What are nominee shareholders? Have they got anything secret to hide from the rest of the market?

![]() Nick Sundich, April 26, 2024

Nick Sundich, April 26, 2024

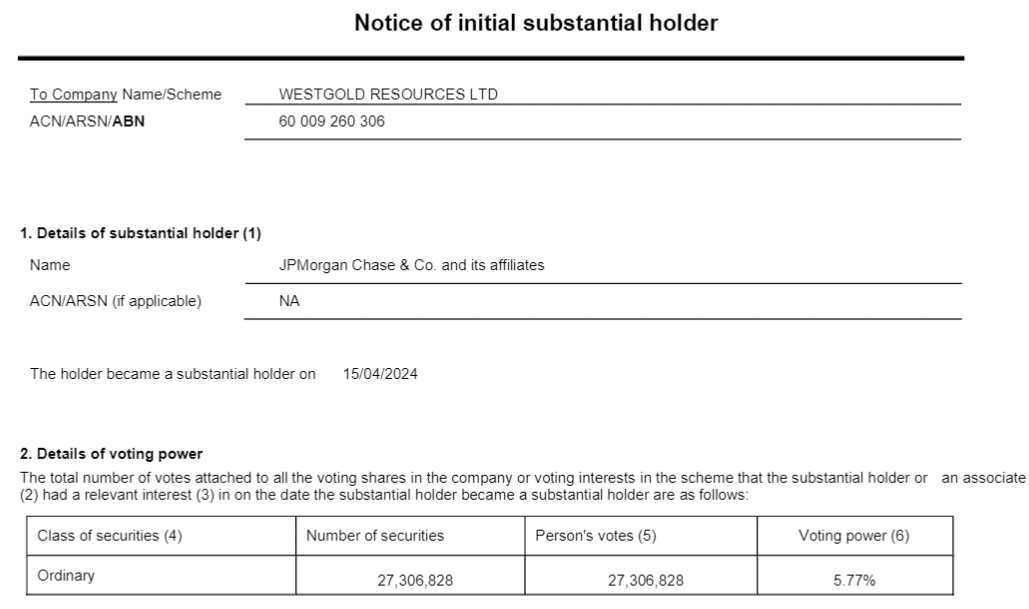

Let’s take a look at who nominee shareholders are. Have you ever seen a substantial shareholder notice lodged with your stock, seeing the heading ‘Becoming a substantial holder from JP Morgan/HSBC/Morgan Stanley/CBA’ and thinking that actual bank has bought into your stock? Is this really the case? Yes and no.

What are nominee shareholders?

Nominee shareholders are individuals or entities listed as the legal owners of shares in a company on behalf of the actual owners. These arrangements are used to maintain the anonymity of the true shareholders. The nominee holds the shares and acts on instructions from the beneficial owner, who retains the economic interests and rights associated with the shares.

Observe we gave 4 names above: JP Morgan, HSBC, Morgan Stanley and CBA. These are the most common nominees that we see, although they are not the only ones used. It is important to note that when you see fund managers like Australian Ethical become substantial shareholders, it is that fund manager buying directly. Even though they are using clients’ money to try and grow it, it is that fundie buying the stock in its own right as opposed to buying as a nominee

Why are nominee shareholders used?

The primary reason to use this system is the privacy it offers to the actual investors. By having a nominee’s name on all public documents, the true owners can keep their involvement in the company confidential. This is particularly beneficial for individuals who wish to keep their business dealings private or protect their identity from public disclosure. Handling shares through a nominee can also simplify the administrative process. Since the nominee is the registered owner of the shares, all corporate communications, dividends, and formal notices are directed to them. The nominee then passes these on to the beneficial owner as per their agreement, streamlining paperwork and reducing administrative burdens on the actual shareholders.

Furthermore, transferring ownership via nominee arrangements can be faster and more discreet compared to traditional methods. Since the legal documentation does not need to be altered in the public register, shares can be transferred between beneficial owners without public record, which can expedite the process. This particularly rings true in relation to for foreign investors who might face restrictions or prefer not to directly appear as shareholders due to legal complexities or strategic reasons. Nominees can hold these shares locally, complying with jurisdictional requirements and facilitating investment.

Of course, there are disadvantages too including costs, potentially reduced control as well as the risk of misuse or fraud. For those who use nominee shareholders, these potential risks and disadvantages outweigh the flip side – where ASX investors know you are the investor in the stock. Granted, journalists can sometimes find out the true identity of nominee shareholders and reveal it, and sometimes it might be blatantly obvious – such as where a shareholder who owns a 40% stake in a company transfers the stake to a nominee and any moves made there are too obvious to attribute to smaller shareholders.

Conclusion

Don’t get over excited when you see a substantial shareholder lodged by JP Morgan, because it isn’t that bank buying your stock. It is the bank buying on behalf of someone else. This is essentially how the system of nominee shareholding works. It is designed to ‘maintain the veil’ with respect to who the actual investor is.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…