ASX Gambling Stocks: How the Australian Market Works

The Australian Securities Exchange (ASX) has become one of the most active and diverse financial marketplaces in the Asia-Pacific region, and among its many listed sectors, gambling-related companies occupy a unique and influential position.

These firms range from global gaming-technology providers to sports-betting operators and payment-service companies. Understanding how gambling stocks work on the ASX requires a clear view of market structure, regulation, company categories, and the factors that influence price movements.

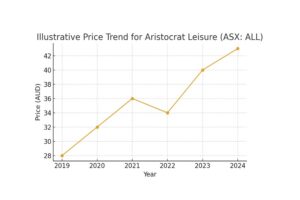

One of the most widely recognised gambling-sector giants on the ASX is Aristocrat Leisure (ASX:ALL). As a global manufacturer of slot machines, digital casino platforms, and online games, it is often used by analysts as a benchmark for the broader performance of gambling-related equities.

The chart above illustrates an example of a multi-year price trend to help visualise how such companies may behave over time. While the figures shown are hypothetical, they demonstrate how long-term growth cycles can appear on an ASX-listed stock.

What are the Best Gaming stocks to invest in right now?

Check our buy/sell tips

How the ASX Market Structure Shapes Gambling Stocks

The ASX operates as a modern, fully electronic exchange where companies must meet strict governance, transparency, and reporting standards. All ASX-listed gambling-related firms follow the same regulatory and disclosure rules as companies in any other sector.

They are required to publish annual and quarterly reports, update stakeholders on major operational shifts, and comply with financial auditing requirements.

However, gambling stocks operate under an additional regulatory layer due to the nature of their business. The primary body governing gambling activity in Australia is the Australian Communications and Media Authority (ACMA), which oversees online gambling compliance, advertising rules, anti-money-laundering obligations, and consumer-protection frameworks.

ACMA’s enforcement actions can significantly influence stock behaviour; for example, when the regulator issues penalties, blocks unlicensed operators, or tightens rules, market volatility often increases.

Despite strict regulation, the gambling industry remains one of the most resilient entertainment sectors in Australia. Consumer demand for wagering, casino games, and fantasy sports persists even during broader market fluctuations.

This demand is partially driven by behavioural patterns where jackpots tend to appear more often in digital promotional ecosystems, leading to bursts of engagement that can strengthen quarterly revenue numbers.

Types of Gambling-Related Companies on the ASX

The ASX hosts multiple categories of gambling-linked businesses:

Gaming Technology Manufacturers

Companies like Aristocrat lead this category, producing slot machines, iGaming platforms, digital casino ecosystems, and mobile gaming content.

Sports Betting and Wagering

Australia has one of the highest levels of sports-betting participation per capita worldwide. Several well-known operators include PlayUp, Betr, and fantasy-sports platforms such as Draftstars. These brands may not all be publicly listed, but they play a major role in shaping market expectations for sports-wagering stocks.

Support and Infrastructure Providers

Payment processors, digital-wallet services, and prepaid solutions are essential for the industry. Companies and services such as Skrill, Neteller, Paysafecard, and Entropay support transaction flows for both domestic and international wagering ecosystems.

Casual, Social, and Interactive Gaming

Some firms operate in adjacent segments, such as social casino platforms or fantasy gaming applications. Picklebe, for instance, represents the type of innovative start-up contributing to diversification within the broader interactive-gaming landscape.

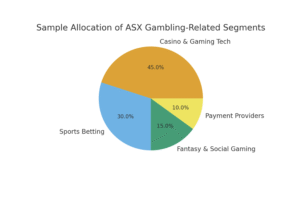

The second chart above shows an illustrative breakdown of how the ASX gambling sector could be segmented—again using hypothetical data for educational purposes.

This visual model highlights that casino and gaming-technology companies tend to dominate the market share, with sports betting close behind.

What Drives the Performance of ASX Gambling Stocks?

Several factors influence how gambling stocks behave on the ASX:

Regulatory Actions

Announcements from ACMA or changes in state-level licensing laws can immediately impact investor sentiment. Stricter rules may temporarily depress stock prices, while regulatory clarity can restore confidence.

Consumer Behaviour and Seasonal Trends

Sports calendars, major tournaments, holiday periods, and online-gaming seasonality all affect company earnings. Sports-betting operators typically see spikes during events like AFL and NRL finals.

Technology and Product Innovation

New platform launches, data-driven odds models, casino-game releases, or mobile-app enhancements often support revenue growth. Gaming-technology companies depend heavily on steady R&D output.

Global Economic Conditions

Consumer discretionary spending shifts with inflation, interest-rate movements, and economic sentiment. Since gambling is often treated as entertainment, it may remain stable even during mild downturns.

International Expansion

Companies with exposure outside Australia—such as Aristocrat, which operates globally—may be influenced by foreign regulations, currency movements, and competition in offshore markets.

Why Investors Study This Sector (Without Recommending Any Stock)

Although gambling stocks attract interest due to their strong revenue streams and highly digital business models, analysing them does not imply that anyone should buy or sell a specific company. Instead, understanding how the market functions provides useful context for evaluating industry stability, regulatory safety, and technological development.

Gambling-related stocks illustrate:

- how regulation shapes entire sectors

- how digital entertainment evolves

- how transaction infrastructure supports online ecosystems

- how Australia’s consumer behaviour influences modern markets

This sector is an excellent example of the interplay between technology, policy, and cultural trends.

Conclusion

The ASX gambling-stocks segment is one of the most dynamic parts of the Australian market. With companies ranging from global gaming-technology providers to local sports-betting platforms and digital-payment services, the industry shows a diverse ecosystem shaped strongly by regulation and innovation.

While the example charts above help visualise long-term price behaviour and industry segmentation, they serve an educational purpose—not investment advice.

Understanding how the ASX works, how ACMA regulates operators, and how consumer trends evolve provides valuable insight into one of Australia’s most highly scrutinised and technologically driven sectors.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Fortuna Metals (ASX:FUN) Mkanda Delivers High Grade Rutile Zones, 485 Holes Still to Come

First Drilling Hits Kasiya Style Rutile Fortuna Metals is a small ASX-listed miner with exposure to the Mkanda and Kampini…

Telix (ASX:TLX) Green Light to Move Into the Pivotal Phase 3 Study

TLX591-Tx Hits Safety Goals, US Enrollment Now in Sight Telix is developing a new type of cancer treatment for advanced…

What does the 2026 health insurance premium rise mean for ASX health insurance stocks?

The 2026 health insurance premium rise is in, and it is 4.41%. It made headlines because it is ahead of…