What is Earnings Per Share (EPS), and How to Calculate It?

What is EPS?

Earnings Per Share (EPS) is a fundamental financial metric used to calculate a company’s profitability on a per-share basis. It’s calculated by dividing the net income available to common shareholders by the weighted average number of shares outstanding during a reporting period. EPS is crucial because it provides a direct insight into the financial health and performance of a business. By breaking down company earnings into a per-share amount, EPS offers an intuitive measure of a company’s earning power.

For investors, EPS is a metric for assessing a company’s financial health. It plays a key role in forming the basis of several other important valuation metrics, such as the price-to-earnings (P/E ratio). A higher EPS indicates more net profit available per share, suggesting better profitability and often leading to a higher market valuation of the company. Therefore, understanding EPS helps investors in making informed decisions about buying, holding, or selling stocks.

How to Calculate EPS

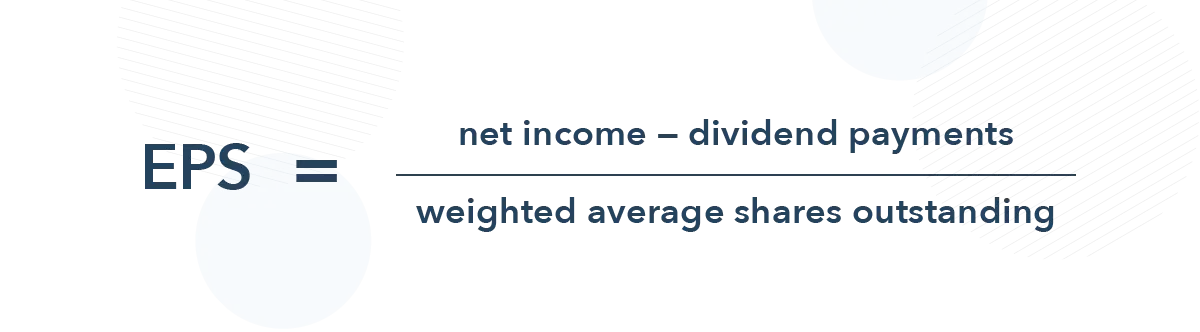

The simplest way to calculate EPS is through the basic EPS formula:

EPS = Net Income / Number of Outstanding Shares.

This calculation provides a quick snapshot of a company’s earnings per share without considering potential future dilution from options, warrants, or convertible securities.

Types of EPS

The distinction between basic EPS and diluted EPS centers on the share count used in the calculation. Basic EPS uses the current number of ordinary shares outstanding, while diluted EPS incorporates all potentially dilutive securities like convertible preferred dividends shares, stock options, and warrants, which can increase the total shares outstanding if exercised. Here’s how it pans out in practice:

- Basic EPS: If a company, say XYZ Inc., has a net income of $150 million and 50 million outstanding shares, its basic EPS would be $3.00 ($150 million / 50 million shares).

- Diluted EPS: If XYZ Inc. also has options and convertibles that could potentially convert into 5 million additional shares, the diluted shares would total 55 million. The diluted EPS would thus be about $2.73 ($150 million / 55 million shares).

Basic EPS offers a straightforward view of earnings, whereas diluted EPS provides a conservative snapshot by assuming all possible shares have been issued. This makes diluted EPS particularly useful when convertible securities are significant.

Adjusted EPS goes a step further by modifying the net income used in the EPS calculation to exclude one-time gains, losses, or other non-recurring items. This adjustment aims to provide a clearer picture of a company’s operational performance.

For instance, if a company had unusually high legal costs one year due to a one-time lawsuit, adjusted EPS would exclude these costs, offering insight into the sustainable earnings power of the business. By focusing on the core net profits from regular operations, adjusted EPS can be a more reliable metric for assessing company’s profitability and making comparisons with past performance or within the same industry.

EPS in Investment Decision Making

EPS is directly linked to a company’s stock valuation through the price-to-earnings (P/E ratio). The P/E ratio is calculated by dividing the company’s share price by its EPS. A higher EPS can lead to a lower P/E ratio, suggesting that the stock might be undervalued relative to its earnings capacity. This relationship helps investors assess whether a stock is priced fairly in relation to its earnings potential.

