What is the All Ordinaries Index and How Does It Work?

The All Ordinaries Index, also known as the “All Ords”, is Australia’s oldest stock index and is considered a benchmark of the country’s equity market. The index tracks the performance of the largest 500 companies on the Australian Securities Exchange, ranked by market capitalization. For financial analysts, economists, and investors, the All Ords is a great barometer that reflects trends in the Australian equity market. Below is a closer look at what the All Ordinaries Index is, how it works, and why it is important.

A Brief History of the All Ordinaries Index

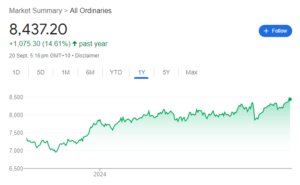

The base level for the All Ordinaries Index was set at 500 points in January 1980 and has been a benchmark of the general health or sickness of the Australian stock market ever since. It is certainly a major index tracking the country’s largest listed companies; and capturing approximately 87% of the value of all stocks traded on the ASX as of 2024, it is a fair reflection of the market.

The index was also significantly overhauled in April 2000, moving from including the largest 500 companies by market capitalization to including the largest 200 companies. This rewrite coincided with the launch of the S&P/ASX 200 index, which only includes the largest 200 companies, but retains the All Ordinaries as a broad measure of market performance.

Key Features of the All Ordinaries Index

Market Capitalization Weighting

The All Ordinaries index is market capitalization weighted, meaning that the size of each company, relative to its market capitalization, determines its impact on the index’s performance. This means that larger companies such as BHP, Commonwealth Bank and Westpac will have a greater impact on the index than smaller companies. Market capitalization is calculated by multiplying a company’s share price by the number of shares outstanding.

For example, a small company with the same percentage gain will have less influence in the All Ords than BHP Group if the share price of this latter company has increased by a lot. The weighting system ensures that the index is a good barometer of the general market performance, with a greater emphasis on larger companies.

The Scope of the Index

It covers firms operating in almost all industries, such as the financial services, materials, healthcare, and consumer discretionary sectors and many others. This makes it quite diversified as a broad index of the Australian economy as a whole. Financial and resources companies usually take up the largest share due to Australia’s banking and mining dominance.

Base Value and Growth

The All Ords was established with a base value of 500 points when it was first launched. This would mean that the value achieved by the index up to this point would describe the degree to which the overall value of listed companies has increased since the first date. For example, if the All Ordinaries is trading at 7,000 points today, the total value of its companies has increased 14-fold since 1980. What’s more, an index has shown remarkable long-term growth, a reflection of the growth in Australia’s economy and its leading companies over the past four decades.

How Does the All Ordinaries Index Work?

Index Composition and Eligibility

The All Ordinaries Index includes the 500 largest listed companies with the most prominent market capitalizations on the Australian Securities Exchange. Companies must have specific characteristics such as market value and liquidity to be included in the list. Companies are continually assessed to ensure they still qualify for the index. When a company no longer meets these requirements, it is removed from the index and replaced by a new company.

The index is broad-based and covers a number of industries. Many of the companies represented in the index are part of the financial services, materials, healthcare and energy sectors. However, unlike other indexes, the All Ordinaries does not include dividend payments in its value. Those interested in a total rate of return with stock price appreciation and any dividends can refer to the All Ordinaries Accumulation Index which takes into account both expected events: price moves and dividends.

Rebalancing the Index

The Australian Securities Exchange regularly reviews the All Ordinaries and rebalances it to ensure it accurately represents the market. Rebalancing occurs annually in March, at which time companies may be added or subtracted from the list if their market capitalization and liquidity changes. This helps the index evolve as the market is always moving, and so the index will continue to track the top 500 companies.

Accumulation Index vs. Price Index

The All Ordinaries Index tracks the price of companies excluding dividends, while there is another version known as the All Ordinaries Accumulation Index which includes dividends in addition to price returns. It is a good indicator of long term investment in stocks as it reflects capital gains and income on dividends.

Why is the All Ordinaries Index Important?

A Key Market Indicator

As part of the larger All-Ordinaries family, the Australian All Ordinaries Index is a highly quoted index of financial news and reports about the health of the Australian stock market. It is an important benchmark for investors where they can measure their portfolio’s performance against it. Economists and market analysts alike have an interest in the overall performance of Australia’s economy, particularly its largest companies.

Being a broad index that combines industries and sectors, the All Ordinaries is also sometimes used to follow specific trends in the market. For example, if the index rises, it may reflect strong investor confidence in Australia’s economy. A decline in the index may indicate economic problems.

Long-Term Growth

In summary, the All Ordinaries Index has, over the years, remained consistent and stable in its long-term growth pattern. In fact, if we look at some periods when the index was very volatile, such as during the global financial crisis in 2008 or during the COVID-19 pandemic in 2020, it always managed to recover. It thus underlines the robustness of the Australian economy and its largest companies.

The All Ordinaries has reached record highs in 2024 due to the strong performance of Australia’s key sectors, crossing 8,000 points multiple times. For example, in 2021, the index was at its highest level due to good performance in the financial services, mining and healthcare sectors. The Australian market remains very strong even against a backdrop of uncertainty in the global economic environment, and the All Ords remains a very reliable indicator of long-term growth potential.

A Broad Representation of Market Performance

The All Ordinaries Index goes beyond just the top companies, which are tracked through the S&P/ASX 200 Index. Therefore, it implies a balance between medium-sized and smaller companies that are still broad market players, making it a more inclusive indicator of market performance. It is therefore particularly useful for investors who want to diversify portfolios across different sectors and market capitalizations.

How to Invest in the All Ordinaries Index

Direct Investment in Stocks

One way to invest in shares of companies listed in the All Ordinaries is to buy them. This involves individual research on each company’s performance, financial health and growth prospects. Direct investing allows investors to pick their own stocks, but it is very demanding and requires a good understanding of market trends.

Exchange-Traded Funds (ETFs) and Index Funds

For example, an individual investor looking to buy the All Ordinaries Index would look to ETFs and index funds, which are simple options that can gain access to the All Ords through a portfolio of companies listed in that index. Through investing in either type of fund, it is possible to gain exposure to the entire market without buying individual stocks.

ETFs and index funds are low-cost management products that have diversification potential and long-term growth. Also, because they are passively managed, fees tend to be lower than actively managed funds, so it can be a cost-effective way to invest in the Australian market.

Conclusion

The All Ordinaries Index is a barometer of stock market performance in the Australian financial landscape. It is quite comprehensive in its coverage with respect to market-cap weighting, which gives some insight into the general state of the economy. This book is useful for both experienced and novice investors who want to understand the All Ordinaries and how it works as a tool to manage Australian equities either through direct stock investing or passive index tracking.

Therefore, tracking this index will enable the investor to make more clear and better informed decisions on market movements provided as part of the general economic environment.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Recent Posts

Anthropic Draws a Line With the Pentagon

The AI-First Military Agenda with Anthropic The Pentagon is moving aggressively to bring cutting-edge commercial AI into defence work. A…

88 Energy (ASX:88E) Doubles on Alaska Upside, Here’s What’s Driving It

The Market Just Repriced Alaska Exploration Optionality 88 Energy surged 100% today on the back of a corporate presentation that…

Oil Jumps to US$111 as Hormuz Stays Shut, ASX Slides Hard

The Oil Chokepoint Shock Brent crude jumped 20% to US$111 per barrel, while the ASX 200 fell 3%, with companies…