What is Market Capitalization, and Why Does It Matter?

Definition of Market Capitalization

Market capitalization, commonly referred to as market cap, is a crucial financial metric that represents the total dollar market value of a company’s outstanding shares.

Essentially, it reflects the public’s perception of a company’s worth and is calculated by multiplying the current stock price by the total number of shares outstanding.

Historically, market cap has served as a foundational element in financial markets, helping categorize companies into various segments like large cap, mid cap, and small cap companies. This classification helps investors in assessing the size and risk associated with investing in a company’s stock.

Calculation of Market Capitalization

The formula for calculating market capitalization is straightforward:

Market Cap = Current Share Price x Total Number of Shares Outstanding.

This calculation provides the total market value of a company’s equity.

For example, if a hypothetical company named “FutureTech” has 10 million shares outstanding and each share is currently trading at $50, the company’s market cap would be $500 million (10 million shares x $50 per share). This figure gives investors and analysts a quick snapshot of FutureTech’s size compared to its peers in the stock market.

Types of Market Capitalization

Market capitalization offers a clear snapshot of a company’s size and its potential impact in the equity market. This assists investors in decision-making by highlighting the value of a company. Here are the categories typically used in the Australian market:

Large-cap

In Australia, large-cap companies generally have a market capitalization of AUD 10 billion or more. These companies are often pillars of the economy, known for their stability and sizable influence across various sectors. For example, Commonwealth Bank of Australia and Woolworths Group Ltd are iconic large cap stocks that dominate their respective industries, providing steady dividends and strong market presences.

Mid-cap

Mid-cap companies, typically valued between AUD 2 billion and AUD 10 billion, like TPG Telecom and Seek Ltd, represent a diverse range of industries. These companies are recognized for their growth potential and are considered more volatile than large cap, but less so than smaller caps, offering a balanced risk profile.

Small-cap

Small cap companies are valued between AUD 300 million and AUD 2 billion. They tend to be younger companies with significant growth potential, which also comes with higher volatility and risk. Examples include Inghams Group and Star Entertainment Group, which may offer high returns but require cautious investment strategies.

Micro-cap

Micro-cap companies have a market capitalization between AUD 50 million and AUD 300 million. These are smaller companies such as Kelly Partners Group Holdings and Volpara Health Technologies, often considered speculative investments due to their size, potential for growth, and corresponding risk levels.

Nano-cap

Nano-cap stocks, with a market cap less than AUD 50 million, represent the smallest publicly listed entities in the Australian equity market. These stocks are highly speculative, with considerable risk due to their small size and limited resources.

Investor Perception and Decision Making

Investors use market capitalization to assess the value of a company and its stocks within the market. A large cap company with a high market cap might be viewed as safer and more reliable, whereas small cap or micro cap companies might be seen as opportunities for significant growth, albeit with increased risk.

The company’s share price and the number of outstanding shares directly affect its market cap, influencing how investments are perceived in terms of size and stability.

Free Float Market Cap

Another important aspect is the free float market cap, which considers only the outstanding shares available to the public and excludes shares held by insiders, governments, or other restricted entities. This measure gives a more accurate picture of a publicly traded company’s market value, crucial for investors using index funds or trading on indices where only the freely available shares are relevant.

Impact of Market Cap on Company’s Financial Health

Market capitalization is often reflective of a company’s stability, perceived risk, and potential for growth. Generally, the total market value of a company, indicated by its market cap, correlates with various aspects of its financial health.

Stability and Risk

Companies with a high market cap, often called large cap companies, tend to be well-established in the market. These companies are usually considered stable because they can leverage their size and established market presence to weather economic downturns better than smaller companies. This stability often results in lower perceived risk for investors.

For example, large caps like Microsoft and Apple have significant resources and diverse revenue streams that help them manage market fluctuations effectively.

Conversely, companies with smaller market caps, including micro cap and small cap companies, often face higher volatility. These companies are typically younger and may serve niche markets.

