Has Lithium Bottomed? 3 ASX Stocks That Could Power Your Portfolio in 2025

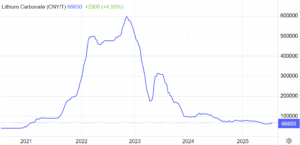

Lithium stocks…have they bottomed? After a brutal sell-off that erased billions in market value, lithium prices may finally be showing signs of life. Investors have watched the commodity collapse from record highs in 2022 to levels not seen since early 2021. But lately, there’s a growing sense that the worst may be behind us. The question is no longer “how low can it go?” but rather “is now the time to start positioning for a rebound?”

With electric vehicle (EV) adoption still on the rise globally and mine closures helping to curb oversupply, several ASX-listed lithium producers are beginning to look interesting again. In our view, this could be the calm before a rally—a strategic window for savvy investors.

What the latest price trends and forecasts really mean for investors

Lithium carbonate prices have dropped sharply from their 2022 highs, with Chinese spot prices hovering around US$9,000/t in July 2025—a far cry from the +US$80,000/t seen at the peak. Spodumene concentrate, the primary feedstock for lithium hydroxide and carbonate, has also tumbled, trading in the US$600–660/t range.

Yet, not all signs are bleak. Recent pricing data from Trading Economics shows a mild uptick to 64,950 CNY/t (~US$8,900), indicating a potential floor. Morningstar has forecast lithium to recover toward US$15,000/t mid-cycle, assuming unprofitable supply phases out. Fastmarkets agrees, projecting a more balanced supply-demand dynamic through 2025.

Source: Trading Economics

Oversupply, pricing pressure, and what’s dragging the market down

The downturn hasn’t come out of nowhere. Global lithium production has surged between 2020 and 2024, driven by a rush to meet anticipated EV demand. However, when EV growth slowed—particularly in China and Europe—producers faced a flood of excess supply.

As a result, lithium inventories have piled up, and prices have undergone a steep correction. According to Benchmark Mineral Intelligence, around 58% of Australian hard-rock lithium producers are now operating below their break-even cost of US$800/t. This means more than half the industry is underwater at current prices.

Meanwhile, South American brine producers—especially in Chile and Argentina—have continued operations with lower-cost bases, taking market share from their hard-rock counterparts. These brine operations often break even below US$400/t, giving them a clear edge in a depressed pricing environment.

Investor sentiment has also been shaky, largely due to policy uncertainty. China’s frequent changes to EV subsidies and consumer incentives have created inconsistent demand signals. Each time subsidies expire or shift, EV sales in China—a key market—take a hit, sending ripples through lithium pricing.

With all these dynamics in play, the market has entered a corrective phase. Some Australian producers have responded by scaling back output or placing operations on hold. While painful, this rationalisation is beginning to rebalance the market.

The signals suggesting we’re close to a bottom—or already there

Despite the headwinds, there are encouraging signs that lithium may be carving out a bottom. Several major mine closures in 2024 have already tightened the supply side. Companies unable to operate profitably at current prices have either paused operations or deferred expansion plans.

Analysts forecast the global lithium surplus shrinking significantly—from an estimated 150,000 tonnes in 2024 to around 80,000 tonnes in 2025. That’s a meaningful drop and brings the market closer to a sustainable balance.

At the same time, EV demand—while slower than originally forecast—remains structurally strong. China, the European Union, and the United States are all pushing battery-powered vehicles through aggressive climate targets and incentives. As battery manufacturing scales up, lithium demand is expected to rebound steadily.

If history is any guide, equity markets often move ahead of the commodity. In previous cycles, lithium stocks have staged strong rallies 6 to 12 months before the physical market fully recovers. That pattern could well repeat—especially as institutional investors begin re-entering the space in anticipation of a turnaround.

These three lithium miners are best placed for a rebound

Amid the wreckage, a few names stand out. Each has a unique combination of asset quality, financial resilience, and strategic positioning that could make them winners as lithium stabilises.

Pilbara Minerals (ASX: PLS)

Pilbara Minerals (ASX: PLS) is arguably the ASX’s lithium heavyweight. Its flagship Pilgangoora project is one of the largest hard-rock lithium operations in the world. Despite price weakness, the company has focused on improving efficiency through ore sorting technology and downstream integration.

Pilbara is well-funded, with over A$1 billion in cash. It is developing a lithium hydroxide plant in South Korea via a JV with POSCO, giving it exposure to higher-margin chemicals.

With production costs trending towards A$578/t and an expanding global footprint, Pilbara appears well-placed to ride out the storm and benefit handsomely when lithium turns.

More importantly, Pilbara is a low-cost producer with long mine life and scale advantages. The company continues to attract global buyers and institutional backing. Brokers such as Macquarie and Citi have noted its ability to generate positive EBITDA even at current spodumene prices, making it one of the most resilient operators in the space.

And while some miners are cutting costs and halting expansion, Pilbara is doing the opposite: building out infrastructure, future-proofing operations, and setting itself up for when demand comes roaring back.

