How Come Zip Co (ASX: ZIP) is Doing So Well? Isn’t Buy Now, Pay Later Dead and Buried?

![]() Ujjwal Maheshwari, November 15, 2024

Ujjwal Maheshwari, November 15, 2024

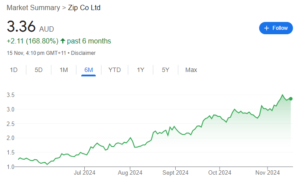

In recent years, Zip Co. has captured attention by defying the odds stacked against the Buy Now, Pay Later (BNPL) industry, which many believed to be declining. Some companies have indeed struggled with fluctuating consumer spending and rising interest rates, however, Zip’s recent performance on the Australian Securities Exchange (ASX) indicates that the company has not only withstood the storm but is thriving.

Before understanding about the company, know about the virtues of BNPL. BNPL, or Buy Now, Pay Later, is a simple way to make purchases without paying the full amount upfront. You can buy something now and pay for it in instalments over a short period. So, why do people believe that this industry is declining? And how is Zip sustaining through this? Let’s explore.

Zip Co: A Brief Overview

Zip Co., a BNPL company, quickly grew and became one of the largest players in the BNPL market in Australia. Like other companies in the sector, Zip allows its consumers to pay for purchases in instalments with no interest, though they incur fees for delayed payments. The company’s stock has been through highs and lows, reflecting both the rapid rise of the BNPL industry and sustaining the market’s volatility at the same time.

Zip operates in multiple countries, including the U.S., Australia and some parts of Europe. Zip has expanded its consumer base which now has millions of active users. The company partnered up with large retailers to offer more refined and broader financial solutions. The company’s revenue reached a great high, reflecting a 28% growth than the previous year. This is a strong rebound for the company and their success is impressive, considering the broader challenges faced by BNPL firms.

What Drives Zip’s Success?

Strategic U.S. Expansion

The U.S. has been a significant growth supporter for Zip. Revenue from the U.S. now accounts for the bulk of Zip’s total revenue. This shows the growing adoption of BNPL in American consumer habits. Many U.S. consumers, particularly younger generations, continue to prefer installment-based payment options as a flexible alternative to traditional credit cards. Due to high transaction volumes and rising merchant partnerships in the U.S., the market showed a whopping number in earnings before tax.

Operational Efficiency

BNPL sector’s profitability is significantly affected by high interest rates. And with that persisting, Zip has zeroed in on improving its cash profit margins. The company has reduced operating costs and successfully optimized its spending, seeing a 243% increase in cash EBITDA than the previous year. This shift allows Zip to balance growth with profitability, a critical challenge as BNPL firms face increased scrutiny over their established business models.

Customer Retention

Zip has prioritized customer engagement as its fundamental objective in its business model. Through this initiative, the company aims to provide a seamless user experience to its consumers. By focusing on and developing easy-to-use platforms with regular feature updates, Zip has created a loyal customer base while attracting new customers. The company has been refining their customer retention strategies and creating exclusive partnerships with retailers that will assist with Zip’s growth and maintain its momentum even as some prominent BNPL players struggle to retain their consumers.

Improved Loan Quality and Reduction in Bad Debt Practices

Zip has a refined credit-checking process to reduce the incidence of bad debts. The company implemented more stringent lending standards for its customers and thereby lowered its bad debt ratio. This is an appealing factor for people, especially in a high-interest-rate environment. This approach initiated by Zip also protects the company from potential losses and builds confidence among investors.

How is Zip Outperforming the Challenges in the BNPL Sector

With various challenges aligning this sector, Zip however has not faced any major scrutiny for its business model. How was achieving this feat significant?

Regulatory Compliance

BNPL has faced increasing challenges in following the regulations, particularly in markets like the U.K. and Australia. As regulators seek to protect consumers from overborrowing, BNPL companies are required to comply with new regulations highlighting transparency and efficient risk management. By establishing itself as a responsible BNPL provider, Zip is less volatile to potential disruptions from regulatory changes compared to some of the other players in the sector.

Rising Interest Rates

One of the most significant challenges for the BNPL sector is the rising cost of borrowing, as high interest rates offset profitability. However, Zip’s ability to remain profitable in this environment is due to its careful cost management structure, lower bad debt practices, and high transaction volumes from its loyal customer base. While interest rates remain a concern, Zip has shown resilience in its performance and it has further adapted efficient operations to mitigate the impact of borrowing costs.

The BNPL Industry: Is it Dead or Evolving?

BNPL was once hailed as a revolutionary alternative to credit cards. But as the sector grew in recent years, people argued that rising interest rates and new regulations will start to threaten its viability and reliability. However, market data shows that BNPL is far from dead; rather, it is evolving. Industry research suggests that BNPL transactions will grow globally over the next five years, driven by demand in markets like the U.S., the U.K., and Australia. A great instance of this is the global BNPL transactions around the world totalled nearly $157 billion. Here’s the icing on the cake, the BNPL market is expected to grow at a CAGR of 30%.

Financial Highlights and Opportunities for Zip

Diversification of Zip and its Product Offerings

Zip’s expansion to other services beyond BNPL has created a strong impact for the company. Its other services include offerings like digital wallets and rewards programs, which enhance its appeal to a broader audience. By diversifying its product line, the company aims to capture additional revenue streams and thereby reduce its current reliance on BNPL alone. These initiatives not only attract new customers but also increase consumer engagement among existing users.

Financial Feat of Zip

The company showed AUD 868 million in revenue alone for the financial year of 2024. This is a solid increase of 28% from the previous year. The company also achieved a high transaction volume of about AUD 10.1 billion. Again, this is a 14% increase from the numbers reported last year. Zip’s EBITDA growth was reported at a 243% increase in cash EBITDA and with a strong base in the U.S., the company’s U.S. earnings growth was significantly higher than the last financial year.

Capturing Emerging Markets

Zip’s global expansion strategy includes potential entry into emerging markets where BNPL is widely adopted. As more consumers in regions like Southeast Asia and Latin America adopt digital payment methods, Zip can leverage its industrial expertise to establish a huge presence in these high-growth areas. These emerging markets present a significant opportunity for Zip as it seeks to capture new industries and diversify its geographical footprint.

What Lies Ahead for Zip Co.?

Zip’s success has opened up further growth prospects. However, the company remains exposed to certain risks. Changes in consumer spending behaviour concerning current financial conditions and economic hurdles could impact Zip’s performance in the long run.

New regulations framed to protect the consumers may impose further compliance requirements from Zip, thus impacting the company’s profit margins. A few credit card companies and banks have introduced their instalment-based payment methods, Zip may face competition from traditional players as well trying to enter the BNPL space.3

Conclusion: Should You Go For Zip Co.?

Zip has indeed defied expectations by posting strong results in 2024, and its future outlook appears optimistic now. However, investors should weigh the risks alongside the growth potential of the company to make informed investment decisions. The BNPL sector is indeed evolving and Zip has demonstrated resilience and adaptability in its approach to challenges. If you believe in growth and strong persistence through hard times, Zip is a great investment in the long run.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Cettire shares are down over 90% from their all time high as investors follow the leader in selling shares

It hasn’t been a good 14 months for Cettire shares. For a long time after the pandemic, eCommerce was one…

How will stocks be impacted by tariffs? Here are 6 victims on the ASX and how they’re responding

How will stocks be impacted by tariffs? Its a long story, but few stocks can say that there’ll be no…

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…