BPM Minerals (ASX:BPM): Picking up unfinished business from AngloGold Ashanti and IGO

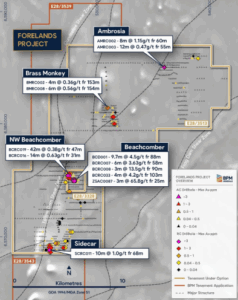

Last week was a big week for BPM Minerals (ASX:BPM). It sold its Claw Gold Project to Capricorn (ASX:CMM) for $1.5m and picked up the Forelands Gold Project from private vendors. Investors in BPM now have an exciting period ahead. Specifically, it is about to kick of an exploration program and could have a modest resource (i.e. tens of thousands of ounces) in the next 6-12 months. And that could be the start of something bigger.

BPM Minerals is seeking to finish what AngloGold and IGO started at Forelands

The Forelands Project is in WA, 150km east of Kalboorlie on the Trans Access Road. It is adjacent to many noteable projects including Anglo Gold’s Tropicana Mine and Ramelius’ Rebecca and Roe prospects. It is also close to multiple gold mills.

BPM is looking to do what was done with Tropicana. Tropicana was discovered 2 decades ago, in 2005 and it is easy to forget the magnitude of a discovery it was. It was not completely unprecedented for gold to be in that part of the world, but the specific rocks and terrane (i.e. high-metamorphic grade gneissic rocks within an Archean terrane) were not previously considered prospective for gold. Turns out the doubters were wrong – Tropicana has a resource of nearly 8Moz gold.

Source: Company

AngloGold actually did some work at Forelands but the last holes were drilled in 2009, as impressive as they were at the time (up 65.8g/t). And BPM is hoping history repeats here. It believes the geological setting is directly analgous to Tropicana, not to mention Carawine’s (ASX:CWX) Hercules resource that is 220km away. Forelands and Tropicana are both at the major intersections of 2 shear zone (Hootanui and Yamarna) as well as the Yilgarn-Albany Fraser boundary. This structural setting is believed to play a key role in focusing large-scale gold systems.

Hang on, why did AngloGold not explore the prospect further if the results were so good? Because gold prices were weak at the time (i.e. they were fluctuating in the ~US$600s for most of the pre-GFC era – as hard as it is to imagine in an era where gold is >US$3,000/A$5,000) and it preferred to focus on brownfields exploration immediately around Tropicana. Its hard to argue that wasn’t a good call for AngloGold at that time, but it was a good call for BPM as it now has the chance to finish what AngloGold started.

Beachcomber will be key

The first prospect that BPM will touch will be Beachcomber. This is where AngloGold Ashanti did its work. TPM has granted tenure wth 3,000 RC Resource definition drilling over the rest of this year, and a maiden resource is planned by mid-2026. This may only be in the tens of thousands of ounces, but even that would bode well for something bigger. There is proven mineralisation beyond Beachcomber and these will be targeted in the future.

The company has bought onboard the project’s vendors (Dr Ross Chandler and Luke Blais) was Technical Advisor and Exploration Manager respectively. The pair are no amateurs – they discovered the Yin REE deposit when working at Dreadnought (ASX:DRE), a feat that won them AMEC’s 2023 Prospector of the Year Award. They will receive:

- $150,000 in cash (in combined consideration and an Option Fee),

- 13.34m BPM shares,

- 7m performance rights and,

- A 1.5% gross smelter return royalty.

Moreover, the company has begun a geophysical data review and targeting exercise with Dr Barry Murphy. That name should ring a bell – he discovered Predictive Discovery’s (ASX:PDI) Bankan project in Guinea.

Source: Company

Conclusion

It is easy to get excited about any gold explorer nowadays with prices so high regardless of who the management is or where the prospect is. But it is rare to find a company with a project where there’s so much ‘unfinished business’, especially so close to a major gold mine like Tropicana. Watch this company in the months ahead.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors at panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…