Investors also use EPS to track the growth and stability of a company’s earnings over time. Increasing EPS figures across consecutive fiscal years can indicate that a company is growing and managing its net profits effectively.

Moreover, comparing EPS from companies within the same industry provides a relative understanding of a company’s financial health. For example, comparing the EPS of two tech companies can help investors identify which company has better earnings efficiency and market leadership potential.

Practical Application: Calculating EPS from Financial Statement

Calculating EPS from a company’s financial statements is a straightforward process, provided you have access to the necessary data. Let’s consider a hypothetical company, ABC Technologies, which has its annual income statement and shares outstanding information readily available.

- Identify Net Income: From ABC Technologies’ income statement, find the net income figure for the fiscal year, say $200 million.

- Find Total Outstanding Shares: Look up the shares outstanding number at the fiscal year-end, suppose it’s 50 million shares.

- Calculate Basic EPS: Divide the net income by the total number of outstanding shares.

- Basic EPS = $200 million / 50 million shares = $4.00 per share

- Adjust for Diluted Shares: If ABC Technologies also has potential shares from convertible securities, like options or convertible bonds, assume these add another 5 million shares, making the total diluted shares 55 million.

- Calculate Diluted EPS: Diluted EPS = $200 million / 55 million shares = $3.64 per share

This step-by-step calculation helps investors understand the basic and diluted earnings capacity of the company.

Consider the case of XYZ Corp., which reported a significant jump in its EPS figure from one year to the next. On closer examination, it’s revealed that the increase was partly due to a large-scale share buyback program, reducing the number of outstanding shares and artificially inflating the EPS. While this might seem like an improvement in profitability at first glance, the actual company’s earnings didn’t grow proportionately, indicating that the higher EPS might not truly reflect enhanced company performance.

Limitations of EPS

Potential for Manipulation

One major criticism of EPS is its susceptibility to manipulation through financial strategies such as share buybacks or creative accounting practices. For instance, a company can boost its EPS by simply reducing the number of shares outstanding, without any real improvement in net income. Such maneuvers can mislead investors about the true financial health of the company.

Beyond EPS

While EPS is a valuable indicator of company’s profitability, it shouldn’t be the sole metric for investment decisions. Other financial metrics like cash flow, debt levels, revenue growth, and return on equity provide a fuller picture of a company’s financial health. For example, a company with a growing EPS but declining cash flow might be facing underlying problems that could affect its long-term sustainability.

Conclusion

Investors should use EPS as one of several tools in their financial analysis toolkit. By combining EPS with other metrics and considering broader economic conditions, investors can make more informed and holistic decisions. Always look beyond the surface numbers to understand the real story of a company’s financial performance and potential.

FAQs

How do you use the treasury stock method to calculate earnings per share?

To calculate earnings per share using the treasury stock method, outstanding share counts are adjusted for the effects of options and warrants that are in the money. This method reflects a potentially increased share count when these securities are converted into common stock.

What does fully diluted EPS tell an investor about a company’s ability to generate profit?

Fully diluted EPS reflects the company’s ability to generate profit if all convertible securities were exercised. This measure includes all potential shares from securities like options, providing a comprehensive view of the company’s EPS under fully converted conditions.

How can dividend payments affect the calculation of basic earnings per share?

Dividend payments made for preferred shares to shareholders are subtracted from the company’s net income before calculating diluted EPS. This adjustment ensures that only the earnings available to common shareholders are included in the EPS calculations.

Why might two companies with the same industry have different EPS ratio measures?

Two companies in the same industry may report different EPS ratios if they manage their finances differently or if one company has more efficient operations leading to more profit. Different levels of company’s profit and capital structure can also influence the EPS ratio.

What factors should be considered when comparing high EPS values to determine which stock is a good EPS?

When comparing high EPS values to determine a good EPS, investors should consider factors such as the stock’s price, the consistency of EPS growth, and how dividend payments reflect on the company’s shares. A good EPS often means the company is healthy, but context and relative industry performance should also be considered.

How does the inclusion of discontinued operations affect EPS calculations?

The inclusion of discontinued operations can skew EPS calculations by providing a one-time gain or loss. To get a clear picture of ongoing profitability, these operations should be excluded from the company’s income statement when reporting basic earnings.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…