Investors are excited about Core Lithium’s planned re-start of Finniss! But here’s why they’re overreacting

Core Lithium’s (ASX:CXO) planned re-start of Finniss has got plenty of investors excited. Shares closed yesterday 35% higher than the day before, making the company one of the biggest gainers on the bourse. This is not just because investors in this company can see light at the end of the tunnel, but it bodes hope for the broader lithium sector. But are investors getting ahead of themselves? In our view, they just might be.

Recap of how Finniss ended up mothballed

The project covers 500 square kilometres within the NT’s Bynoe Pegamite Field lying 88km trucking distance from Darwin Port.

Lithium was first discovered at Finniss in 2016 and the project has grown ever since. The April 2022 Definitive Feasibility Study (DFS) reported a JORC compliant Mineral Resource of 15 million tonnes (Mt) at 1.3% lithium oxide. The study reported a Pre-Tax IRR of 80%, an NPV of $114m and free cash flows of $158m from $501m revenue. A 180,000tpa operation was anticipated. Keep in mind that this was based on a spodumene concentrate price of $981/t, far below the all time high of $8,125/mt in November 2022.

Production at Finniss began in April 2023, only to be suspended by the end of the year due to poor lithium prices. The price of spodumene concentrate—lithium ore in layman’s terms— plunged 86 percent throughout 2023.

We noted above that the DFS assumed a price of US$986/t, which delivered Pre-Tax IRR of 80%, an NPV of $114m and free cash flows of $158m from $501m revenue. It is natural investors would get overly excited when prices accelerate to more than 8x that…but now prices are even below that point. And things have continued to be that way well across 2024 and well into 2025.

CXO has a plan to re-start Finniss

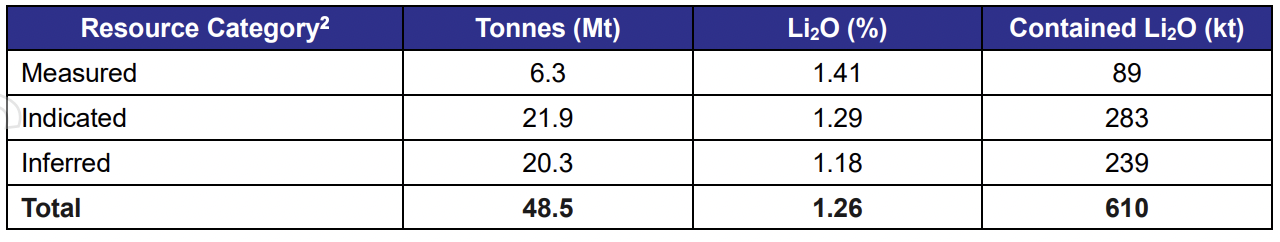

Despite suspending production, the company continued to sell stock-piled ore and continued exploration work. And yesterday, the company announced an increased Resource, which is now 48.5Mt @ 1.26% lithium. Moreover, the company announced a further Exploration Target of 10.9-16.5Mt at 1.5-1.7% lithium.

Source: Company

But most pleasingly of all, CXO announced the results of a Restart Study. This was effectively another feasibility study but with much better metrics than earlier studies. It cut mining costs by 40%, processing costs to 33% and increased concentrate production by optimising the plant and simplifying the flowsheet without major capital. Pre-production capex was reduced by 29% to $175-200m from $282m. It anticipated a 20-year mine life with an average concentrate produced of 2,911kt.

Sounds great, doesn’t it?

There’s just one problem.

It’s no more than a plan (for now)

The company has not made a final decision to re-start the project. Yes, CXO has hired Morgan Stanley to look at funding and mentioned it was talking to potential partners, but it has not made a decision to re-start. It has $30m in cash, but will need to raise up to $200m to fund the project.

There was no time frame for re-starting, or even for making a decision. ‘FID for the Finniss restart will be subject to the approval of the Core Board and securing a suitably attractive funding option’, the board said. Now obviously the board wants a funding option that will work for the company and its investors. But we think investors’ reaction was as if the company had made a firm decision and perhaps even had established a near-future time frame.

Although the company did not explicitly this, we’d guess there would have to be little hope unless there is at least some upward momentum in lithium prices. While the unit prices have improved, the company has razor-thin margins at current levels. The study did not include any NPV – this study just elated to the operational aspects and costs were reduced. But it doesn’t appear assumptions have been made as far as the potential revenues are concerned.

Conclusion

At the end of the day Wednesday May 14, 2025, Core Lithium finished in a better position than it began as there is hope on the horizon for investors.

When lithium prices recover, the company will restart the project and be able to make more money than it otherwise would have made because it has been able to cut costs through operational improvements. The problem is that we just don’t know when lithium prices will recover from their present lows, and thus we don’t know just when production will recommence at Finniss.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…