Weebit Nano (ASX:WBT): Here’s why it has done so well and why the next 2 years will be extremely exciting!

Our long-time followers would know we are big fans of Weebit Nano (ASX:WBT). This company has delivered stellar returns to shareholders over the past few years. But just where is this company at right now, and what is next?

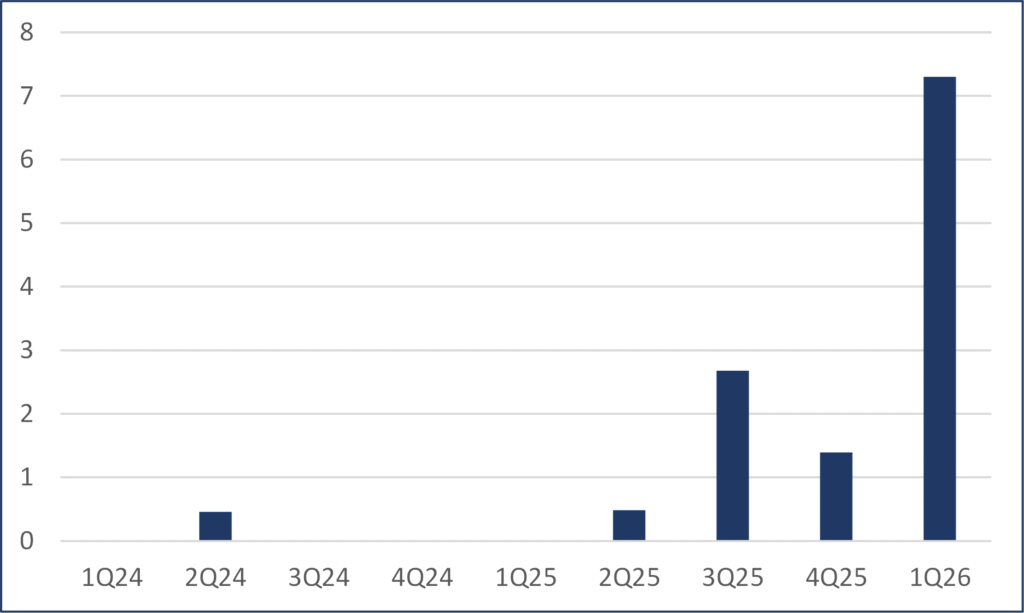

To make a long story short, it has achieved what no other ASX semiconductor stock has in having successfully commercialised a technology and deriving material revenues from it. In fact, Weebit is the only independent provider of its technology (ReRAM) in the world! And after making >$1m in revenues in FY24, it made $4.4m in FY25 and generated $7.3m in cash receipts from customers in just the first quarter of FY26! And this is just the beginning!

In this article, we recap the company’s technology, the progress made to date, where to next, and the potential upside from here!

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Disclosure: Stocks Down Under directors own shares in WBT.

This article was first published in July 2023, last updated in October 2025.

Who is Weebit Nano? And what is so special about its ReRAM

Weebit Nano is a semiconductor technology development company that is listed on the ASX. The company specialises in a Non-Volatile Memory (NVM) technology called Resistive Random Access Memory (ReRAM) that has strong potential to replace Flash memory technology, among other things.

For investors wondering, NVM is ‘Non-Volatile’ because it retains data even when the power is turned off, and ReRAM is ‘resistive’ because it works by changing the resistivity of the material by running a current through it rather than storing an electrical charge in that material. Just about every electronic device needs Non-Volatile Memory to operate, and this is typically some form of embedded memory.

Have you ever noticed that electronic devices have become smaller while still being able to do more? Well, in part this is because computer chips, including memory chips and modules, are getting smaller and smaller, while their capabilities are increasing.

But the NVM market is at a critical juncture because stand-alone Flash memory cannot scale down below 40nm (nanometer), while embedded Flash can’t scale below 28nm, let alone while meeting the increasing performance needs.