Their size can make them more susceptible to market swings and economic downturns, thus representing a higher risk to investors.

Growth Potential

While large caps offer stability, smaller caps often provide substantial growth potential. Investors may seek out small or micro cap stocks because these companies could be in the early stages of development, and their stock prices may increase significantly as they grow. However, this potential comes with increased risk, making it vital for investors to consider their risk tolerance.

Influence on Capital Raising Abilities: The total dollar value of a company’s market cap also influences its ability to raise capital. Companies with a higher market cap have more leverage when issuing debt or equity, as they are often more trusted by investors and financial institutions. This trust can lead to better terms for loans and a more favorable reception to new share issues.

In contrast, smaller caps might struggle to attract investment, affecting their ability to expand or innovate.

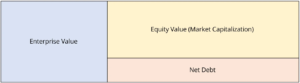

Market Cap vs. Enterprise Value

Enterprise Value (EV) is a broader measure that includes debt, preferred shares, and subtracts cash and cash equivalents from the valuation. EV gives a more comprehensive snapshot of a company’s worth because it accounts for the company’s debt levels and cash reserves, which are not reflected in the market cap.

Significance of Each: Market cap is useful for investors wanting to understand the size of a company and compare it to others in the same industry or the broader market. It affects everything from the liquidity of shares to the company’s ability to secure loans.

Enterprise value, however, is often considered a more accurate measure of a company’s total value, especially in scenarios like mergers and acquisitions. It provides a clearer picture of what it would cost to purchase the entire business outright because it considers debt as part of the company’s total market value.

When Enterprise Value is More Accurate?

EV becomes a crucial metric in situations where a company carries significant debt. Since the market cap does not reflect this debt, EV is used by investors to evaluate whether a company is undervalued or overvalued relative to its peers.

For example, a company might have a high market cap, but if it also has substantial debt, its EV would provide a higher and perhaps more alarming figure.

Financial metrics help investors make informed decisions, balancing potential growth against stability and risk, particularly in diverse markets like mutual funds and publicly traded companies.

Market Cap Trends and Market Movements

Historical data on market capitalization can reveal significant trends in how different segments of the market have grown over time. Generally, during periods of economic recovery and growth, small-cap stocks tend to perform well, as they are quick to capitalize on market opportunities.

Conversely, during recessive phases, large-cap stocks usually provide safer returns as they are less volatile. Analyzing these trends helps investors understand how market valuations shift and can even predict future market movements.

For instance, a broad increase in small-cap market cap increases might indicate investor confidence in economic expansion, suggesting a bullish market.

Summary

Market capitalization, a fundamental metric derived by outstanding shares multiplied by the closing price of a stock. Market cap measures the total value of a company’s shares on the stock market, reflecting the market’s current valuation of a company.

It is essential for investors as it helps size up companies, offering a comparative perspective that aids in risk assessment and investment decision-making.

Different market caps present unique risks and rewards. Large caps often include the largest companies and are considered stable investments with less volatility, suitable for risk-averse investors.

Mid caps are likely to experience rapid growth, offering a balance between risk and potential returns.

Small caps and penny stocks, although risky, provide high growth potential, especially attractive during economic upturns.

Final thoughts

With the rise of digital currencies and the proliferation of startups that rapidly ascend to high market caps, the traditional metrics of evaluating a company’s value are being tested.

Market cap remains a relevant and dynamic indicator, but it must now be considered alongside other financial and economic developments.

The digital transformation of financial markets means that market capitalization needs to be viewed through a modern lens.

For example, companies in the tech sector can achieve substantial market caps quickly due to innovation and market disruption, even if their physical assets or traditional metrics do not align with older large caps standards.

Furthermore, the global accessibility of stock exchanges through digital platforms means that more people can invest in the market, potentially leading to faster changes in company valuations as seen with phenomena like meme stocks.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Recent Posts

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors are panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…