‘Never buy an airline’: Who said this and does it still hold in the post-COVID-19 travel boom?

![]() Nick Sundich, March 15, 2024

Nick Sundich, March 15, 2024

Never buy an airline – you’ve probably heard this saying before. Just why is this said and is it still true amidst high industry demand?

Why should you never buy an airline?

It’s a common saying that you should “never buy an airline” because of the high costs and risks associated with running such a business.

Airlines must constantly compete for customers, and there is constant pressure from ever-changing fuel costs, labour costs, maintenance costs, customer service expectations, government regulations and other economic factors.

The airline industry is also highly cyclical in nature as demand for air travel fluctuates significantly with the state of the economy. All of these factors combine to make successful airline operations difficult to maintain.

Even amidst record demand?

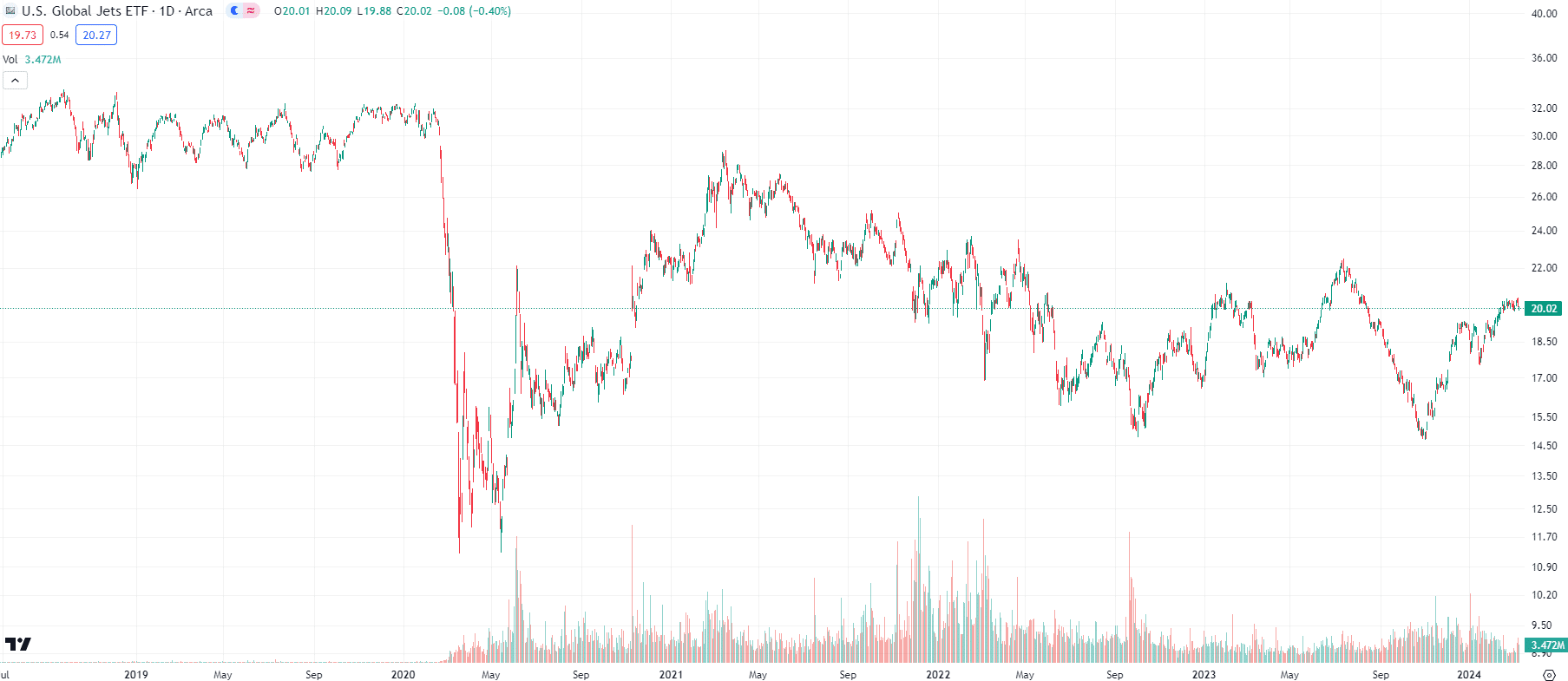

Just look at the fact that the most famous airline ETF – the JETS ETF – is still down from pre-COVID levels.

US Global Jets ETF (NYSE:JETS) share price chart, log scale (Source: TradingView)

