Westgold is merging with Karora Resources and creating a A$2.2bn company: Is it a match made in heaven?

![]() Nick Sundich, April 8, 2024

Nick Sundich, April 8, 2024

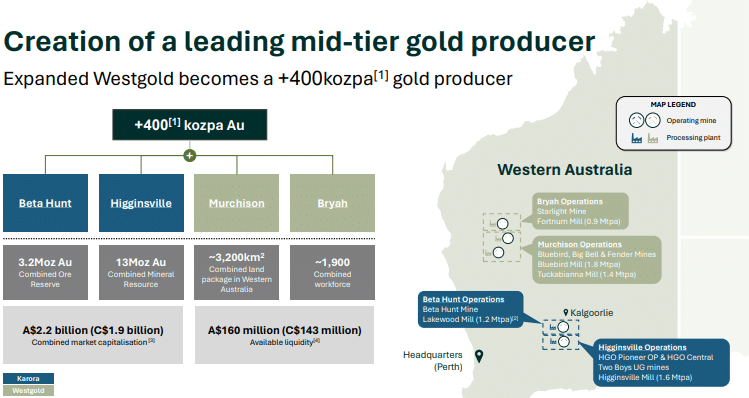

This morning, investors heard the news that Westgold is merging with Karora Resources, a TSX-listed gold miner. The deal will create a A$2.2bn company with assets capable of producing over 400koz per annum and a A$160m cash balance. And the new company will be dual-listed. But let’s take a closer look at the details.

Introduction to Westgold

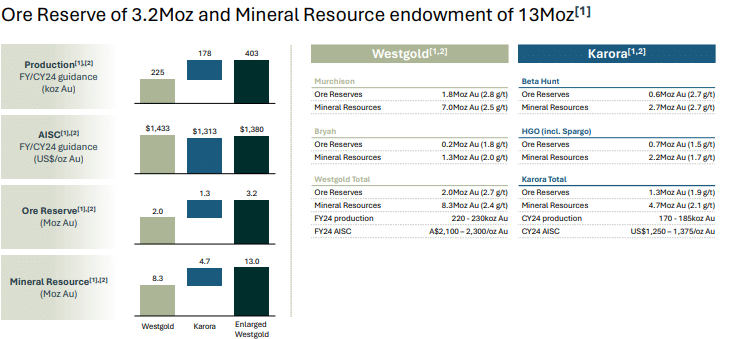

Let’s recap Westgold Resources (ASX:WGX) for the sake of unfamiliar investors. It is a WA-focused gold producer that produced 257,116oz in FY23. It has four projects with 2.0Moz Ore Reserves and 8.3Moz of Mineral Resources. It has no debt and A$192m in cash and liquid assets.

The company holds four underground mines and three processing plants in the Murchison and Bryan Basin. It operates on a hub and spoke model with ore being fed direct to its processing hubs.

Westgold is merging with Karora Resources…but why?

Inevitably, both companies want to stand above their peers from an investor relations perspective. In other words, they want to appear more attractive than their peers to investors. Yes, gold is hot at the moment and almost all gold miners are benefiting, but not all are deriving the same share price benefit. Nonetheless, some of the best performers have been M&A participants, with Ramelius (ASX:RMS) and Genesis (ASX:GMD) being two such examples.

There’s little doubt that this deal will help the company’s cause, making it dual-listed and boosting its portfolio, cash balance.

Source: Company

Source: Company

However, it cannot be hidden that Westgold is far from the most profitable gold stock and has suffered from recent operational issue. It made a modest $10m NPAT in FY23. If it is any consolation it is up from a $111m loss the year before.

It was less than a week before the deal was announced that the company downgraded it full-year guidance to 220,000-230,000 oz at an AISC of $2,100-2,300/oz. This led to shares falling over 10% on that day.

Westgold had previously guided to 245-265,000oz at an AISC of $1,800-2,000/oz and reiterated it only 3 weeks prior, even in spite of revealing the operational issues – caused by heavy rainfall. It only paid a dividend of 1c per share in 1HY24, and even that was prior to the knowledge that the rainfall would be as bad as it ultimately turned out.

An M&A deal is one way to make shareholders think issues are just temporary and/or that the deal will fix everything. It may well, but nothing is guaranteed.

The fine print of the deal

The deal is expected to close on or about July 19, only a few days after shareholder approval from Karora. It needs a 66% vote to pass, as well as FIRB, ASX, TSX and regulatory approval. Any failure of the deal to pass would lead to a mutual break fee of A$45m.

Karora investors will receive 2.524 WGX shares per Karora share held, equating to A$5.755, plus A$0.68 in cash and 0.30 of a share in SpinCo with an implied value of A$0.164 per Karora share held. SpinCo is a separate company with a 22.1% interest in Kali Metals and a 1% lithium royalty on mining interests held by Kali.

The new company, which will retain the Westgold name, will be roughly 50-50 split between Westgold and Karora on its register – with Westgold at 50.1% and Karora at 49.9%.

Conclusion

It’ll take another year or two to tell if this deal will catapult Westgold into the upper echelon of ASX gold miners. But it will hinge on the company meeting its guidance, gold continuing to run hot and battery metal prices remaining in a bear market (or at least not entering a new bull market) over that time frame.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…