Australia’s Data Centre Boom Is Pushing Your Energy Bills Higher

AI, Data Centres and the Rising Cost of Power in Australia

Over the past four years, the global data boom has become impossible to ignore, particularly the rapid buildout of data centres. These facilities are effectively giant commercial warehouses filled with high density GPU infrastructure, and they consume far more electricity than traditional commercial buildings.

In Australia, operators such as NextDC, AirTrunk and Macquarie Data Centres are now meaningful electricity users in their own right. This matters because rising power prices have been a key contributor to recent cost of living and inflation concerns, and data centres sit directly in that equation.

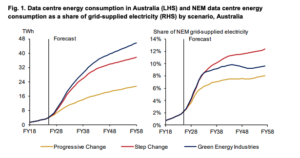

According to AEMO, data centres across Australia consumed an estimated 3.9 TWh of electricity in FY25. To put that into context, the average data centre uses enough power each year to supply around 3,600 households, and that figure reflects smaller scale facilities rather than the newest hyperscale builds.

As more capacity comes online to support cloud computing, AI workloads and enterprise data demand, electricity consumption from this sector is only moving one way.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Data Centres Are Becoming a Major Force

The Australian Energy Regulator has noted that, over time and through periods of volatility, retail household electricity prices have remained under sustained pressure. This reflects a combination of factors, including network costs, wholesale electricity prices and retail margins.

While data centres currently account for only around 2% of total grid demand, that headline figure understates the pace of change.

Electricity consumption from data centres is growing at an estimated compound rate of around 25% per year, with projections suggesting the sector could represent closer to 6% of total demand by 2030.

This naturally raises the question many of us are asking: why does data centre demand matter for household power bills? The answer lies in the nature of the technology itself. GPU infrastructure used to process and train AI models requires large volumes of continuous, reliable electricity.

As this demand scales, it tightens the supply and demand balance in the power system and increases the likelihood that higher cost generation sets the marginal price more frequently. AEMO has also been clear that data centre demand may not be uniform quarter to quarter, but early signs suggest it is already contributing to inflationary pressure within the energy system.

What to take away from this analysis

What we want readers to take away from this is that data centres are not the sole driver of rising household electricity bills. The biggest contributors are still the broader cost stack, particularly network charges and retail operating costs. These factors continue to do the heavy lifting when it comes to higher prices faced by households.

That said, data centres are emerging as an important new variable in the system. While their share of total electricity demand remains relatively small today, their growth rate means they are increasingly influencing the supply and demand balance across the grid. In simple terms, this adds another layer of pressure to an already tight system.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

ASX Lithium Stocks Surge as Prices Triple: Is It Too Late to Buy or Just the Beginning?

ASX lithium stocks rally as prices rebound ASX lithium stocks surged this week, with PLS Group (ASX: PLS) up 8%,…

Lynas (ASX:LYC) Posts 13x Profit Jump But Stock Fades. Is This a Buying Opportunity?

Lynas profits surge, but doubts remain Lynas Rare Earths (ASX: LYC) jumped as much as 5% on Thursday after reporting…

ASX 200 Reporting Season Wrap: 5 Earnings Surprises That Signal Buy Opportunities Heading Into March

ASX 200 reporting season- five stocks the market rewarded The ASX 200 touched a fresh record high of 9,202 this…