DroneShield (ASX:DRO) FY25 A$216m Revenue, Strong Cash, and Rising Defence Demand

DroneShield Delivers Breakout FY25 Growth and Converts It Into Cash

DroneShield’s (ASX:DRO) numbers this quarter did not come as a surprise. The company ended the year on a strong note, delivering A$216 million in FY25 revenue, up 277%.

In this note, we are going to break down the quarterly result in a clear, objective way. We will walk through the key revenue segments, the profitability profile and what it suggests about the pathway from here, and how the backlog supports future revenue visibility.

we will also step back and look at how defence budget allocation is trending for the types of capabilities DroneShield provides, and what that could mean for demand over time.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

DroneShield’s FY25 Print Strong Top Line, Real Cash, and Clear Reinvestment Capacity

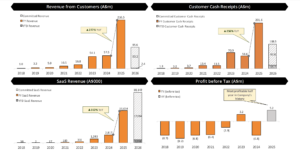

FY25 revenue came in at a substantial A$216 million, with Q4 FY25 revenue of A$51 million, up 94% year on year.

Management also disclosed that it has already secured A$95.6 million of contracted revenue for FY26, which provides a solid base of revenue visibility heading into the new year.

Cash conversion was also strong. FY25 cash receipts totalled A$201.6 million, a meaningful inflow and a 256% increase from FY24. That matters because it shows DroneShield is not just booking revenue on paper. It is collecting cash and turning growth into real funding capacity.

This cash performance has enabled DroneShield to invest at scale. The company reinvested around A$70 million into research and development during the year, without appearing financially constrained. A large portion of this spend went into expanding the engineering team and supporting broader hiring, which is consistent with management prioritising capability build out to sustain product leadership.

As revenue grows, demand appears to be holding up and the cash being delivered is scaling with it. That is a positive signal for the underlying business model and for DroneShield’s ability to fund growth internally.

The SaaS Rollout

Another area worth focusing on is the pace of the SaaS rollout, which is starting to scale quickly and should become a bigger part of the story from here.

SaaS revenue reached A$11 million in FY25, up from A$2.8 million in the prior year. In Q4 FY25 alone, SaaS revenue came in at A$4.6 million. If that momentum holds, the next two quarters should deliver strong growth in this segment, and importantly, a higher mix of software revenue should support margin expansion over time.

What makes this shift meaningful is how the software layer is becoming more valuable as DroneShield rolls out newer generation counter UAS capability. Modern systems rely more heavily on software for detection, decision support, control, and ongoing updates. As that dependency increases, the platform becomes harder to replace, which improves customer retention and makes revenue more recurring and predictable.

Management has also pointed to the commercial and civilian market as a longer term growth driver, noting it could contribute up to 50% of revenue over the next five years. If that plays out, it would provide an additional tailwind for the SaaS and software led components of the product suite as the platform scales beyond traditional defence customers.

DroneShield’s A$2.1bn Pipeline Expands as Europe Emerges as the Key Growth Engine

DroneShield’s commercial pipeline remains large, with management reporting a total pipeline of roughly A$2.09 billion across more than 300 opportunities. Combined with around A$70 million of R&D investment, it reinforces the picture of a company still building capability while trying to convert a growing pipeline into delivered revenue.

Profitability is starting to show through, but it is still early. At this stage, results are likely to remain sensitive to quarterly delivery timing, particularly given how contract awards and shipment schedules can move around in defence procurement.

Regionally, Europe is becoming a meaningful revenue engine for DroneShield. The company reported a European pipeline of around A$1.3 billion across 66 projects. In FY25, Europe contributed A$87 million of sales, representing about 40% of total revenue.

Asia was also a solid contributor. Management reported a pipeline of around A$272 million across 28 projects, with FY25 revenue of A$46 million, or roughly 21% of total revenue.

Everything an investor needs to understand the risks

So far, the result has been clearly positive. DroneShield has executed well and the year delivered real momentum, both in revenue growth and in cash conversion. With some of the earlier internal operational noise now largely behind the company, the key risks that matter for the share price from here are more fundamental and easier to define.

The first is pipeline conversion. A headline pipeline of roughly A$2 billion looks impressive, but converting opportunities into signed contracts and then delivered revenue is a different challenge. Defence procurement is rarely linear. Timelines can slip, awards can be delayed, and funding cycles can shift. We have seen defence programs impacted by budget resets, procurement bottlenecks, and broader government disruption. Any slowdown in conversion can quickly show up in quarterly revenue volatility.

Cost discipline is the second watch point. The company has indicated fixed costs of around A$150 million per year. That cost base is manageable while growth is strong, but it also creates operating leverage in both directions. If revenue growth slows, profitability can unwind quickly because the fixed cost line does not adjust at the same speed as revenue.

On the technology side, the risk is staying ahead of the threat environment. As counter UAS systems become more widely deployed, adversaries adapt and the focus shifts toward electronic warfare resilience, including anti jamming software and hardware. That is an opportunity for DroneShield to deepen its competitive edge, but it is also a moving target. The next generation product roadmap needs to keep pace with fast iteration cycles in the counter UAS market, or the company risks losing relevance in the parts of the stack that buyers are prioritising.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Anthropic Draws a Line With the Pentagon

The AI-First Military Agenda with Anthropic The Pentagon is moving aggressively to bring cutting-edge commercial AI into defence work. A…

88 Energy (ASX:88E) Doubles on Alaska Upside, Here’s What’s Driving It

The Market Just Repriced Alaska Exploration Optionality 88 Energy surged 100% today on the back of a corporate presentation that…

Oil Jumps to US$111 as Hormuz Stays Shut, ASX Slides Hard

The Oil Chokepoint Shock Brent crude jumped 20% to US$111 per barrel, while the ASX 200 fell 3%, with companies…