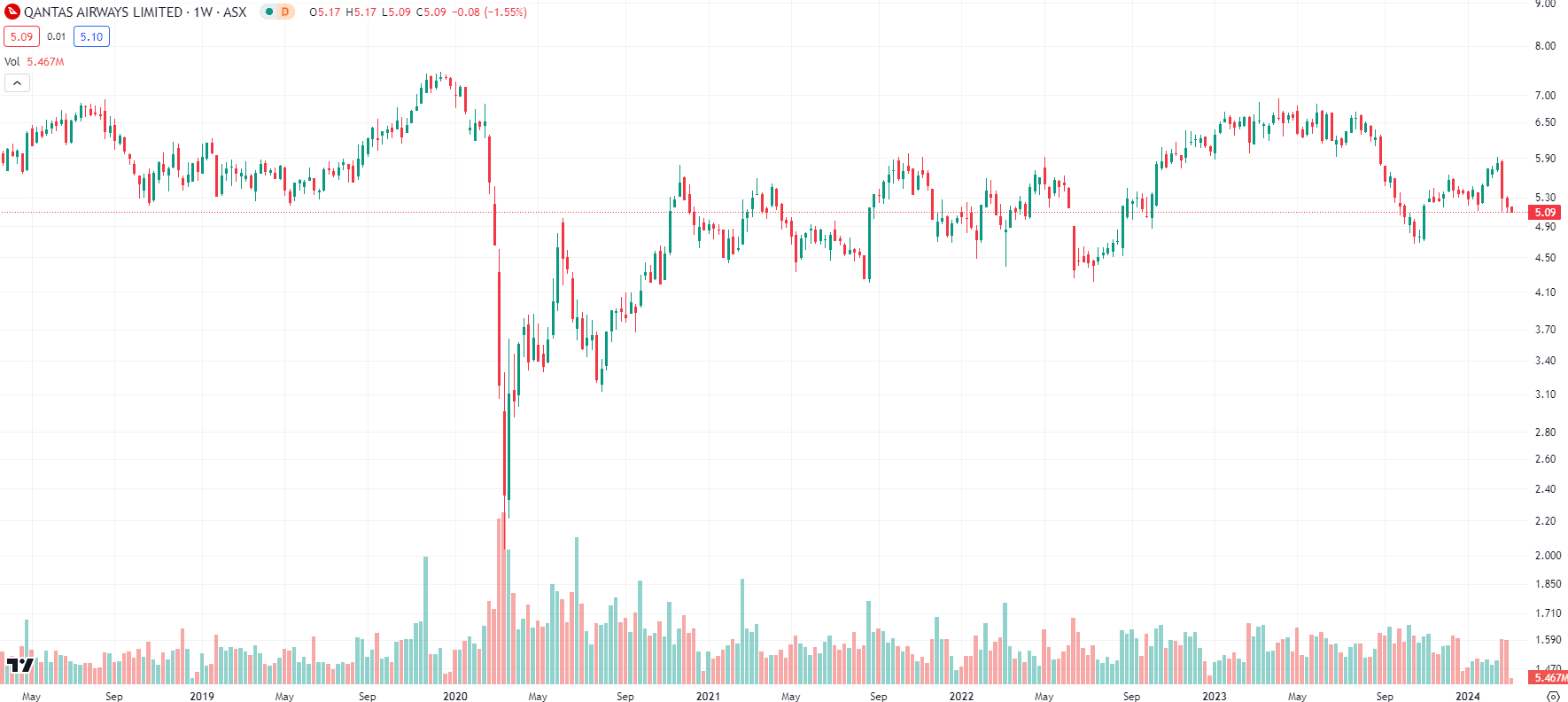

Ditto, Australia’s flag carrier Qantas (ASX:QAN).

Qantas share price chart, log scale (Source: TradingView)

What about the high demand

But hang on, isn’t this an argument to buy into this industry now because of high demand? No. We think that if Qantas couldn’t reach its pre-COVID levels by now (early 2024), it is unlikely to in the next few years as inflation bites and as it pays for its fleet renewal.

UBS estimated it will have to pay $12bn over the next 5 years – nearly 3 times its projected FY23 EBITDA. And this is just for the confirmed orders it already has, which may not be enough to refresh its entire fleet. We think it could be way higher. We estimated last year it would cost A$25.7bn all up, assuming all existing orders were fulfilled and options were exercised. This is 130% of Qantas’ FY23 revenue as well as 11x its statutory profit and 10x its FY23 cash balance. And of course, its 1HY24 bottom line results were ~10% lower than in 1HY23 (the EBITDA, EBIT and profit lines).

It is more difficult to undertake capital raisings given the Qantas Sale Act requires the majority of it to be Australian owned. Also consider that Virgin Australia has opted to wait for equity market conditions to list. If it was certain to rise just because of travel demand, why not list by now?

Just look at Warren Buffett

Even the most famous investor of all time makes mistakes and he has done so. Notwithstanding long scepticism after he made a big loss on US Airways shares in 1989, Buffet bought shares in several US airlines in 2016, reaching nearly 10% in a couple of them.

Why the (brief) change of heart? Some speculate it was the industry consolidation that occurred over the first half of the 2010s because he previously stated that intense competition was a reason to stay away. But he exited his positions in early April 2020, no doubt at significant losses.

Of course had he held he would have made some of his money back. Yet when push came to shove, he was not certain the airlines would be bailed out and that business travel would return to pre-COVID levels – indeed, it still hasn’t now.

Never buy an airline – if you’re a long-term investor

Let’s go back to 2007 to find Buffett’s best quote on airlines. ‘The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, then earns little or no money,’ he said at the time.

Inevitably, some have made money from day trading airlines in the aftermath of the pandemic.

But there is a fine line between day traders and investors, and far more difficult for the latter to make money from airlines in light of all the reasons listed in this article.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…