While not physically impossible, it would be commercially unviable to design this technology in a way that would cause it to be immune from problems, such as leakages of current between adjacent memory cells.

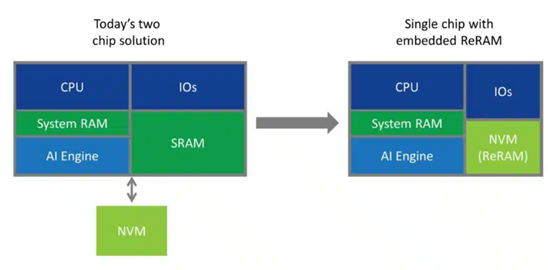

Source: Company

AI makes the case for ReRAM stronger

And of course, as goes without saying, AI applications need chips with even higher performance standards. By AI, we are not just talking about ChatGPT – this is an example that most laypersons would understand.

But the term ‘AI’ also includes technologies such as smart home applications (ranging from voice generation apps to smart lighting), creative design tools, coding assistance tools and dataset analysis (for purposes ranging from stock research to drug discovery).

AI inference is increasingly being done in smaller devices ‘at the edge’ of the Internet, hence the term Edge AI. Increasingly, AI capabilities, and more efficient Edge computing capabilities in general, will be integrated in chipsets where the addition of small modules, with ReRAM embedded in those modules will lead to incremental improvements of devices.

Certain applications could include devices with edge AI chips in them, such as wearables and home assistance devices as well as neuromorphic processors and hardware-based identity or authentication applications.

ReRAM has some major advantages over existing technologies

ReRAM technology generally, and Weebit’s ReRAM specifically is not the only alternative non-volatile memory technology, it is the most promising.

In particular, WBT’s ReRAM can perform 10-100x better than Flash because it can handle 100k-1m read/write cycles, can store and retain data for 10 years at 175C or 20 years at 125C, has a 100x faster access time, and can withstand up to 350x more radiation than Flash.

All the while, it adds far less to the cost of a semiconductor wafer than flash or other technologies and has lower power consumption levels and lower voltage requirements, thus enabling a longer battery life. And most critically, it can scale down further than Flash Memory, i.e. Weebit’s ReRAM has been taped-out at 22nm already and can likely be scaled down further below 20nm.

As if this all was not enough, being an independent provider enables Weebit Nano to offer its ReRAM to a diverse range of clients and be flexible to meet their needs.

In fact, some customers may find Weebit Nano to be the only choice out there in the market! For instance, deals with certain companies may exclude the possibility of major fabs to supply the same ReRAM to competitors. Even where this is not the case, large foundries typically offer standard ‘products’ and are either unwilling or unable to offer flexible, tailored options.

WBT’s ReRAM is commercialised!

Since its ASX listing, Weebit has been developing its ReRAM technology with the intent of bringing it to market. As of late October 2025, the company has 3 foundries/IDMs and 3 product companies. These include:

- SkyWater (NDQ:SKYT): A Minnesota-based foundry that signed on September 2021. A foundry is a chip maker that manufactures chips for third-party customers. SkyWater services customers in the aerospace, defence, automotive, biomedical, industrial and consumer sectors. Weebit Nano’s ReRAM can be integrated in SkyWater’s customers’ system-on-a-chip design.

- DBHiTek: A South Korean semiconductor manufacturer and ‘top 10’ foundry, that signed in October 2023. DB HiTek’s customers include chip companies like Intel and Infineon as well as car maker BYD and fabless chip company Qualcomm.

- onsemi: A NASDAQ-100 integrated device manufacturer (an IDM which is a device maker that designs and manufactures its own chips) spun out of Motorola in 1999. It will make ReRAM avaliable in its Treo platform for analogue and mixed-signal applications; and

- Three unnamed product development companies. These are design license agreements involving undisclosed US-based companies incorporating Weebit Nano’s IP into various products, including security-related applications.

