What is a dividend reinvestment plan and should you entertain participating in it?

In this article we look at what Dividend reinvestment plans are, why directors participate in them and whether or not you should too.

Dividend reinvestment plans

Dividend reinvestment plans (DRPs or DRIPs) are a popular way for listed companies to reward shareholders by allowing them to reinvest their dividends directly into a company’s stock or other investment opportunities. This type of plan can provide investors with many benefits, such as lower transaction costs, increased diversification, and the potential for higher returns. Dividend reinvestment plans also allow companies to retain more of their profits and use them to further strengthen their balance sheets.

Additionally, reinvesting dividends rather than taking them as cash allows companies to increase their ownership in the business, which may lead to increased market share and higher valuations. This is beneficial for both the company and its investors alike, as it helps ensure that shareholders have an ongoing stake in the business’ success while also providing an opportunity for long-term growth.

Finally, dividend reinvestment plans may help encourage long-term investments in a company’s stock due to the compounding effect of using dividends to purchase new shares over time.

Why directors participate in them?

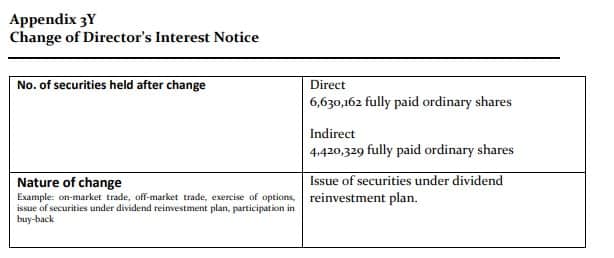

You may see your company’s directors participating in them. You’ll see a ‘Change in Directors Interest’ notice that has to be lodged within 5 business days of the trade and you can decipher whether it is a DPR or another trade under the ‘Nature of change’ box. The company is required to specify the type of directors trade or change in interest.

Sample ASX Change of Directors Interest notice where investors can see that a director trade is a DRP

Is this a sign of confidence in the company? The short answer is yes but we don’t think you should give as much weight to it as a large (>$100k) on-market trade because it isn’t their own money they are putting into the company. It is not the same as investing one’s personal savings into buying new shares versus just using the cash you would have gotten to keep anyway.

Nonetheless, directors still have a case that they are expressing confidence in the company because it is money they couldn’t just taken but think they can gain more by investing it into the company. And that is why they participate in them.

Should I invest in a DRP myself?

It depends on whether or not you are an income or a growth investor. If you are a growth investor, you should definitely participate in a DPR if your company offers one. A DRP is an efficient and cost effective way to build wealth over time.

By reinvesting dividends back into the same stock, you are taking advantage of compounding returns, which can greatly increase your investment over time. Additionally, many companies offer discounted commissions on purchases made through their DRPs or even waive them completely. This makes it a great option for those who are looking to invest small amounts of money at regular intervals. Finally, many companies also allow shareholders to purchase additional shares of stock through their DRPs at a discount or with no fees attached.

Nonetheless, you will be missing out on the dividend. If you are an income investor, the amount you’ll be getting is may worth more to you than potential stock growth over time, and then you probably shouldn’t. Yes, the stock market is risky, but it is a good sign for the company’s health if it is able to pay dividends. Ultimately, the decision is up to you as an individual investor.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

WiseTech Global (ASX:WTC) CEO Buys $1m of Shares, Here’s What It Signals

WiseTech $1m Insider Buy, The Synergy Curve Is the Thesis WiseTech Global (ASX: WTC) has just given investors a simple…

Block (NYSE:SQ) Up 28% as a 40% Headcount Cut Rewrites the Earnings Outlook

Jack Dorsey Goes Lean, The Market Pays Up Block shares surged 28% following the announcement that the company intends to…

AML3D (ASX:AL3): Order Book at $16.5m, The Growth Runway Stays Intact

A $150m to $200m Navy Opportunity, But Execution Comes First AML3D has reported its interim half-year results, and while revenue…