cost of living crisis, with rising rents, HECS debts and bracket creep.

The last 2 set of annual results show that talk of the demise of their spending power was greatly exaggerated, or perhaps the Stage 3 tax cuts helped. Let’s look into it.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Introduction to Universal Store (ASX:UNI)

What do young people want? The ever-allusive question that is asked over and over again in the media and by parents is, in part, the basis of the fashion industry. We know they spent a lot on experiences (just look at the Taylor Swift tour), as well as on fashion. The latter is a broad term that can include unhealthy dieting habits, but also can include good clothes. That is what Universal Store provides, at value for money pricing.

This company’s history dates back to 1999 and it spent nearly 2 decades in the hands of its founders before being sold for $100m to a buyout consortium led by private equity firm Five V Capital, which exited soon after the IPO as did Brett Blundy.

Can the stock rebound?

Universal Store listed in November 2020 with an enterprise value of $290m and is now worth $390m, even in spite of COVID-19 store closures and the cost of living crisis. Admittedly, it is off its all time highs, but we think has scope to rebound in the year ahead for reasons which we will come to.

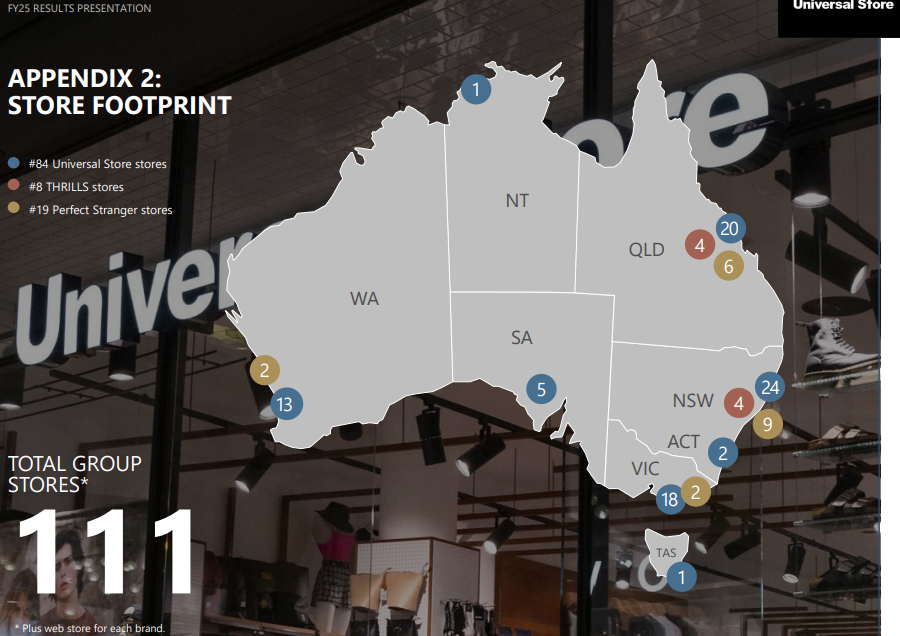

Universal Store has 84 stores across Australia, which tend to be in major shopping centres, as well as a further 27 exclusive for particular brands like Perfect Stranger and Thrills, and the group makes 14% of its sales online. Both curated third-party products and private brand products are sold in-house, although the former dominates.

Source: Company

It has solid technology, enabling stock to be automatically order based on what is popular with customers rather than what management thinks might be popular several months down the track.

Good results (all things considered)

Let’s go back to FY22, the year that begun amidst the Delta lockdowns and included the start of the cost of living crisis.

Universal Store made $208m in sales, down 1.4% from FY21, underlying EBITDA of $35.7m (down 27%) and an NPAT of $21.1m (down 21%). This represented a margin drop from 14.4% to 10.1%. And keep in mind that FY22 included new stores that were not open in FY21, so like-for-like sales were down 3% overall and nearly 10% just in brick and mortar stores. 3,192 trading days were lost, resulting in a sales impact of $20m. You can see investors were not too happy.

Now, let’s go forward 12 months to FY23. Total Sales were up $263.1m, up 26.5% overall, although like for like sales were only up 1.2%. It made underlying EBIT of $40.4m, up 24%) and an NPAT of $23.6m, up 15%. Not bad in the rising interest rate environment. This was because the company was better able to manage inventory and offset costs of doing business.

In FY24, sales grew 10% to $288.5m, EBIT increased by 17% to $47.1m and its profit rose 45% to $34.23m. The company closed the period with $14.3m net cash and 102 physical store locations, 80 of which were Universal and the rest were either Perfect Stranger of Thrills. The company paid 35.5cps in dividends throughout the year. You can see that sales grew, but the company maintained disciplined cost control. The company achieved this through consolidation of its other brands, direct sourcing of private brands and it reduced international freight imports.

And finally in FY25, Universal made $333.5m revenue (up 15.5%), $54.6m underlying EBIT (up 16%) and a $34.8m underlying profit (up 15.2%). Its statutory profit was $23.3m, down 32% due to a $13.6m goodwill impairment expense. It paid 38.5c per share in dividends (representing an 80% payout ratio) and closed the period with $17.2m cash and no debt.

No guidance, but analysts see top and bottom line growth

The company has not given specific financial guidance, but told investors it has a longer-term goal of 100 Universal Stores and so planned to open 11-17 across FY26. In the first 7 weeks, it reported 14.7% sales growth in Universal Store and 53% in Perfect Strangers. It has warned that CTC wholesales market may remain challenging, but this would be less than 5% of group sales, as well as that forex headwinds could be a risk.

Analysts covering the company expect $370m revenue and a $42m profit in FY26, followed by $398.5m revenue and a $45m profit. Their mean target price is $9.92, a 11% premium to the share price prior to the release of FY25 results. It is trading at a P/E of 16.8x, an EV/EBITDA of 6.9x and a PEG of 1.2x.

But can it achieve this?

We appreciate investors may be sceptical that this can be achieved. Yes, we know millennials have less money than Baby Boomers or Gen Z. But we think they are still willing to spend on items that provide value for money like Universal does.

Or sometimes, to go all out on big occasions when Taylor Swift comes to town. Forget about spending on tickets, just look at how many people lined up to buy merchandise outside the venue 2 days before the first concert in Sydney – fans spent $66m on merchandise alone.

You may think that Stage 3 tax cuts helped in FY25 and be wondering what will help in FY26? We reckon it’ll be the cut to the HECS debt repayment thresholds which will see debtors pay $600 less a year.

Ticking ESG boxes…Millenials will like that!

Turning to ESG, we mentioned the positive element of helping younger people look and feel good without unhealthy diets or cosmetic surgery. There is even more to like here. It told investrs that by 2025:

- 100% of its bags and online mailers will be reusable, recyclable or compostable,

- 50% of all cotton and polyester (at least) will be procured from certified recyclable sources,

- The proportion of electricity coming from renewables for the support office and distribution centre will be maximised (although there is not a formal target for this),

- There’ll be 1 million customer educational touchpoints on responsible use and care of garments

And on top of all this, it is targeting zero waste to landfill from DC operations by 2030. It has also audited 100% of its Tier 1 factories and intends to have 100% of its Tier 2 factories audited this year.

Paying dividend, but you should be in it for the growth

As it continues to grow its store network, and Millennials and Gen Z customers hike their spending, we expect it to be reflected in the company’s top and bottom lines.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…