Liontown Resources (ASX: LTR)

Liontown Resources (ASX: LTR) has moved into production at its highly anticipated Kathleen Valley project. Despite the tough pricing environment, Liontown is generating revenue and operating cash flow while keeping costs under control. It ended Q1 FY25 with A$173 million in cash and posted A$14 million in positive operating cash flow.

The company’s resilience is partly due to strong strategic partnerships, including supply agreements with LG Energy and financial support from Hancock Prospecting. It is one of the few new entrants not cutting production in response to the downturn.

What sets Liontown apart is its careful ramp-up strategy and commitment to capital discipline. Rather than chasing expansion for the sake of scale, the company has focused on operational excellence and protecting margins. This approach could help it emerge stronger once market conditions improve.

Liontown has also been relatively shielded from the worst of the lithium price crash thanks to fixed-price offtake agreements in its first year of operation. As these contracts roll off, the company will need higher spot prices to maintain profitability—but its low cost base and strong backers put it in a good position to weather the challenge.

Core Lithium (ASX: CXO)

Core Lithium (ASX: CXO) operates the Finniss project in the Northern Territory. Although it paused production in 2024 due to low prices, the mine remains on standby and could ramp up quickly if market conditions improve.

What makes Core intriguing is its offtake deal with Tesla, offering long-term demand certainty. It also provides geographic diversification away from Western Australia’s heavily saturated market.

While Core lacks the scale of Pilbara or Liontown, it offers high torque to a lithium rebound. When prices rise, companies like Core may see disproportionately large share price gains due to their operating leverage and the market’s hunger for growth stories.

Core Lithium has also been active on the exploration front. The company is advancing additional deposits in the NT and evaluating future development scenarios. This optionality could drive long-term value as market conditions improve.

Moreover, its commitment to ESG practices and First Nations engagement gives Core a social licence to operate—an increasingly critical factor in today’s investing landscape. For investors willing to take on a bit more risk for potentially larger rewards, Core remains one of the most attractive junior lithium plays on the ASX.

Timing your entry: cautious optimism or wait-and-see?

While lithium itself may not surge overnight, equity markets often move ahead of the commodity. Historically, stocks begin to recover 6–12 months before the underlying prices show meaningful improvement. That dynamic may already be playing out in 2025, with a few lithium stocks stabilising or even trending slightly upward.

In our view, the worst may be over and sentiment is slowly improving. Institutional buyers are beginning to re-enter the space, and analysts are revising their price forecasts upward. However, the road to recovery is unlikely to be smooth.

Caution is still warranted. Prices remain near breakeven levels for many miners, and if demand weakens or oversupply returns, more companies could be forced into care and maintenance.

That’s why a staggered approach makes sense. Investors should consider scaling into positions gradually, focusing on financially secure operators with the flexibility to withstand further volatility. Look for signs of strength, such as rising spodumene prices, improved quarterly earnings, and sustained cash reserves.

How to play the lithium rebound without losing sleep

To navigate the current market with confidence, investors should:

- Monitor spodumene prices closely – a sustained move above US$850/t would signal a firmer price floor and stronger margin environment.

- Prioritise miners with strong balance sheets – cash-rich companies, like Pilbara and Liontown are less vulnerable to price shocks.

- Diversify exposure – blend large-cap stability (PLS), mid-cap growth (LTR) and high-upside speculative names (CXO).

- Track global EV trends – changes in battery adoption rates, policy incentives and automaker forecasts all influence lithium demand.

This approach allows investors to participate in the upside while managing downside risk—a smart way to ride the lithium recovery without the stress.

A strategic window for early movers or another bear trap?

We believe the market is in the early stages of recovery. The lithium oversupply narrative is beginning to fade, while the broader energy transition remains intact and well supported by global policy.

Stocks have already priced in a tremendous amount of negativity. History shows that once sentiment turns, rebounds can be fast and substantial. That makes this period a strategic entry point for patient investors.

Pilbara Minerals offers the best combination of scale, cost discipline, and downstream optionality. Liontown is a compelling mid-tier producer with strong partnerships already in place. Core Lithium, while speculative, provides credible upside potential for those willing to accept higher risk.

In our view, this isn’t the time for maximum caution—it’s the time for careful optimism.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

FAQs

- Is lithium demand still strong?

Yes. Despite short-term disruptions, global EV and battery storage demand is forecast to grow 15–20% annually through 2030, supported by aggressive decarbonisation targets.

- What is the break-even price for Australian miners?

Most Australian hard-rock miners need lithium prices around US$800/t to break even. Some low-cost operators can survive below that level, but many remain under pressure.

- Are lithium stocks undervalued?

In our view, yes. Many lithium stocks are trading near multi-year lows despite having solid balance sheets and long-term offtake agreements in place.

- What’s the biggest risk now?

A further drop in prices or prolonged weakness in EV sales could force more mine closures and delay the broader rebound.

- Should I invest now or wait?

If you’re investing for the long term, gradually accumulating during this stabilisation phase could lead to attractive returns as the cycle turns.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…