The company has a licensing model with all existing customers and intends to do likewise with future partner fabs. WBT will generate revenue in the form of license fees (upfront and milestone payments), a per-unit royalty and Non Recurring Engineering (NRE) fees. The royalty percentage could be 1.5-3%, based on industry standards.

To illustrate how this might work, let’s assume a foundry can make a chip using WBT’s technology that costs US$10 per unit and WBT receives a 3% royalty on all sales of chips that use its technology. If the foundry sells 1m of these chips and generates US$10m in sales, WBT would receive US$300,000 from this customer for this product.

A big opportunity ahead: US$2.8bn by 2030 would be a conservative assumption

McKinsley and PwC both estimate that the global semiconductor industry will grow to more than US$1tn by 2030, up 66% from 2021 levels! Moreover, PwC estimates the total investment in semiconductors between 2024 and 2030 will total approximately US$1.5tn, equal to the investment made over the preceding two decades.

Now of course, it is unrealistic to assume any individual company can capture a significant share of that entire market. But there are certain segments where Weebit has a major opportunity, and even if it only captures a small share of those market segments, it could be lucrative.

One could be automotive applications which will be US$147bn by 2030. 1% of that would be US$1.47bn which could be significant for an IP-based technology, especially one with high margins.

ReRAM could be useful in powering applications, including side and rear-view cameras, or in battery management. Another could be industrial and IoT applications which will be US$131tn by 2030. This includes chips for sensors, medical devices, smart meters and automated machinery. 1% of that could be US$1.3tn which could mean a US$2.8bn revenue opportunity by the early 2030s.

The upside for investors

In 5 years, Weebit has climbed from an A$30m company to an A$1bn company. But is there further upside, and how could it be realised?

We believe that even if Weebit did not sign one additional customer, it would be lucrative enough, as the revenues still mostly only reflect one customer (specifically onsemi), given it takes time to ‘qualify’ the technology. But with the company making as much revenue in the most recent quarter as it made in the entire preceding 12 months, we expect revenues to continue to ramp up, and for more customers to be signed.

Indeed, Weebit expects two additional foundry/IDM signings before the end of 2025, although we may not receive confirmation until the company’s next quarterly report which will be released in January 2026.

The key for Weebit will be signing product customers (i.e. onsemi) rather than fabs. With all due respect to fabs, there is a higher pool of customers in the product space and the process of qualification (i.e. transfer, design, testing and validation) takes quicker because companies can use a module qualified in its own right.

Again, consider that Weebit generated ~$1m in revenue during FY24, then >$4m in FY25 and exceeded the latter figure just in the first quarter of 2026!

Source: Pitt Street Research

Pitt Street reckons $9.74 per share

Our sister company Pitt Street Research has covered Weebit for several years and has watched the company’s progress from when its technology was little more than an idea to it being a commercial reality. Its most recent report values Weebit at $9.74 per share – based upon valuing it at 25% of the value of Taiwanese listed peer eMemory (TW:3529).

Although eMemory is further advanced, we think it is a great example of what WBT’s journey may look like, specifically because, like eMemory, WBT aims to complement its future customers’ IP libraries with proprietary IP in a highly lucrative licensing model. Consider that in CY24, eMemory generated A$180m in revenues and a 55.2% EBIT margin!

Nonetheless, an M&A scenario could generate a higher value. There are few deals to directly compare Weebit to because not many disclose the price. One is Qualcomm’s acquisition of Alphawave in June 2025, which was US$2.4bn or A$3.6bn. Applying this to Weebit would generate a share price above A$10 per share, although we think investors shouldn’t ‘wait out’ for a takeover and should instead watch and see continued cash flow and earnings from the company.

Keep your eye on WBT!

We think WBT has earned its re-rating over the last several years. But we think the best is still to come from this company – we expect further growth to come as it achieves the catalysts above.

For more information on this great company, check out our library of reports from our sister company Pitt Street Research!

Disclosure: Weebit Nano is a Pitt Street Research client and directors own shares in this company.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…