Capricorn Metals (ASX:CMM): Its sequel gold mine will be even better than the original

Capricorn Metals (ASX:CMM) is one of several gold miners on the ASX that has slid under the radar of many investors, but delivered spectacular returns to those who took the gamble. In the last five years, it has gained over 600%, all thanks to one gold mine in WA.

The company is about to bring a second mine into production, that could be even better than the original one. And it may not stop at 2

How Capricorn Metals (ASX:CMM) reached its riches

Capricorn Metals’ flagship project is the Karlawinda Gold Mine, near Newman in WA’s Pilbara. The deposit was discovered by IGO (then known as Independence Group) back in 2008 and Capricorn bought it in 2016. It entered production in the middle of CY21 (right on June 30) on time and on budget. Prior to entering production, the plan was for it to be a 100-120,000 ounce a year mine. So far so good, it has produced 113,007/oz at an AISC of $1,421. And this is a figure down from FY23 due to weather events. For FY25, it has guided to 110-120,000/oz gold at an AISC of $1,370-1,470/oz.

The irony is that this company was close to throwing this all away. Regis Resources tried to buy Capricorn in 2018 but was unsuccessful. Perhaps for the better, because the bid was only 11c per share. Ironically, Capricorn’s board was for it, but major shareholder Hawke’s Point indicated opposition to the proposal. We digress.

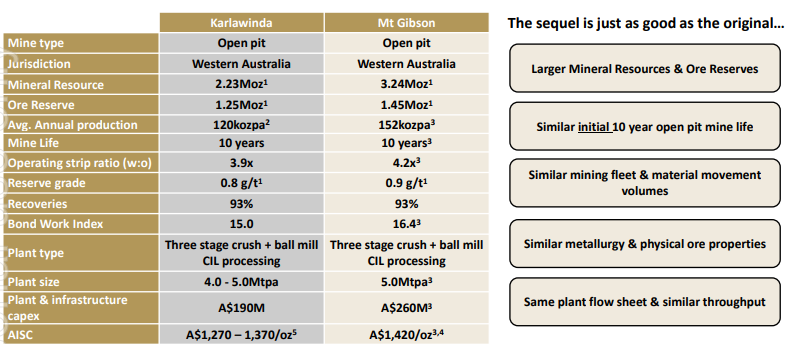

Karlawinda is an open pit mine that is anticipated to last another 10 years and possesses 1.25Moz Ore Reserves and 2.23Moz Mineral Resources. This does not account for the prospect for further discoveries at the project, which could enable a mine life extension. Capricorn raised $200m in November last year and one of the reasons was to enable increased gold production of 150,000/oz per annum through an increase in processing capacity by 2.5Mtpa to 6.5Mtpa. It bought the neighbouring Sylvania project in December 2024 for $1.5m.

Mt Gibson – a second company maker

Capricorn Metals is hoping to do the same with Mt Gibson, a historic gold mine in the Murchison region of WA that had produced >868koz gold between 1986 and 1999. The project was mothballed for 30 years due to low gold prices in the 1990s – we’re talking A$450/oz – and remained mothballed for 20 years. Capricorn picked it up in December 2021 when it was granted tenure.

Ever since, the company has built up a 1.45Moz Ore Reserve Estimate, with an operation delivering A$1.2bn in free cash flow and with an NPV of A$828m. It anticipates an average of 152kozpa for the first 7.5 years and a full mine life of 10 years. Again, the company thinks it can extend this, given the average pit depth is only 140m. It is fully funded and the company has $404.6m in cash and gold on hand.

Think the sequel sounds better than the original? So does the company. When will it enter production? Sometime in the next 12 months, but it is continuing to explore while building it up for production – including building a camp for workers.

Source: Company

Capricorn has also recently expanded its tenure buying Sabre Resources’ Ninghan Gold project, which lies to the north of Mt Gibson – 20km NNE to be precise. It paid $1.6m for the project and has granted Sabre a 1% net smelter royalty. It has also bought the Kings Find Project from Serena Minerals which is 35km NNE.

What analysts think

There are 7 analysts covering the company and they expect revenue of $476.7m and a $163m profit in FY25, followed by $585.1m revenue and a $241m profit in FY25. Analysts expect first revenues from Mt Gibson to substantially flow in FY27, with $1bn revenue and a $564.3m profit.

Evidently, there is growth potential, but it may still take another year or two until Mt Gibson enters production and revenues pick up substantially. It also ought to be noted that Capricorn does not yet pay dividends, so investors wanting income would be better off in an even larger company such as Newmont or Northern Star. And also, it can never be certain when gold prices go.

However, Capricorn Metals could be one to hold for the long-term.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…