Here are 5 reasons why Woolworths shares aren’t as great an investment as you might think

![]() Nick Sundich, April 16, 2024

Nick Sundich, April 16, 2024

Woolworths shares may at first glance appear to be one of the most risk-free investments on the ASX. It has a duopoly with Coles, makes multi-billion profits, and is a reliant dividend payer. Few other businesses were allowed to continue to operate with little to no disruption other than mandated PPE during COVID-19 lockdowns. But…that doesn’t mean Woolworths shares are a buy right now. The regulatory scrutiny that it an Coles are facing is just one of several reasons why investors should tread with caution.

Who is Woolworths?

Woolworths is one of Australia’s big Two supermarkets, owning the grocery stores under its own name, as well as the Big W discount retail stores. The first Woolworths store opened in December 1924 in Sydney’s Imperial Arcade. It was an innovator in many ways: in embracing radio advertising, offering a retirement pension to its employees, offering self-service stores and a Quality Assurance Laboratory for its products. Its former forays include a period of owning Dick Smith as well as into alcohol – the latter came to an end in 2021 when it spun out Endeavour Group (ASX:EDV). The company has been listed since 1993 and was at the time the largest ever share float.

5 reasons why Woolworths shares aren’t a buy right now

1. Potential regulation

Now, we are only speculating here. Nonetheless, the facts are that an independent inquiry mandated by the government has recommended supermarkets and suppliers abide by a mandatory code of conduct, breaches of which could lead to penalties of up to $5.2bn. Specifically, it would be up to 10% of annual turnover, 3 times the benefit gained or $10m – whichever was greater. For Woolworths, it would be $5.2bn, given its $50.2bn annual turnover.

As we’ve seen with the banks (just look at Westpac during 2020), any major penalty from regulatory against illegal conduct can turn any growth story into an ‘avoid like the plague’ story. And why can it be big? Not just because the company is big, but so often these issues bubble under the surface, unaddressed for several months.

You could argue Woolworths would only substantially be hit in the event it fell afoul of the law, and they would likely beef up its in-house legal teams to avoid it. However, if it involves addressing grocery prices, this may impact margins even further.

2. Low margins

Notwithstanding that Woolworths (and indeed Coles) has made a profit of over $1bn in FY23, it is a low-margin company, recording little over 3%. This means shareholders will receive less of a dividend pay out than otherwise would be the case as well as a greater risk of falling into a loss if revenue growth were to slow or go into decline.

Consensus estimates expect little improvement to margins over the next decade, even though revenue are expected to grow nearly 50%.

3. Intense competition

Yes, Woolworths and Coles have an effective duopoly right now so far as grocery stores are concerned.

Nonetheless, it faces increasing competition from online rivals such as Amazon, Temu and Shein, not to mention category killers like Chemist Warehouse, the Reject Shop and Bunnings, some of which are higher margin business. It remains to be seen if any of them would be subject to any regulations proposed for Woolworths and Coles. If not, this would put Woolworths and Coles at a major disadvantage.

4. Slower sales growth

Despite being only 60% of the size of Woolworths by market cap, Coles is seeing faster sales growth with 4.9% growth in the first 2 months of CY24, while Woolworths saw just 1.5%. So, it is clear that Coles is performing better right now and will likely keep doing so in the immediate future.

5. The recent CEO turnover

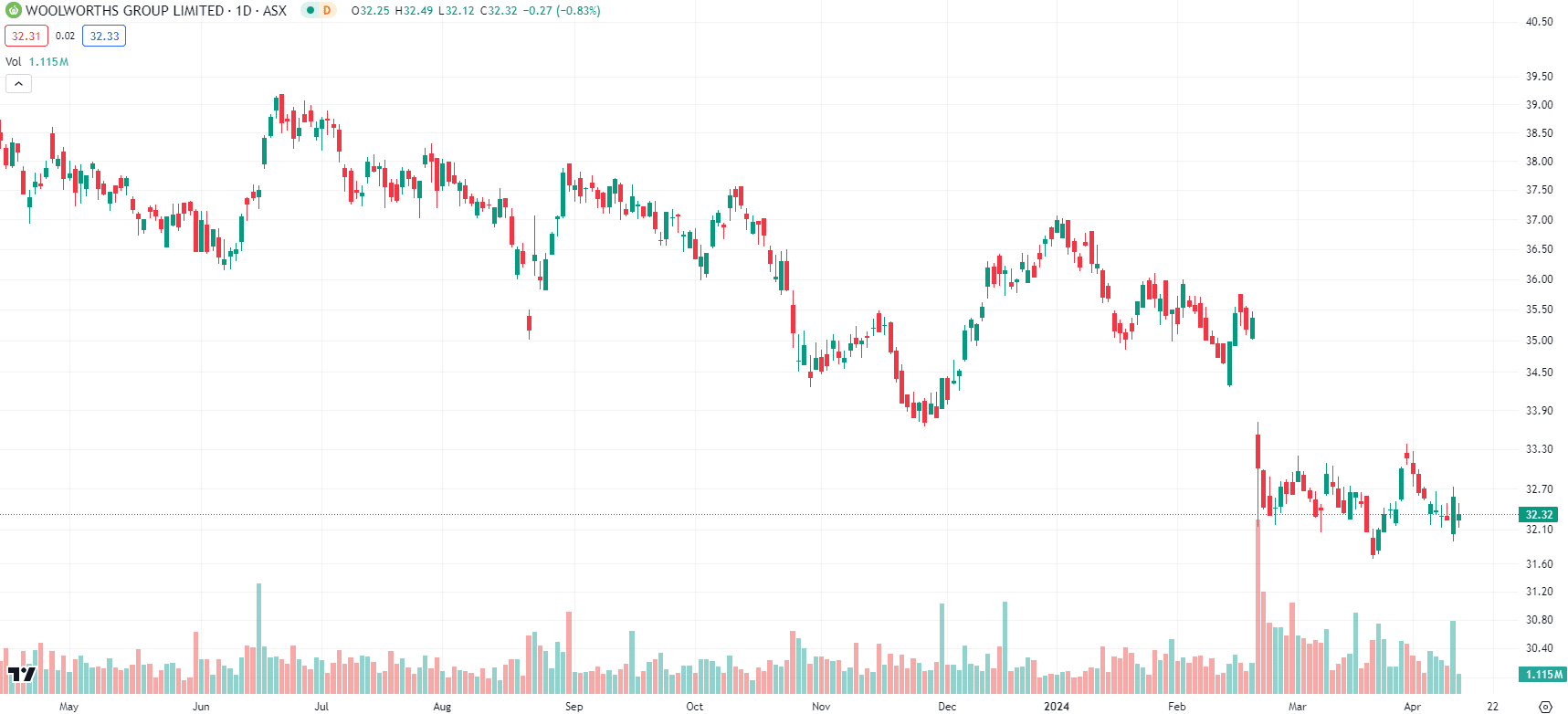

Brad Banducci announced his exit in February after 8 years in the top job. He will be replaced by Amanda Bardwell, the head of loyalty and eCommerce, in September. We won’t comment on the circumstances that led to his departure because we all know what happened. It is natural that whenever a long-serving CEO exits and is replaced, there is always a few months of uncertainty as to where the company will go. Just look at how Woolworths shares fell 8% in the two days that followed the announcement of Banducci’s departure as evidence of that.

Woolworths (ASX:WOW) share price chart, log scale (Source: TradingView)

Conclusion

Back to consensus estimates, drawn from 15 analysts, and their mean share price is $35.46, a premium of barely 10% above the current price. Given all of the above, we don’t think Woolworths shares are a buy right now.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…