Why did uranium prices drop for over 10 years post-GFC? And are thing back on track now?

![]() Nick Sundich, October 12, 2023

Nick Sundich, October 12, 2023

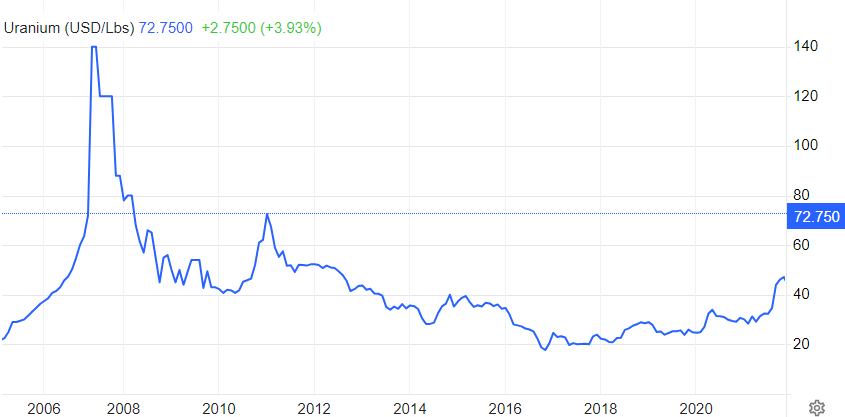

Why did uranium prices drop for the best part of a decade and a half until now? It was a long, painful period for investors as uranium prices collapsed from over US$120/lb after peaking in 2007 and lulled in the doldrums for years.

But why did it stay down for so long and is the uranium market out of the woods for good?

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Why did uranium prices drop?

It was because of three key events. Two were the GFC and Fukashima and these happened last. But the third was the end of a frenzied bull market that saw prices skyrocket from around US$10/lb to US$140/lb.

It was part of a run in commodities generally but there were also factors specific to the market. These included interest in nuclear power by Western governments after the insecure nature of Russian and Middle Eastern oil became apparent once more and the 2006 flooding of the Cigar Lake Mine in Saskatchewan.

Anyone who remembers this time would recall that Paladin Energy went from 1.3c to touch a high of $9.46. Bannerman Energy was the best performing stock on the ASX in 2006.

The GFC put an end to the commodities bull market generally. And Fukashima terrified the world against any form of nuclear power. The tragedy with prices remaining so low is that many good projects held by ASX companies had to be mothballed. Many remain so to this day or are just being bought into production now.

The uranium spot price (Source: Trading Economics)

So why does uranium look good now?

Simply put, investors are waking up to the benefits once again. Uranium is one of the few commodities with a decarbonisation angle. And keep in mind that it can be used for non-nuclear power purposes medical research and other industrial processes. And just as was the case in the mid 2000s bull market, countries are once again keen for either their own energy sources or those from geopolitically stable countries.

Most importantly though, demand is not keeping up with supply. Keep in mind that uranium prices are still below all time highs so there could be some growth to come.

What are the best stocks for investors to capitalise on this trend?

We think the best companies are those that are restarting mothballed projects. Yes, there are other companies exploring for new deposits but we think the developers are a safer bet. And there is far more upside uranium developers have compared to developers other commodities that haven’t had such long bear markets and had to halt production for so long.

We’ve previously outlined our 3 favourite uranium stocks: Boss Energy (ASX:BOE), Peninsula Energy (ASX:PEN) and Paladin Energy (ASX:PDN). And these are in order from first to third, the best developers. These have all good projects, but we’ve been spooked by Paladin being in Namibia and the threat of government intervention of some kind in that market.

Peninsula has little sovereign risk, being in the American state of Wyoming, although it is slightly behind Boss Energy in undergoing final construction works necessary before production starts again.

Boss Energy is our favourite, with its Honeymoon project in South Australia. The deposit has a JORC Resource of 71.6Mlb at an average grade of 620ppm. It is anticipated that the mine can last for 11 years, produce 21.81Mlb, with an IRR of 47.1% and a pre-tax NPV of A$412m (using a US$60/lb spot price and an 8% discount rate). And production will begin before the end of this year.

Uranium is a good opportunity for investors

Even in spite of the rally in yellowcake stocks, there is more growth potential to come. This is because there’s still upside in the uranium spot price and many companies are yet to hit the restart button on their projects.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…