Battery Age Minerals (ASX:BM8) hopes for a Golden Age from one of the biggest sources of Kerry Packer’s wealth

Last November, our colleagues at Pitt Street Research introduced you to Battery Age Minerals (ASX:BM8), whose potential company-maker is an old lead-zinc mine in Austria called Bleiberg.

A re-cap of Bleiberg

This project, if it works, will win big for Battery Age shareholders. The mine has been around since the Middle Ages, but the company’s advisers believe there’s potentially another 2 million tonnes of ore in the already developed areas of the mine, plus another 8 million tonnes from areas that were never developed. At average grades of 1% lead and 6% zinc and…get this… 200 ppm germanium. That’s a lot of potential future shareholder value.

Germanium alone could significantly lift this project, given the great need for this rare metal in the semiconductor industry and the current dearth of European domestic supply. Importantly, Bleiberg’s mineralisation appears to extend beyond the historic workings, with significant high-potential upside along strike now secured by Battery Age’s expanded 26 km highly prospective corridor.

We think investors ought to pay attention because Battery Age intends to have its first drilling campaign at Bleiberg this year. That will be a key milestone where the company will begin testing what it believes are some of the most compelling critical mineral targets in Europe.

BM8 has another appealing project

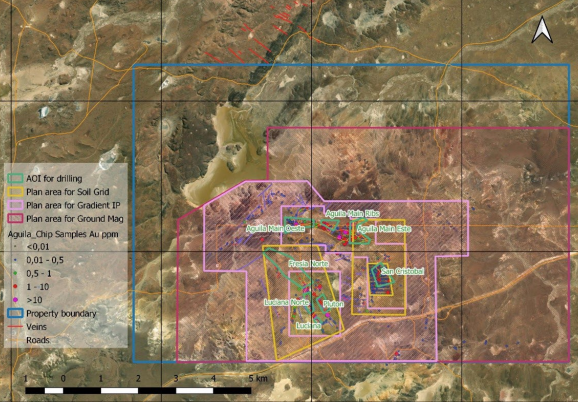

This article, however, isn’t about Bleiberg. It’s about another potential company-maker which Battery Age has picked up in Argentina called El Aguila, where the focus is gold and silver. El Aguila is in Argentina’s Santa Cruz province, way down in Patagonia.

Source: Company

When Battery Age’s CEO, Nigel Broomham, described the project to me I said to him, ‘With that kind of ground you might be able to do another Packer’.

I was referring to the late Australian billionaire Kerry Packer, who died in 2005. Kerry may have been a household name in Australia thanks to his media properties but a little known fact about the Packer family was that their most spectacular return ever came from a Patagonian gold project.

The ground, near a town called Esquel, probably cost less than a $1m in the mid-1990s but a major gold deposit was found there in 1998. There’s still no mine at Esquel but when Meridian Gold bought Brancote Holdings for Esquel’s 3 million ounces in early 2002, Kerry as Brancote’s major shareholder was able to walk away with something like A$100m cash. This at a time when gold was trading a lot lower than the current levels.

Esquel is around 800 km north of Battery Age’s El Aguila project, in Chubut Province, but what the two projects have in common is vein-hosted gold in a low-sulphidation epithermal setting. Epithermal gold tends to come in high grades, and what’s prompted Battery Age Minerals to farm in to El Aguila is the high grades that have shown up in the rock chip samples.

One came in at a massive 174.58 g/t Au and 4,739 g/t Ag, but there were others like 56.58 g/t Au and 44.22 g/t Au. Drilling from Fredonia Mining (TSX-V: FRED), which has farmed out, yielded high-grade intersections such as 0.55 metres at 40.55 g/t Au and 107 g/t Ag and 7.0m at 2.48 g/t Au, but there’s been no previous exploration below 100 metres.

Santa Cruz is an established gold destination

Santa Cruz is great place to be looking for gold. The provincial government is mining-friendly, and in the eastern part of the province the Deseado Massif has already yielded several multimillion ounce mines including AngloGold Ashanti’s Cerro Vanguardia, Newmont’s Cerro Negro and Pan American Silver’s Cerro Moro.

Source: Company

Al Aguila sits midway between Cerro Vanguardia and Cerro Moro. As the word ‘massif’ will have suggested, the country is flat-lying, albeit about 600 metres above sea level, so it’s easy to get equipment and people in and out.

The main north-south highway, Ruta Nacional 3, which runs all the way to Buenos Aires, is not far away. And the project isn’t quite in the middle of nowhere. Sure, it’s still a six-hour drive southwest from Comodoro Rivadavia, where the closest commercial airport with flights to Buenos Aires is located. However, there’s a small town about 140 km away on the coast called Puerto San Julian, at the place where Ferdinand Magellan’s famous expedition wintered back in 1520.

The other good thing about Argentina is that the country is now open for business at a Federal level thanks to the amazing ascendancy of Javier Milei, who won the 2023 Presidential election to become the world’s first ever anarcho-capitalist head of state. We expect strong inbound investment into Argentina given the new market-friendly regime, and that could also help levitate a decent gold project the way Kerry levitated his.

Set to go with the drillbit at El Aguila

Battery Age Minerals is now well advanced on the ground at El Aguila, having completed detailed structural mapping along with geophysical and surface geochemistry surveys. The company expects to report final geochemical and geophysical interpretations in the next quarter, once all assay results and modelling are complete. Battery Age is aiming to launch its drilling program shortly thereafter. We think investors should follow Battery Age’s progress carefully.

Source: Company

The key catalysts are coming soon

There’s also likely to be some drilling at Bleiberg within the coming quarter, and that has potential to get investors excited if the germanium grades are any good.

And with lithium potentially ending its bear market, there could be good things to come from the Falcon Lake project in Canada, which, being in Ontario, has a much better location than a lot of the projects going on in places like James Bay.

Throw in the potential for the company’s 22% of Equinox Resources (ASX: EQN) to yield some excitement from the Mata da Corda Titanium Project in Brazil, and there’s a lot going on for this junior explorer.

What are the Best ASX Resources Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…